A pension is a fund into which amounts are paid regularly during the individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides retirement income.

The Canada Pension Plan is a contributory, earnings-related social insurance program. It forms one of the two major components of Canada's public retirement income system, the other component being Old Age Security (OAS). Other parts of Canada's retirement system are private pensions, either employer-sponsored or from tax-deferred individual savings. As of Jun 30, 2022, the CPP Investment Board manages over C$523 billion in investment assets for the Canada Pension Plan on behalf of 21 million Canadians. CPPIB is one of the world's biggest pension funds.

The Employee Retirement Income Security Act of 1974 (ERISA) is a U.S. federal tax and labor law that establishes minimum standards for pension plans in private industry. It contains rules on the federal income tax effects of transactions associated with employee benefit plans. ERISA was enacted to protect the interests of employee benefit plan participants and their beneficiaries by:

A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the United States are based on provisions of the Internal Revenue Code and the plans are regulated by the Department of Labor under the provisions of the Employee Retirement Income Security Act (ERISA).

The California Public Employees' Retirement System (CalPERS) is an agency in the California executive branch that "manages pension and health benefits for more than 1.5 million California public employees, retirees, and their families". In fiscal year 2020–21, CalPERS paid over $27.4 billion in retirement benefits, and over $9.74 billion in health benefits.

The Pension Benefit Guaranty Corporation (PBGC) is a United States federally chartered corporation created by the Employee Retirement Income Security Act of 1974 (ERISA) to encourage the continuation and maintenance of voluntary private defined benefit pension plans, provide timely and uninterrupted payment of pension benefits, and keep pension insurance premiums at the lowest level necessary to carry out its operations. Subject to other statutory limitations, PBGC's single-employer insurance program pays pension benefits up to the maximum guaranteed benefit set by law to participants who retire at 65. The benefits payable to insured retirees who start their benefits at ages other than 65 or elect survivor coverage are adjusted to be equivalent in value. The maximum monthly guarantee for the multiemployer program is far lower and more complicated.

The pensions crisis or pensions timebomb is the predicted difficulty in paying for corporate or government employment retirement pensions in various countries, due to a difference between pension obligations and the resources set aside to fund them. The basic difficulty of the pension problem is that institutions must be sustained over far longer than the political planning horizon. Shifting demographics are causing a lower ratio of workers per retiree; contributing factors include retirees living longer, and lower birth rates. An international comparison of pension institution by countries is important to solve the pension crisis problem. There is significant debate regarding the magnitude and importance of the problem, as well as the solutions. One aspect and challenge of the "Pension timebomb" is that several countries' governments have a constitutional obligation to provide public services to its citizens, but the funding of these programs, such as healthcare are at a lack of funding, especially after the 2008 recession and the strain caused on the dependency ratio by an ageing population and a shrinking workforce, which increases costs of elderly care.

Pensions in the United States consist of the Social Security system, public employees retirement systems, as well as various private pension plans offered by employers, insurance companies, and unions.

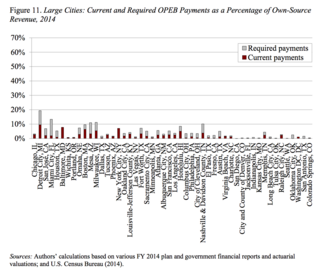

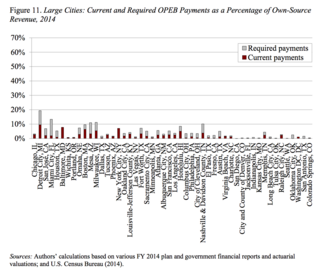

Other postemployment benefits is a term used in the United States to describe the benefits that an employee begins to receive at the start of their retirement. These benefits do not include the pension paid to the retired employee. "Other postemployment benefits" were originally intended to be an important source of supplemental coverage for people on Medicare. Typically this means that if employees retire before the age of 65 they can remain on their employer's health plan. Upon turning 65 they leave their employers plan for Medicare but still receive additional benefits from their employer. These benefits may include health insurance and dental, vision, prescription, or other healthcare benefits provided to eligible retirees and their beneficiaries. They also may include life insurance, disability insurance, long-term care insurance, and other benefits.

