Related Research Articles

An auction is usually a process of buying and selling goods or services by offering them up for bid, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory.

New Zealand's electricity market (NZEM) is regulated by the Electricity Industry Participation Code administered by the Electricity Authority (EA). The Authority was established in November 2010 to replace the Electricity Commission.

In economic terms, electricity is a commodity capable of being bought, sold, and traded. An electricity market, also power exchange or PX, is a system enabling purchases, through bids to buy; sales, through offers to sell. Bids and offers use supply and demand principles to set the price. Long-term contracts are similar to power purchase agreements and generally considered private bi-lateral transactions between counterparties.

Variable pricing is a pricing strategy for products. Traditional examples include auctions, stock markets, foreign exchange markets, bargaining, electricity, and discounts. More recent examples, driven in part by reduced transaction costs using modern information technology, include yield management and some forms of congestion pricing. Increasingly, sport venues, such as AT&T Park in San Francisco, have employed variable pricing to capture the most revenue possible out of consumers and fans.

The Ontario Energy Board regulates natural gas and electricity utilities in the province of Ontario, Canada. This includes setting rates, and licensing all participants in the electricity sector including the Independent Electricity System Operator (IESO), generators, transmitters, distributors, wholesalers and electricity retailers, as well as natural gas marketers who sell to low volume customers.

The National Electricity Market (NEM) is an arrangement in Australia's electricity sector for the connection of the synchronous electricity transmission grids of the eastern and southern Australia states and territories to create a cross-state wholesale electricity market. The Australian Energy Market Commission develops and maintains the Australian National Electricity Rules (NER), which have the force of law in the states and territories participating in NEM. The Rules are enforced by the Australian Energy Regulator. The day-to-day management of NEM is performed by the Australian Energy Market Operator.

Energy demand management, also known as demand-side management (DSM) or demand-side response (DSR), is the modification of consumer demand for energy through various methods such as financial incentives and behavioral change through education.

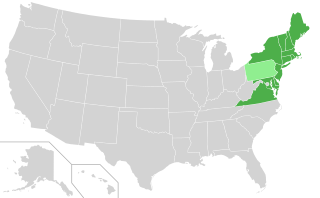

The Regional Greenhouse Gas Initiative (RGGI, pronounced "Reggie") is the first mandatory market-based program in the United States to reduce greenhouse gas emissions. RGGI is a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia to cap and reduce carbon dioxide (CO2) emissions from the power sector. RGGI compliance obligations apply to fossil-fueled power plants 25MW and larger within the ten-state region. As of 2021, Pennsylvania is pending RGGI membership with an anticipated start in early 2022, and North Carolina is currently considering joining RGGI.

European Energy Exchange (EEX) AG is a central European electric power and related commodities exchange located in Leipzig, Germany. It develops, operates and connects secure, liquid and transparent markets for energy and related products, including power derivative contracts, emission allowances, agricultural and freight products.

A combinatorial auction is a type of smart market in which participants can place bids on combinations of discrete heterogeneous items, or “packages”, rather than individual items or continuous quantities. These packages can be also called lots and the whole auction a multi-lot auction. Combinatorial auctions are applicable when bidders have non-additive valuations on bundles of items, that is, they value combinations of items more or less than the sum of their valuations of individual elements of the combination.

The Energy Exchange Austria (EXAA) is a Central European energy exchange headquartered in Vienna. Currently, the EXAA Market encompasses trading areas in the entire of Austria and Germany.

The merit order is a way of ranking available sources of energy, especially electrical generation, based on ascending order of price and sometimes pollution, together with amount of energy that will be generated. In a centralized management, the ranking is so that those with the lowest marginal costs are the first ones to be brought online to meet demand, and the plants with the highest marginal costs are the last to be brought on line. Dispatching generation in this way, known as "economic dispatch", minimizes the cost of production of electricity. Sometimes generating units must be started out of merit order, due to transmission congestion, system reliability or other reasons.

Availability Based Tariff (ABT) is a frequency based pricing mechanism applicable in India for unscheduled electric power transactions. The ABT falls under electricity market mechanisms to charge and regulate power to achieve short term and long term network stability as well as incentives and dis-incentives to grid participants against deviations in committed supplies as the case may be.

In 1996, Alberta began to restructure its electricity market away from traditional cost-of-service regulation to a market-based system. The market now includes a host of buyers and sellers, and an increasingly diverse infrastructure.

An electrical grid is an interconnected network for electricity delivery from producers to consumers. Electrical grids vary in size and can cover whole countries or continents. It consists of:

Virtual bidding is a strategy implemented in various Independent System Operator electricity markets of trading Day-Ahead prices against Real-Time prices. The term "bid" can be used loosely in electricity markets to refer to an offer to buy or to sell. And the term "virtual" is used to refer to the fact that, while these trades occur in a physical market, virtual trades never entail taking a physical position—because every sell Day Ahead will be closed by a buy in Real Time. The ISO maintains a trade execution system that ensures all virtual positions will be closed before delivery time. A virtual bidding platform gives financial entities a way to participate in these physical markets, with no physical assets or presence on the grid. They can attempt to capitalize on regular divergences between these markets of different time period for the same underlying. If this strategy of trading one time period against another without the intent to deliver or receive physical power is implemented outside of a transaction system that identifies virtual bids and ensures they will be closed, it may be referred to as "implicit" virtual bidding. Virtual positions are included in the same simultaneous feasibility tests and price determination processes as real positions. Thus they can serve to reduce inefficiencies in the market.

