8690483132

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations. Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac.

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods. Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods, a practice known as redlining.

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia. The FHLMC was created in 1970 to expand the secondary market for mortgages in the US. Along with its sister organization, the Federal National Mortgage Association, Freddie Mac buys mortgages, pools them, and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purchases. The name "Freddie Mac" is a variant of the FHLMC initialism of the company's full name that was adopted officially for ease of identification.

Real estate economics is the application of economic techniques to real estate markets. It aims to describe and predict economic patterns of supply and demand. The closely related field of housing economics is narrower in scope, concentrating on residential real estate markets, while the research on real estate trends focuses on the business and structural changes affecting the industry. Both draw on partial equilibrium analysis, urban economics, spatial economics, basic and extensive research, surveys, and finance.

The KfW, which together with its subsidiaries DEG, KfW IPEX-Bank and FuB forms the KfW Bankengruppe, is a German state-owned investment and development bank, based in Frankfurt. As of 2014, it is the world's largest national development bank and as of 2018 Germany's third largest bank by balance sheet. Its name originally comes from Kreditanstalt für Wiederaufbau. It was formed in 1948 after World War II as part of the Marshall Plan.

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of credit to targeted sectors of the economy, to make those segments of the capital market more efficient and transparent, and to reduce the risk to investors and other suppliers of capital. The desired effect of the GSEs is to enhance the availability and reduce the cost of credit to the targeted borrowing sectors primarily by reducing the risk of capital losses to investors: agriculture, home finance and education. Well known GSEs are the Federal National Mortgage Association, known as Fannie Mae, and the Federal Home Loan Mortgage Corporation, or Freddie Mac.

The 2000s United States housing bubble or house price boom or 2000shousing cycle was a sharp run up and subsequent collapse of house asset prices affecting over half of the U.S. states. In many regions a real estate bubble, it was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller home price index reported the largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States.

The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), is a United States federal law enacted in the wake of the savings and loan crisis of the 1980s.

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

The Royal Norwegian Ministry of Finance is a Norwegian ministry established in 1814. The ministry is responsible for state finance, including the state budget, taxation and economic policy in Norway. It is led by Trygve Slagsvold Vedum. The department must report to the Parliament of Norway.

The Federal Housing Finance Agency (FHFA) is an independent federal agency in the United States created as the successor regulatory agency of the Federal Housing Finance Board (FHFB), the Office of Federal Housing Enterprise Oversight (OFHEO), and the U.S. Department of Housing and Urban Development government-sponsored enterprise mission team, absorbing the powers and regulatory authority of both entities, with expanded legal and regulatory authority, including the ability to place government-sponsored enterprises (GSEs) into receivership or conservatorship.

In September 2008, the Federal Housing Finance Agency (FHFA) announced that it would take over the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation. Both government-sponsored enterprises, which finance home mortgages in the United States by issuing bonds, had become illiquid as the market for those bonds collapsed in the subprime mortgage crisis. The FHFA established conservatorships in which each enterprise's management works under the FHFA's direction to reduce losses and to develop a new operating structure that will allow a return to self-management.

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression.

Lars Wilhelmsen is a Norwegian civil servant.

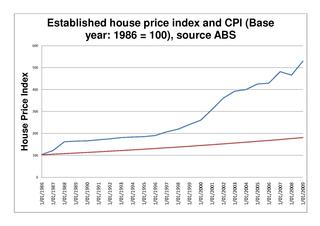

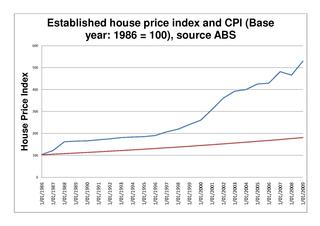

The Australian property bubble is the economic theory that the Australian property market has become or is becoming significantly overpriced and due for a significant downturn. Since the early 2010s, various commentators, including one Treasury official, have claimed the Australian property market is in a significant bubble.

National Housing Bank(NHB), is the apex regulatory body for overall regulation and licensing of housing finance companies in India. It is under the jurisdiction of Ministry of Finance, Government of India. It was set up on 9 July 1988 under the National Housing Bank Act, 1987. NHB is the apex financial institution for housing. NHB has been established with an objective to operate as a principal agency to promote housing finance institutions both at local and regional levels and to provide financial and other support incidental to such institutions and for matters connected therewith. The Finance Act, 2019 has amended the National Housing Bank Act, 1987. The amendment confers the powers of regulation of Housing Finance Companies (HFCs) to the Reserve Bank of India.

The Danish Financial Supervisory Authority (DFSA) is the financial regulatory authority of the Danish government responsible for the regulation of financial markets in Denmark.

The 2007–2008 financial crisis, or the global financial crisis (GFC), was the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a "perfect storm", which led to the Great Recession.

The Uganda Business Facilitation Centre (UBFC) is a government office building in Uganda's capital city of Kampala. The centre is intended to house the offices of key business-related departments, including (a) the Uganda Registration Services Bureau, (b) the Uganda Investment Authority and (c) the Capital Markets Authority. The aim of housing these and other government agencies under one roof is to increase their effectiveness and to improve service delivery to the business community. Ultimately, these actions are expected to improve Uganda's ranking in the ease of doing business.