The Pension Protection Act of 2006, 120 Stat. 780, was signed into law by U.S. President George W. Bush on August 17, 2006.

Teacher Retirement System of Texas (TRS) is a public pension plan of the State of Texas. Established in 1937, TRS provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the State of Texas and manages a $180 billion trust fund established to finance member benefits. More than 1.6 million public education and higher education employees and retirees participate in the system. TRS is the largest public retirement system in Texas in both membership and assets and the sixth largest public pension fund in America. The agency is headquartered at 1000 Red River Street in the capital city of Austin.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

The statutory and fiduciary mandate of the State Board of Administration of Florida (SBA) is to invest, manage and safeguard assets of the Florida Retirement System (FRS) Trust Fund as well as the assets of a variety of other funds. The SBA manages 25 different investment funds and trust clients.

The State Universities Retirement System, or SURS, is an agency in the U.S. state of Illinois government that administers retirement, disability, death, and survivor benefits to eligible SURS participants and annuitants. Membership in SURS is attained through employment with 61 employing agencies, including public universities, community colleges, and other qualified state agencies. Eligible employees are automatically enrolled in SURS when employment begins.

Oklahoma Teacher's Retirement System (OTRS) is the pension program for public education employees in the State of Oklahoma. As of June 30, 2014, the program had nearly 168,000 members. Public education teachers and administrators are required to be OTRS members; support staff can join voluntarily. State law established OTRS in 1943 to manage retirement funds and provide financial security for public education employees. Its first checks to retirees were sent out in 1947. It is administered by a staff and 14-member board of trustees. Its current executive director is Tom Spencer, who started in that position on November 1, 2014.

Utah Retirement Systems administers pension plans and retirement savings plans for public employees in the U.S. state of Utah. There are eight separate defined-benefit pension plans administered by URS, as well as various retirement savings plans. As of December 31, 2014, the URS was managing over $31 billion in its pension trust funds, for nearly 200,000 members. Besides the pension trust funds, the URS manages a 401(k), 457(b), a traditional IRA and Roth IRA with around $4.5 billion in assets combined at the end of 2014.

Indiana Public Retirement System (INPRS) is a U.S.-based pension fund responsible for the pension assets for public employees in the state of Indiana. INPRS is among the largest 100 pension funds in the United States, with $47.961 billion in actuarial accrued liabilities and $34.479 billion in actuarial assets as of June 30, 2021. The fund administers and manages several pension funds in the State of Indiana, the two largest of which are the Indiana State Teachers' Retirement Fund and the Indiana Public Employees' Retirement Fund. The others are the 1977 Police Officers' and Firefighters' Retirement Fund; the Judges' Retirement System; the Excise, Gaming, and Conservation Officers' Retirement Fund; the Prosecuting Attorneys' Retirement Fund; the Legislators' Defined Benefit Fund; and the Legislators' Defined Contribution Fund. Each of the current funds remains separate but all are administered by the nine-member board of trustees of INPRS.

The Illinois pension crisis refers to the rising gap between the pension benefits owed to eligible state employees and the amount of funding set aside by the state to make these future pension payments. As of 2020, the size of Illinois' pension obligation is $237B, but the state's pension funds have only $96B available for payouts to retirees.

The Kentucky Public Pensions Authority (KPPA), formerly known as The Kentucky Retirement Systems (KRS), is the administrator of defined-benefit pension and insurance plans for most of Kentucky's state and county employees and retirees. KPPA oversees Kentucky's three separate retirement systems: Kentucky Employee Retirement System (KERS), County Employee Retirement System (CERS) and State Police Retirement System (SPRS). CERS and KERS are multiple-employer, cost-sharing defined-benefit pension plans with Non-Hazardous and Hazardous members. SPRS is a single-employer, defined-benefit pension plan with Hazardous members. Each system covers regular full-time members employed by the participating agencies. Kentucky's public employee pension system has been ranked one of the most underfunded public pension systems in the country.