International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services.

An export in international trade is a good produced in one country that is sold into another country or a service provided in one country for a national or resident of another country. The seller of such goods or the service provider is an exporter; the foreign buyers is an importer. Services that figure in international trade include financial, accounting and other professional services, tourism, education as well as intellectual property rights.

Economic sanctions are commercial and financial penalties applied by states or institutions against states, groups, or individuals. Economic sanctions are a form of coercion that attempts to get an actor to change its behavior through disruption in economic exchange. Sanctions can be intended to compel or deterrence.

Non-tariff barriers to trade are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs. Such barriers are subject to controversy and debate, as they may comply with international rules on trade yet serve protectionist purposes.

In its economic relations, Japan is both a major trading nation and one of the largest international investors in the world. In many respects, international trade is the lifeblood of Japan's economy. Imports and exports totaling the equivalent of nearly US$1.309.2 Trillion in 2017, which meant that Japan was the world's fourth largest trading nation after China, the United States and Germany. Trade was once the primary form of Japan's international economic relationships, but in the 1980s its rapidly rising foreign investments added a new and increasingly important dimension, broadening the horizons of Japanese businesses and giving Japan new world prominence.

The Council of Arab Economic Unity (CAEU) was founded by Egypt, Iraq, Jordan, Kuwait, Libya, Mauritania, Palestine, Saudi Arabia, Sudan, Tunisia, Syria, United Arab Emirates and Yemen on May 30, 1964, following an agreement in 1957 by the Economic Council of the Arab League.

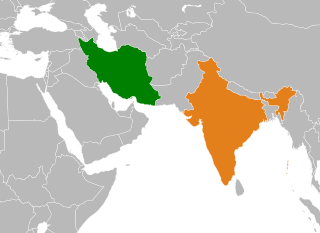

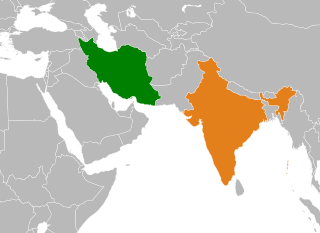

India–Iran relations are the bilateral relationship between the Republic of India and the Islamic Republic of Iran. Independent India and Iran established diplomatic relations on 15 March 1950. However, ties between both ancient Persia and ancient India date back millennia. During much of the Cold War, relations between India and the erstwhile Imperial State of Iran suffered due to their differing political interests: India endorsed a non-aligned position but fostered strong links with the Soviet Union, while Iran was an open member of the Western Bloc and enjoyed close ties with the United States. While India did not welcome the 1979 Islamic Revolution, relations between the two states strengthened momentarily in its aftermath. However, Iran's continued support for Pakistan in the India–Pakistan conflict and India's close relations with Iraq during the Iran–Iraq War greatly strained bilateral ties. In the 1990s, both India and Iran supported the Northern Alliance against the Taliban in Afghanistan, the latter of which received overt Pakistani backing and ruled most of the country until the 2001 United States-led invasion. They continued to collaborate in supporting the broad-based anti-Taliban government, led by Ashraf Ghani and backed by the international community, until the Taliban captured Kabul in 2021 and re-established the Islamic Emirate of Afghanistan. India and Iran signed a defence cooperation agreement in December 2002.

An importer is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. Import is part of the International Trade which involves buying and receiving of goods or services produced in another country. The seller of such goods and services is called an exporter, while the foreign buyer is known as an importer.

A Certificate of Origin or Declaration of Origin is a document widely used in international trade transactions which attests that the product listed therein has met certain criteria to be considered as originating in a particular country. A certificate of origin / declaration of origin is generally prepared and completed by the exporter or the manufacturer, and may be subject to official certification by an authorized third party. It is often submitted to a customs authority of the importing country to justify the product's eligibility for entry and/or its entitlement to preferential treatment. Guidelines for issuance of Certificates of Origin by chambers of commerce globally are issued by the International Chamber of Commerce.

