A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides retirement income.

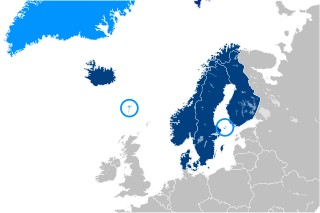

The Government Pension Fund of Norway is the sovereign wealth fund collective owned by the government of Norway. It consists of two entirely separate sovereign wealth funds: the Government Pension Fund Global and the Government Pension Fund Norway.

The Employee Retirement Income Security Act of 1974 (ERISA) is a U.S. federal tax and labor law that establishes minimum standards for pension plans in private industry. It contains rules on the federal income tax effects of transactions associated with employee benefit plans. ERISA was enacted to protect the interests of employee benefit plan participants and their beneficiaries by:

Norges Bank is the central bank of Norway. It is responsible for managing the Government Pension Fund of Norway, which is the world's largest sovereign wealth fund, as well as the bank's own foreign exchange reserves.

Employee benefits and benefits in kind, also called fringe benefits, perquisites, or perks, include various types of non-wage compensation provided to employees in addition to their normal wages or salaries. Instances where an employee exchanges (cash) wages for some other form of benefit is generally referred to as a "salary packaging" or "salary exchange" arrangement. In most countries, most kinds of employee benefits are taxable to at least some degree. Examples of these benefits include: housing furnished or not, with or without free utilities; group insurance ; disability income protection; retirement benefits; daycare; tuition reimbursement; sick leave; vacation ; social security; profit sharing; employer student loan contributions; conveyancing; long service leave; domestic help (servants); and other specialized benefits.

The Employees' Provident Fund Organisation (EPFO) is one of the two main social security organization under the Government of India's Ministry of Labour and Employment and is responsible for regulation and management of provident funds in India, the other being Employees' State Insurance. The EPFO administers the retirement plan for employees in India, which comprises the mandatory provident fund, a basic pension scheme and a disability/death insurance scheme. It also manages social security agreements with other countries. International workers are covered under EPFO plans in countries where bilateral agreements have been signed. As of May 2021, 19 such agreements are in place. The EPFO's top decision-making body is the Central Board of Trustees (CBT), a statutory body established by the Employees' Provident Fund and Miscellaneous Provisions (EPF&MP) Act, 1952. As of 2021, more than ₹15.6 lakh crore are under EPFO management.

Superannuation in Australia, or "super", is a savings system for workplace pensions in retirement. It involves money earned by an employee being placed into an investment fund to be made legally available to members upon retirement. Employers make compulsory payments to these funds at a proportion of their employee's wages. From July 2024, the mandatory minimum "guarantee" contribution is 11.5%, rising to 12% from 2025. The superannuation guarantee was introduced by the Hawke government to promote self-funded retirement savings, reducing reliance on a publicly funded pension system. Legislation to support the introduction of the superannuation guarantee was passed by the Keating Government in 1992.

India has a robust social security legislative framework governing social security, encompassing multiple labour laws and regulations. These laws govern various aspects of social security, particularly focusing on the welfare of the workforce. The primary objective of these measures is to foster sound industrial relations, cultivate a high-quality work environment, ensure legislative compliance, and mitigate risks such as accidents and health concerns. Moreover, social security initiatives aim to safeguard against social risks such as retirement, maternity, healthcare and unemployment while tax-funded social assistance aims to reduce inequalities and poverty. The Directive Principles of State Policy, enshrined in Part IV of the Indian Constitution reflects that India is a welfare state. Food security to all Indians are guaranteed under the National Food Security Act, 2013 where the government provides highly subsidised food grains or a food security allowance to economically vulnerable people. The system has since been universalised with the passing of The Code on Social Security, 2020. These cover most of the Indian population with social protection in various situations in their lives.

In France employees of some government-owned corporations enjoy a special retirement plan, collectively known as régimes spéciaux de retraite. These professions include employees of the SNCF, the RATP, the electrical and gas companies which used to be government-owned; as well as some employees whose functions are directly related to the State such as the military, French National Police, sailors, Civil law notaries' assistants, employees of the Opéra de Paris, etc. The main differences between the special retirement plan and the usual private sector retirement plans are the retirement age and the number of years a worker must contribute to the fund before being allowed a full pension. In the private sector the minimum retirement age is 62 and the minimum number of quarters of contribution to the retirement fund in order to receive a full pension is between 166 and 172 quarters depending on date of birth. Employees who are enrolled in the special retirement plan can retire earlier.

Teacher Retirement System of Texas (TRS) is a public pension plan of the State of Texas. Established in 1937, TRS provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the State of Texas and manages a $180 billion trust fund established to finance member benefits. More than 1.6 million public education and higher education employees and retirees participate in the system. TRS is the largest public retirement system in Texas in both membership and assets and the sixth largest public pension fund in America. The agency is headquartered at 1000 Red River Street in the capital city of Austin.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

Pensions in Norway fall into three major divisions; State Pensions, Occupational Pensions and Individual or personal Pensions.

Social security or welfare in Finland is very comprehensive compared to what almost all other countries provide. In the late 1980s, Finland had one of the world's most advanced welfare systems, which guaranteed decent living conditions to all Finns. Created almost entirely during the first three decades after World War II, the social security system was an outgrowth of the traditional Nordic belief that the state is not inherently hostile to the well-being of its citizens and can intervene benevolently on their behalf. According to some social historians, the basis of this belief was a relatively benign history that had allowed the gradual emergence of a free and independent peasantry in the Nordic countries and had curtailed the dominance of the nobility and the subsequent formation of a powerful right wing. Finland's history was harsher than the histories of the other Nordic countries but didn't prevent the country from following their path of social development.

In France, pensions fall into five major divisions;

India operates a complex pension system. There are however three major pillars to the Indian pension system: the solidarity social assistance called the National Social Assistance Programme (NSAP) for the elderly poor, the civil servants pension and the mandatory defined contribution pension programs run by the Employees' Provident Fund Organisation of India for private sector employees and employees of state owned companies, and several voluntary plans.

The Swiss pension system rests on three pillars:

- the state-run pension scheme for the aged, orphans, and surviving spouses ;

- the pension funds run by investment foundations, which are tied to employers ;

- voluntary, private investments.

The National Social Security Fund (NSSF) is the government agency of Tanzania responsible for the collection, safekeeping, responsible investment, and distribution of retirement funds of all employees in all sectors of the Tanzania economy that do not fall under the governmental pension schemes. The headquartersare located in Kivukoni ward of Ilala District of Dar es Salaam Region. There are one other pension fund organizations in the country; the Public Services Social Security(PSSSF). Fund for all employees working directly under the government and for all employees working under governmental Parastatal organization

This article is intended to give an overview of pensions in the Netherlands.

Pensions in Japan comprise the National Pension system run by the government, and a series of voluntary private pension plans.