H&R Block, Inc., or H&R Block, is an American tax preparation company operating in Canada, the United States, and Australia. The company was founded in 1955 by brothers Henry W. Bloch and Richard Bloch.

Predatory lending refers to unethical practices conducted by lending organizations during a loan origination process that are unfair, deceptive, or fraudulent. While there are no internationally agreed legal definitions for predatory lending, a 2006 audit report from the office of inspector general of the US Federal Deposit Insurance Corporation (FDIC) broadly defines predatory lending as "imposing unfair and abusive loan terms on borrowers", though "unfair" and "abusive" were not specifically defined. Though there are laws against some of the specific practices commonly identified as predatory, various federal agencies use the phrase as a catch-all term for many specific illegal activities in the loan industry. Predatory lending should not be confused with predatory mortgage servicing which is mortgage practices described by critics as unfair, deceptive, or fraudulent practices during the loan or mortgage servicing process, post loan origination.

Jackson Hewitt Tax Service Inc. is the second largest tax-preparation service in the United States; responsible for preparing over 2 million federal, state, and local income-tax returns each year.

Intuit Inc. is an American multinational business software company that specializes in financial software. The company is headquartered in Mountain View, California, and the CEO is Sasan Goodarzi. Intuit's products include the tax preparation application TurboTax, the small business accounting program QuickBooks, the credit monitoring and personal accounting service Credit Karma, and email marketing platform Mailchimp. As of 2019, more than 95% of its revenues and earnings come from its activities within the United States.

A tax refund is a payment to the taxpayer due because the taxpayer has paid more tax than owed.

TurboTax is a software package for preparation of American and Canadian income tax returns, produced by Intuit. TurboTax is a market leader in its product segment, competing with H&R Block Tax Software and TaxAct. TurboTax was developed by Michael A. Chipman of Chipsoft in 1984 and was sold to Intuit in 1993.

The Free File Alliance is a group of tax preparation companies which operate a public-private partnership with the Internal Revenue Service (IRS) to provide free electronic tax filing services under the IRS Free File program to United States taxpayers meeting certain guidelines. The IRS stipulates filers must have an adjusted gross income (AGI) of $73,000 or less for tax year 2022 to qualify, but participating companies can set their own requirements and restrictions. The IRS Free File program is a compromise between the IRS and for-profit tax software companies that enables lower and middle-income filers to file their taxes for free while ensuring the IRS does not develop its own free-to-use tax software that would compete with private, for-profit tax software companies.

Debt settlement is a settlement negotiated with a debtor's unsecured creditor. Commonly, creditors agree to forgive a large part of the debt: perhaps around half, though results can vary widely. When settlements are finalized, the terms are put in writing. It is common that the debtor makes one lump-sum payment in exchange for the creditor agreeing that the debt is now cancelled and the matter closed. Some settlements are paid out over a number of months. In either case, as long as the debtor does what is agreed in the negotiation, no outstanding debt will appear on the former debtor's credit report.

Tax preparation is the process of preparing tax returns, often income tax returns, often for a person other than the taxpayer, and generally for compensation. Tax preparation may be done by the taxpayer with or without the help of tax preparation software and online services. Tax preparation may also be done by a licensed professional such as an attorney, certified public accountant or enrolled agent, or by an unlicensed tax preparation business. Because United States income tax laws are considered to be complicated, many taxpayers seek outside assistance with taxes.

Circular 230 refers to Treasury Department Circular No. 230. This publication establishes the rules governing those who practice before the U.S. Internal Revenue Service (IRS), including attorneys, certified public accountants (CPAs) and enrolled agents (EAs).