The ATA Carnet, often referred to as the "Passport for goods", is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. It consists of unified customs declaration forms which are prepared ready to use at every border crossing point. It is a globally accepted guarantee for customs duties and taxes which can replace the security deposit required by each customs authority. It can be used in multiple countries in multiple trips up to its one-year validity. The acronym ATA is a combination of French and English terms "Admission Temporaire/Temporary Admission". The ATA carnet is now the document most widely used by the business community for international operations involving temporary admission of goods.

Trade is a key factor of the economy of China. In the three decades following the dump of the Communist Chinese state in 1949, China's trade institutions at first developed into a partially modern but somewhat inefficient system. The drive to modernize the economy that began in 1978 required a sharp acceleration in commodity flows and greatly improved efficiency in economic transactions. In the ensuing years economic reforms were adopted by the government to develop a socialist market economy. This type of economy combined central planning with market mechanisms. The changes resulted in the decentralization and expansion of domestic and foreign trade institutions, as well as a greatly enlarged role for free market in the distribution of goods, and a prominent role for foreign trade and investment in economic development.

The ASEAN–India Free Trade Area (AIFTA) is a free trade area among the ten member states of the Association of Southeast Asian Nations (ASEAN) and the Republic of India. The initial framework agreement was signed on 8 October 2003 in Bali, Indonesia. and the final agreement was on 13 August 2009. The free trade area came into effect on 1 January 2010. India hosted the latest ASEAN-India Commemorative Summit in New Delhi on 26 January 2018. In the financial year 2017–18, Indo-ASEAN bilateral trade grew by almost 14% to reach US$81.3 billion. India's imports from ASEAN were valued at US$47.13 billion while its exports to ASEAN stood at US$34.2 billion.

European Union–Iran relations are the bilateral relations between Iran and the European Union (EU). The EU is Iran's largest trading partner, along with China and the United Arab Emirates. Trade with Iran is subject to the general EU import regime and the EU supports the goal of Iranian accession to the World Trade Organization (WTO). The EU has accused and criticized Iran for human rights violations, which led to diplomatic tensions, but both sides aim at improving and normalizing relations. Should Turkey's accession to the EU take place, Iran will border the European Union.

Iran is an energy superpower and the petroleum industry in Iran plays an important part in it. In 2004, Iran produced 5.1 percent of the world's total crude oil, which generated revenues of US$25 billion to US$30 billion and was the country's primary source of foreign currency. At 2006 levels of production, oil proceeds represented about 18.7% of gross domestic product (GDP). However, the importance of the hydrocarbon sector to Iran's economy has been far greater. The oil and gas industry has been the engine of economic growth, directly affecting public development projects, the government's annual budget, and most foreign exchange sources.

Since the end of apartheid, foreign trade in South Africa has increased, following the lifting of several sanctions and boycotts which were imposed as a means of ending apartheid.

A resistance economy, also known as a resistive economy is an economy that tries to circumvent sanctions imposed on the country or region. This can involve increasing resilience by substituting local inputs for imported inputs, the smuggling of goods and an increase in barter trade. A country may even attempt to turn these pressures into opportunities. In some ways sanctioned economies bear some resemblance to an economy on a war or emergency footing.

The Arab League boycott of Israel is a strategy adopted by the Arab League and its member states to boycott economic and other relations between Arabs and the Arab states and Israel and specifically stopping all trade with Israel which adds to that country's economic and military strength. A secondary boycott was later imposed, to boycott non-Israeli companies that do business with Israel, and later a tertiary boycott involved the blacklisting of firms that do business with other companies that do business with Israel.

Economic sanctions are defined as financial penalties imposed on a nation, country or self-governing state by an individual or a group of nations in order to harm and disrupt the economy of the target nation. This effect can be accomplished by imposing tariffs, quotas, subsidies, restrictions on financial transactions and much more.

As part of the sanctions which have been imposed on the Russian Federation as a result of the 2022 Russian invasion of Ukraine, on 2 September 2022, finance ministers of the G7 group of nations agreed to cap the price of Russian oil and petroleum products in an effort which was intended to reduce Russia's ability to finance its war on Ukraine and curb further increases in the 2021–2022 inflation surge.