An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff.

Arthur Frederick Hailey, AE was a Canadian novelist whose plot-driven storylines were set against the backdrops of various industries. His books, which include such best sellers as Hotel (1965), Airport (1968), Wheels (1971), The Moneychangers (1975), and Overload (1979), have sold 170 million copies in 38 languages.

The Bank of America Corporation is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina, with investment banking and auxiliary headquarters in Manhattan. The bank was founded by the merger of NationsBank and Bank of America in 1998. It is the second-largest banking institution in the United States and the second-largest bank in the world by market capitalization, both after JPMorgan Chase. Bank of America is one of the Big Four banking institutions of the United States. It serves about 10 percent of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services revolve around commercial banking, wealth management, and investment banking.

Svenska Handelsbanken AB is a Swedish bank providing banking services including traditional corporate transactions, investment banking and trading as well as consumer banking including insurance. Handelsbanken is one of the major banks in Sweden with a nationwide branch network.

Banco Bradesco S.A. is a Brazilian financial services company headquartered in Osasco, in the state of São Paulo, Brazil. It is the third largest banking institution by assets in Brazil and Latin America. It is also one of fifty most valuable banks in the world. The bank is listed at the B3 in São Paulo, where it is part of the Índice Bovespa, in the New York Stock Exchange and in the Madrid Stock Exchange.

The PNC Financial Services Group, Inc. is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 states and the District of Columbia, with 2,629 branches and 9,523 ATMs. PNC Bank is on the list of largest banks in the United States by assets and is one of the largest banks by number of branches, deposits, and number of ATMs.

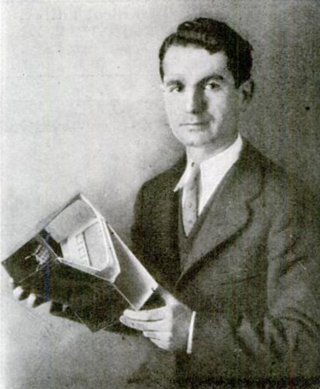

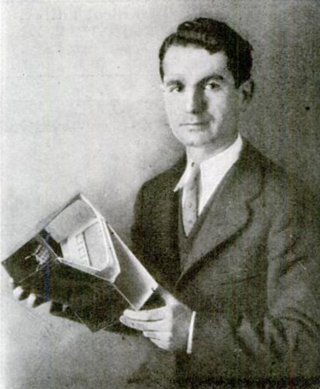

Luther George Simjian was an Armenian-American inventor and entrepreneur. A prolific and professional inventor, he held over 200 patents, mostly related to optics and electronics. His most significant inventions were a pioneering flight simulator, arguably the first ATM and improvement to the teleprompter.

KeyBank is an American regional bank headquartered in Cleveland, Ohio, and the 25th largest bank in the United States. Organized under the publicly traded KeyCorp, KeyBank was formed from the 1994 merger of the Cleveland-based Society Corporation, which operated Society National Bank, and the Albany-headquartered KeyCorp. The company today operates over 1,000 branches and 40,000 ATMs, mostly concentrated in the Midwest and Northeast United States, though also operates in the Pacific Northwest as well as in Alaska, Colorado, Texas and Utah.

Israel Discount Bank, Ltd. is an Israeli banking institution that offers a range of financial services, including retail banking, commercial banking, private banking, and financial services. The bank, headquartered in Tel Aviv, operates 112 branches throughout Israel.

Regions Financial Corporation is an American bank holding company headquartered in the Regions Center in Birmingham, Alabama. The company provides retail and commercial banking, trust, stock brokerage, and mortgage services. Its banking subsidiary, Regions Bank, operates about 2,000 automated teller machines and 1,300 branches in 15 states in the Southern and Midwestern United States.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards.

Sony Bank, Inc. (ソニー銀行株式会社) is a Japanese commercial bank established in April 2001. It operates as a direct bank and has no physical branches or ATMs. It is one of the largest online banks in Japan and a subsidiary of Sony Financial Holdings, the financial business unit of the multinational conglomerate Sony Group Corporation. Its main business is offering online banking with foreign currency deposits, investment trusts, and home loans.

Dollar Bank is a full-service regional savings bank serving both individuals and business customers, operating more than 90 offices throughout Pennsylvania, Ohio, Maryland, and Virginia. The bank's corporate headquarters is in downtown Pittsburgh alongside its Pennsylvania regional headquarters. The Ohio headquarters is located in downtown Cleveland, and the Virginia headquarters is located in Hampton Roads.

Butterfield, officially The Bank of N. T. Butterfield & Son Limited, is a financial services company founded and headquartered in Bermuda. It provides services to clients from Bermuda, the Cayman Islands, Guernsey and Jersey, where its principal banking operations are located, and The Bahamas, Switzerland, Singapore and the United Kingdom, where it offers specialized financial services. Banking services comprise deposit, cash management and lending for individual, business and institutional clients. Wealth management services are composed of trust, private banking, asset management and custody. In Bermuda, the Cayman Islands and Guernsey, Butterfield offers both banking and wealth management. In The Bahamas, Singapore and Switzerland, Butterfield offers select wealth management services. In the UK, Butterfield offers residential property lending. In Jersey, it offers banking and wealth management services. Butterfield is publicly traded on the New York Stock Exchange and the Bermuda Stock Exchange.

Axis Bank Limited, formerly known as UTI Bank (1993–2007), is an Indian multinational banking and financial services company headquartered in Mumbai, Maharashtra. It is India's third largest private sector bank by assets and fourth largest by market capitalisation. It sells financial services to large and mid-size companies, SMEs and retail businesses.

VakıfBank is the second-largest bank in Turkey in terms of asset size, established with an initial capital of TL 50 million on January 11, 1954, and later started operating on April 13, 1954.[citation needed] Abdi Serdar Üstünsalih is CEO of the Bank.

Tamilnad Mercantile Bank Limited (TMB) is an Indian bank headquartered at Thoothukudi, Tamil Nadu. TMB was founded in 1921 as the Nadar Bank, but changed its name to Tamilnad Mercantile Bank in November 1962 to widen its appeal beyond the Nadar community. The bank currently has 509 full branches throughout India, 12 regional offices and two link offices, two central processing centres, one service branch, four currency chests, 48 eLobby centres, 262 cash recycler machines and 1151 automated teller machines (ATM).

Amalgamated Bank is an American financial institution. It is the largest union-owned bank and one of the only unionized banks in the United States. Amalgamated Bank is currently majority-owned by Workers United, an SEIU Affiliate.

A Bitcoin ATM is a kiosk that allows a person to purchase Bitcoin and other cryptocurrencies by using cash or debit card. Some Bitcoin ATMs offer bidirectional functionality, enabling both the purchase of Bitcoin and the sale of Bitcoin for cash. In some cases, Bitcoin ATM providers require users to have an existing account to transact on the machine.

The ATM Industry Association (ATMIA), originally the ATM Owners Association, was established in 1997 in the United States as a global nonprofit trade association to service an industry that built around the global growth of the ATM.