The Indian Energy Exchange (IEX) is an Indian electronic system based power trading exchange regulated by the Central Electricity Regulatory Commission (CERC). IEX started its operations on June 27, 2008. Indian Energy Exchange pioneered the development of power trading in India and provides an electronic platform to the various participants in power market, comprising State Electricity Boards, Power producers, Power Traders and Open Access Consumers.

The United Kingdom is committed to legally binding greenhouse gas emissions reduction targets of 34% by 2020 and 80% by 2050, compared to 1990 levels, as set out in the Climate Change Act 2008. Decarbonisation of electricity generation will form a major part of this reduction and is essential before other sectors of the economy can be successfully decarbonised.

The electricity sector in the Philippines provides electricity through power generation, transmission, and distribution to many parts of the Philippines. The Philippines is divided into three electrical grids, one each for Luzon, the Visayas and Mindanao. As of June 2016, the total installed capacity in the Philippines was 20,055 megawatts (MW), of which 14,348 MW was on the Luzon grid. As of June, 2016, the all-time peak demand on Luzon was 9,726 MW at 2:00 P.M. on May 2, 2016; on Visayas was 1,878 MW at 2:00 P.M. on May 11, 2016; and on Mindanao was 1,593 MW at 1:35 P.M. on June 8, 2016. However, about 12% of Filipinos have no access to electricity. The Philippines is also one of the countries in the world that has a fully functioning electricity market since 2006 called the Philippine Wholesale Electricity Spot Market(WESM) and is operated by an independent market operator.

The Commission for Regulation of Utilities (CRU), formerly known as the Commission for Energy Regulation, is the Republic of Ireland's energy and water economic utility regulator.

References

- ↑ McCabe, Kevin, Stephen Rassenti, and Vernon Smith (1991). Smart computer-assisted markets. Science. 254 534-538.

- ↑ Pekec, Aleksandar and Michael H. Rothkopf (2003), Combinatorial Auction Design, MANAGEMENT SCIENCE, Vol. 49, No. 11, November 2003, pp. 1485-1503.

- ↑ Rassenti, S.J., V.L. Smith, and R.L. Bluffing (1982). “A Combinatorial Auction Mechanism for Airport time Slot Allocation,” Bell J. of Economics, v.13, pp. 402-417.

- ↑ Wald, Matthew L.; Belson, Ken (4 December 2008). "U.S. to Auction Slots Soon at New York City Airports". NY Times.

- ↑ Alvey T., Goodwin D., Xingwang M., Streiffert D. and Sun D. (1998). A security-constrained bid-clearing system for the NZ wholesale electricity market. IEEE Trans. Power Systems, 13(2), 340-346.

- ↑ Hogan W.W, Read E.G and Ring B.J. (1996). Using Mathematical Programming for Electricity Spot Pricing. Int’l Trans. in Operations Research, 3, (3-4), 243-253.

- ↑ McCabe, Kevin, Stephen Rasenti, and Vernon Smith (1990). Auction Design for Composite Goods: The Natural Gas Industry, J. of Economic Behavior and Organization, September, 127-149.

- ↑ Chakravorti, B., W.W. Sharkey, Y. Spiegel and S. Wilkie (1995). Auctioning the Airwaves: The Contest for Broadband PCS Spectrum, J. Econ. & Mgt Strategy, 4(2), 267-343.

- ↑ O’Neill, R.P., P.M. Sotkiewicz, B.F. Hobbs, M.H. Rothkopf, W.R. Stewart (2005). Effective market-clearing prices in markets with non-convexities. European Journal of Operational Research. 164 269-285.

- ↑ Epstein, Rafael, Lysette Henriquez, Jaime Catalán, Gabriel Y. Weintraub, Cristián Martinez, “A Combinatorial Auction Improves School Meals in Chile,” Interfaces, vol. 32, no. 6, Nov-Dec 2002, pp. 1-14.

- ↑ Graves, R.L., J. Sankaran, and L. Schrage (1993). An Auction Method for Course Registration, Interfaces, 23(5).

- ↑ Murphy, J. J., A. Dinar, et al. (2000). The Design of ‘Smart’ Water Market Institutions Using Laboratory Experiments. Env and Resource Economics 17(4), 375-394.

- ↑ Raffensperger, J F; Milke, M (2017). Smart Markets for Water Resources: A Manual for Implementation. Springer Publishing.

- ↑ Ahlfeld, D., Barlow, P., and Mulligan, A. (2005). GWM–A ground–water mgt process for the USGS modular ground–water model (MODFLOW–2000), U.S. Geological Survey Open–File Report 2005–1072.