The Economic Stimulus Act of 2008 was an Act of Congress providing for several kinds of economic stimuli intended to boost the United States economy in 2008 and to avert a recession, or ameliorate economic conditions. The stimulus package was passed by the U.S. House of Representatives on January 29, 2008, and in a slightly different version by the U.S. Senate on February 7, 2008. The Senate version was then approved in the House the same day. It was signed into law on February 13, 2008, by President George W. Bush with the support of both Democratic and Republican lawmakers. The law provides for tax rebates to low- and middle-income U.S. taxpayers, tax incentives to stimulate business investment, and an increase in the limits imposed on mortgages eligible for purchase by government-sponsored enterprises. The total cost of this bill was projected at $152 billion for 2008.

Customer Account Data Engine (CADE) is the name of two Internal Revenue Service (IRS) tax processing systems, used for filing United States income tax returns. Work on the original CADE, designed to replace the Individual Master File (IMF) system, was begun in 2000 and stopped in 2009. The original CADE is in active use; for instance, in 2009, it was used to process over 40 million tax returns.

The United States federal earned income tax credit or earned income credit is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.

Back taxes is a term for taxes that were not completely paid when due. Typically, these are taxes that are owed from a previous year. Causes for back taxes include failure to pay taxes by the deadline, failure to correctly report one's income, or neglecting to file a tax return altogether.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

The IRS Return Preparer Initiative was an effort by the Internal Revenue Service (IRS) to regulate the tax return preparation industry in the United States. The purpose of the initiative is to improve taxpayer compliance and service by setting professional standards for and providing support to the tax preparation industry. Starting January 1, 2011 and, until the program was suspended in January 2013, the initiative required all paid federal tax return preparers to register with the IRS and to obtain an identification number, called a Preparer Tax Identification Number (PTIN). The multi-year phase-in effort called for certain paid tax return preparers to pass a competency test and to take annual continuing education courses. The ethics provisions found in Treasury Department's Circular 230 were extended to all paid tax return preparers. Preparers who have their PTINs, pass the test and complete education credits were to have a new designation: Registered Tax Return Preparer.

The IRS Free File Program is a service that allows U.S. taxpayers to prepare and e-file their federal income tax returns for free. Through the program, commercial tax software companies that are part of the Free File Alliance offer free tax preparation software to tax filers with annual adjusted gross income (AGI) below $73,000 for Tax Year 2022. The AGI is adjusted and typically increases slightly for each tax-filing season. The service is available through the IRS's website at www.irs.gov/freefile. Free fillable forms also are available to all taxpayers as part of the Free File Program.

Santa Barbara Tax Products Group is based in San Diego, California and operates as a subsidiary of Green Dot Corporation. Santa Barbara Tax Products Group was established in 2010 upon the sale of the Tax Products Business Unit of Santa Barbara Bank & Trust (SBBT), and was acquired by Green Dot Corporation in 2014.

The Registered Tax Return Preparer Test was a test produced by the U.S. Internal Revenue Service (IRS). Until the program was suspended in January 2013, the IRS had implemented rules requiring that certain individuals who wanted to work as tax return preparers pass this test to demonstrate their ability to understand U.S. tax law, tax form preparation and ethical requirements. The competency test was part of an agency effort to better regulate the tax return preparation industry, to improve the accuracy of tax return preparation and to improve service to taxpayers. Candidates who passed the test, a tax compliance check, and met certain other requirements had a new designation: Registered Tax Return Preparer.

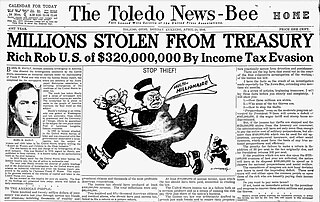

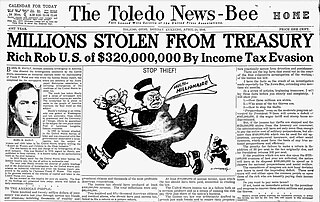

Under the federal law of the United States of America, tax evasion or tax fraud is the purposeful illegal attempt of a taxpayer to evade assessment or payment of a tax imposed by Federal law. Conviction of tax evasion may result in fines and imprisonment. Compared to other countries, Americans are more likely to pay their taxes on time and law-abidingly.