Related Research Articles

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

Labour economics, or labor economics, seeks to understand the functioning and dynamics of the markets for wage labour. Labour is a commodity that is supplied by labourers, usually in exchange for a wage paid by demanding firms. Because these labourers exist as parts of a social, institutional, or political system, labour economics must also account for social, cultural and political variables.

Neoclassical economics is an approach to economics in which the production, consumption, and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory.

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

This aims to be a complete article list of economics topics:

Classical economics, classical political economy, or Smithian economics is a school of thought in political economy that flourished, primarily in Britain, in the late 18th and early-to-mid-19th century. Its main thinkers are held to be Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill. These economists produced a theory of market economies as largely self-regulating systems, governed by natural laws of production and exchange.

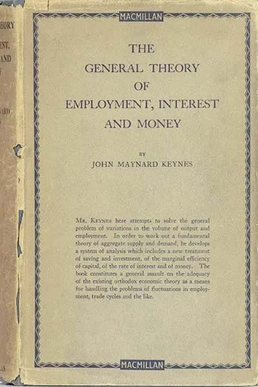

The General Theory of Employment, Interest and Money is a book by English economist John Maynard Keynes published in February 1936. It caused a profound shift in economic thought, giving macroeconomics a central place in economic theory and contributing much of its terminology – the "Keynesian Revolution". It had equally powerful consequences in economic policy, being interpreted as providing theoretical support for government spending in general, and for budgetary deficits, monetary intervention and counter-cyclical policies in particular. It is pervaded with an air of mistrust for the rationality of free-market decision making.

Factor price equalization is an economic theory, by Paul A. Samuelson (1948), which states that the prices of identical factors of production, such as the wage rate or the rent of capital, will be equalized across countries as a result of international trade in commodities. The theorem assumes that there are two goods and two factors of production, for example capital and labour. Other key assumptions of the theorem are that each country faces the same commodity prices, because of free trade in commodities, uses the same technology for production, and produces both goods. Crucially these assumptions result in factor prices being equalized across countries without the need for factor mobility, such as migration of labor or capital flows.

The term efficiency wages was introduced by Alfred Marshall to denote the wage per efficiency unit of labor. Marshallian efficiency wages are those calculated with efficiency or ability exerted being the unit of measure rather than time. That is, the more efficient worker will be paid more than a less efficient worker for the same amount of hours worked.

Fritz Machlup was an Austrian-American economist known for his work in information economics. He was President of the International Economic Association from 1971 to 1974. He was one of the first economists to examine knowledge as an economic resource, and is credited with popularising the concept of the information society.

The Frisch elasticity of labor supply captures the elasticity of hours worked to the wage rate, given a constant marginal utility of wealth. Marginal utility is constant for risk-neutral individuals according to microeconomics. In other words, the Frisch elasticity measures the substitution effect of a change in the wage rate on labor supply. This concept was proposed by the economist Ragnar Frisch after whom the elasticity of labor supply is named.

In economics, distribution is the way total output, income, or wealth is distributed among individuals or among the factors of production. In general theory and in for example the U.S. National Income and Product Accounts, each unit of output corresponds to a unit of income. One use of national accounts is for classifying factor incomes and measuring their respective shares, as in national Income. But, where focus is on income of persons or households, adjustments to the national accounts or other data sources are frequently used. Here, interest is often on the fraction of income going to the top x percent of households, the next x percent, and so forth, and on the factors that might affect them.

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism — academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936) with neoclassical economics.

Demand-led growth is the foundation of an economic theory claiming that an increase in aggregate demand will ultimately cause an increase in total output in the long run. This is based on a hypothetical sequence of events where an increase in demand will, in effect, stimulate an increase in supply. This stands in opposition to the common neo-classical theory that demand follows supply, and consequently, that supply determines growth in the long run.

The following outline is provided as an overview of and topical guide to economics:

In economics, a monopsony is a market structure in which a single buyer substantially controls the market as the major purchaser of goods and services offered by many would-be sellers. The microeconomic theory of monopsony assumes a single entity to have market power over all sellers as the only purchaser of a good or service. This is a similar power to that of a monopolist, which can influence the price for its buyers in a monopoly, where multiple buyers have only one seller of a good or service available to purchase from.

In economics, a factor market is a market where factors of production are bought and sold. Factor markets allocate factors of production, including land, labour and capital, and distribute income to the owners of productive resources, such as wages, rents, etc.

Bowley's law, also known as the law of the constant wage share, is a stylized fact of economics which states that the wage share of a country, i.e., the share of a country's economic output that is given to employees as compensation for their work, remains constant over time. It is named after the English economist Arthur Bowley. Research conducted near the start of the 21st century, however, found wage share to have declined since the 1980s in most major economies.

The Cambridge capital controversy, sometimes called "the capital controversy" or "the two Cambridges debate", was a dispute between proponents of two differing theoretical and mathematical positions in economics that started in the 1950s and lasted well into the 1960s. The debate concerned the nature and role of capital goods and a critique of the neoclassical vision of aggregate production and distribution. The name arises from the location of the principals involved in the controversy: the debate was largely between economists such as Joan Robinson and Piero Sraffa at the University of Cambridge in England and economists such as Paul Samuelson and Robert Solow at the Massachusetts Institute of Technology, in Cambridge, Massachusetts, United States.

Keynes's theory of wages and prices is contained in the three chapters 19-21 comprising Book V of The General Theory of Employment, Interest and Money. Keynes, contrary to the mainstream economists of his time, argued that capitalist economies were not inherently self-correcting. Wages and prices were "sticky", in that they were not flexible enough to respond efficiently to market demand. An economic depression for instance, would not necessarily set off a chain of events leading back to full employment and higher wages. Keynes believed that government action was necessary for the economy to recover.

References

- J.R. Hicks, 1932, 2nd ed., 1963. The Theory of Wages. London: Macmillan.

- _____, 1973a. "Recollections and Documents," Economica, N.S., 40(157), pp. 2-11.

- _____, 1973b. "The Mainspring of Economic Growth," Nobel Prize Lecture. Recurring discussion of Hicks, 1932, vis-à-vis later writings.

- Christopher Bliss, 1987 [2008]. “Hicks, John Richard," The New Palgrave: A Dictionary of Economics , v. 2, sect. 2, p. 642. Abstract.

- Gordon F. Bloom, 1946. "A Note on Hicks's Theory of Invention," American Economic Review, 36(1), p p. 83-96.

- Aaron Director, 1935. Review, Journal of Political Economy, 43(1), p p. 109-111.

- Paul Flatau, 2002. "Hicks’s The Theory Of Wages: Its Place in the History of Neoclassical Distribution Theory," History of Economics Review, June, pp. 44-65 (press +).

- Adalmir Marquetti, 2004. "Do Rising Real Wages Increase The Rate Of Labor-Saving Technical Change? Some Econometric Evidence," Metroeconomica, 55(4), pp. 432–441. Abstract.

- M. W. Reder, 1965. Review, Economica, N.S., 32(125), p p. 88-90.

- Kurt W. Rothschild, 1995. "The Theory of Wages Revisited," in Harald Hagemann and O. F. Hamouda, ed., The Legacy of Hicks: His Contribution to Economic Analysis, ch. 5, pp. 57-70.

- G.F. Shove, 1933. "The Theory of Wages. By J.R. Hicks," Economic Journal, 43(171), p p. 460-72. Reprinted in Hicks, 1963.