This article includes a list of general references, but it lacks sufficient corresponding inline citations .(December 2017) |

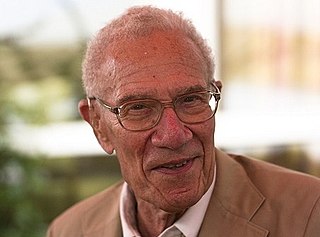

Paul Sultan was a labour economist, born in 1924 in Vancouver, Canada, died in 2019 Edwardsville, Illinois

This article includes a list of general references, but it lacks sufficient corresponding inline citations .(December 2017) |

Paul Sultan was a labour economist, born in 1924 in Vancouver, Canada, died in 2019 Edwardsville, Illinois

After serving as an aircraft pilot during World War II for the Royal Canadian Air Force, he pursued an academic career at Cornell University, the University at Buffalo, Claremont Graduate School in California, UCLA, Simon Fraser University and the University of Southern Illinois.

His early text, Labour Economics, [1] pioneered the relationship between the inflation rate and the unemployment rate, now known as the Phillips curve, which Sultan was the first to represent as a graph. [2] [3] [4] Sultan has written five books and hundreds of articles, monographs and position papers. In recognition of his work in labour-management relations he was honoured in 1997 through being admitted to the Southwestern Illinois Labour Management Hall of Fame.

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation.

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment.

Unemployment, according to the OECD, is people above a specified age not being in paid employment or self-employment but currently available for work during the reference period.

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States.

Full employment is a situation in which there is no cyclical or deficient-demand unemployment. Full employment does not entail the disappearance of all unemployment, as other kinds of unemployment, namely structural and frictional, may remain. For instance, workers who are "between jobs" for short periods of time as they search for better employment are not counted against full employment, as such unemployment is frictional rather than cyclical. An economy with full employment might also have unemployment or underemployment where part-time workers cannot find jobs appropriate to their skill level, as such unemployment is considered structural rather than cyclical. Full employment marks the point past which expansionary fiscal and/or monetary policy cannot reduce unemployment any further without causing inflation.

This aims to be a complete article list of economics topics:

The Phillips curve is an economic model, named after William Phillips, that predicts a correlation between reduction in unemployment and increased rates of wage rises within an economy. While Phillips himself did not state a linked relationship between employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place.

Robert Merton Solow, GCIH is an American economist whose work on the theory of economic growth culminated in the exogenous growth model named after him. He is currently Emeritus Institute Professor of Economics at the Massachusetts Institute of Technology, where he has been a professor since 1949. He was awarded the John Bates Clark Medal in 1961, the Nobel Memorial Prize in Economic Sciences in 1987, and the Presidential Medal of Freedom in 2014. Four of his PhD students, George Akerlof, Joseph Stiglitz, Peter Diamond and William Nordhaus later received Nobel Memorial Prizes in Economic Sciences in their own right.

Sir William Arthur Lewis was a Saint Lucian economist and the James Madison Professor of Political Economy at Princeton University. Lewis was known for his contributions in the field of economic development. In 1979, he was awarded the Nobel Memorial Prize in Economic Sciences.

Neutrality of money is the idea that a change in the stock of money affects only nominal variables in the economy such as prices, wages, and exchange rates, with no effect on real variables, like employment, real GDP, and real consumption. Neutrality of money is an important idea in classical economics and is related to the classical dichotomy. It implies that the central bank does not affect the real economy by creating money. Instead, any increase in the supply of money would be offset by a proportional rise in prices and wages. This assumption underlies some mainstream macroeconomic models. Others like monetarism view money as being neutral only in the long run.

Ricardo A. M. R. Reis is a Portuguese economist and the A. W. Phillips professor of economics at the London School of Economics. In a 2013 ranking of young economists by Glenn Ellison, Reis was considered the top economist with a PhD between 1996 and 2004., and in 2016 he won the Germán Bernácer Prize for top European-born economist researching macroeconomics and finance. He writes a weekly op-ed for the Portuguese newspaper Jornal de Notícias and Expresso, and participates frequently in economic debates in Portugal.

Edmund Strother Phelps is an American economist and the recipient of the 2006 Nobel Memorial Prize in Economic Sciences.

Robert JamesGordon is an American economist. He is the Stanley G. Harris Professor of the Social Sciences at Northwestern University. Gordon is one of the world’s leading experts on inflation, unemployment, and long-term economic growth. His recent work asking whether U.S. economic growth is “almost over” has been widely cited, and in 2016 he was named as one of Bloomberg’s top 50 most influential people in the world.

David Edward Card is a Canadian-American labour economist and the Class of 1950 Professor of Economics at the University of California, Berkeley, where he has been since 1997. He was awarded half of the 2021 Nobel Memorial Prize in Economic Sciences "for his empirical contributions to labour economics", with Joshua Angrist and Guido Imbens jointly awarded the other half.

The tendency of the rate of profit to fall (TRPF) is a theory in the crisis theory of political economy, according to which the rate of profit—the ratio of the profit to the amount of invested capital—decreases over time. This hypothesis gained additional prominence from its discussion by Karl Marx in Chapter 13 of Capital, Volume III, but economists as diverse as Adam Smith, John Stuart Mill, David Ricardo and Stanley Jevons referred explicitly to the TRPF as an empirical phenomenon that demanded further theoretical explanation, although they differed on the reasons why the TRPF should necessarily occur.

David Graham Blanchflower,, sometimes called Danny Blanchflower, is a British-American labour economist and academic. He is currently a tenured economics professor at Dartmouth College, Hanover, New Hampshire. He is also a research associate at the National Bureau of Economic Research, part-time professor at the University of Glasgow and a Bloomberg TV contributing editor. He was an external member of the Bank of England's interest rate-setting Monetary Policy Committee (MPC) from June 2006 to June 2009.

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1983. It is widely considered to have been the most severe recession since World War II. A key event leading to the recession was the 1979 energy crisis, mostly caused by the Iranian Revolution which caused a disruption to the global oil supply, which saw oil prices rising sharply in 1979 and early 1980. The sharp rise in oil prices pushed the already high rates of inflation in several major advanced countries to new double-digit highs, with countries such as the United States, Canada, West Germany, Italy, the United Kingdom and Japan tightening their monetary policies by increasing interest rates in order to control the inflation. These G7 countries each, in fact, had "double-dip" recessions involving short declines in economic output in parts of 1980 followed by a short period of expansion, in turn, followed by a steeper, longer period of economic contraction starting sometime in 1981 and ending in the last half of 1982 or in early 1983. Most of these countries experienced stagflation, a situation of both high inflation rates and high unemployment rates.

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s, 60s, and 70s.

Non-accelerating inflation rate of unemployment (NAIRU) is a theoretical level of unemployment below which inflation would be expected to rise. It was first introduced as NIRU by Franco Modigliani and Lucas Papademos in 1975, as an improvement over the "natural rate of unemployment" concept, which was proposed earlier by Milton Friedman.

Marxian economics, or the Marxian school of economics, is a heterodox school of political economic thought. Its foundations can be traced back to Karl Marx's critique of political economy. However, unlike critics of political economy, Marxian economists tend to accept the concept of the economy prima facie. Marxian economics comprises several different theories and includes multiple schools of thought, which are sometimes opposed to each other; in many cases Marxian analysis is used to complement, or to supplement, other economic approaches. Because one does not necessarily have to be politically Marxist to be economically Marxian, the two adjectives coexist in usage, rather than being synonymous: They share a semantic field, while also allowing both connotative and denotative differences.

Priority for drawing the Phillips curve goes to Paul Sultan, whose contribution predates Phillips' by one year.