Related Research Articles

Econometrica is a peer-reviewed academic journal of economics, publishing articles in many areas of economics, especially econometrics. It is published by Wiley-Blackwell on behalf of the Econometric Society. The current editor-in-chief is Guido Imbens.

Sir Clive William John Granger was a British econometrician known for his contributions to nonlinear time series analysis. He taught in Britain, at the University of Nottingham and in the United States, at the University of California, San Diego. Granger was awarded the Nobel Memorial Prize in Economic Sciences in 2003 in recognition of the contributions that he and his co-winner, Robert F. Engle, had made to the analysis of time series data. This work fundamentally changed the way in which economists analyse financial and macroeconomic data.

In econometrics, the autoregressive conditional heteroskedasticity (ARCH) model is a statistical model for time series data that describes the variance of the current error term or innovation as a function of the actual sizes of the previous time periods' error terms; often the variance is related to the squares of the previous innovations. The ARCH model is appropriate when the error variance in a time series follows an autoregressive (AR) model; if an autoregressive moving average (ARMA) model is assumed for the error variance, the model is a generalized autoregressive conditional heteroskedasticity (GARCH) model.

Jerry Allen Hausman is the John and Jennie S. MacDonald Professor of Economics at the Massachusetts Institute of Technology and a notable econometrician. He has published numerous influential papers in microeconometrics. Hausman is the recipient of several prestigious awards including the John Bates Clark Medal in 1985 and the Frisch Medal in 1980.

Robert Fry Engle III is an American economist and statistician. He won the 2003 Nobel Memorial Prize in Economic Sciences, sharing the award with Clive Granger, "for methods of analyzing economic time series with time-varying volatility (ARCH)".

Financial econometrics is the application of statistical methods to financial market data. Financial econometrics is a branch of financial economics, in the field of economics. Areas of study include capital markets, financial institutions, corporate finance and corporate governance. Topics often revolve around asset valuation of individual stocks, bonds, derivatives, currencies and other financial instruments.

Takeshi Amemiya is an economist specializing in econometrics and the economy of ancient Greece.

Lars Peter Hansen is an American economist. He is the David Rockefeller Distinguished Service Professor of economics at the University of Chicago and a 2013 recipient of the Nobel Memorial Prize in Economics.

Christopher Albert Sims is an American econometrician and macroeconomist. He is currently the John J.F. Sherrerd '52 University Professor of Economics at Princeton University. Together with Thomas Sargent, he won the Nobel Memorial Prize in Economic Sciences in 2011. The award cited their "empirical research on cause and effect in the macroeconomy".

William Arnold Barnett is an American economist, whose current work is in the fields of chaos, bifurcation, and nonlinear dynamics in socioeconomic contexts, econometric modeling of consumption and production, and the study of the aggregation problem and the challenges of measurement in economics.

Mark W. Watson is the Howard Harrison and Gabrielle Snyder Beck Professor of Economics and Public Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University. Prior to coming to Princeton in 1995, Watson served on the economics faculty at Harvard University and Northwestern University. His research focuses on time-series econometrics, empirical macroeconomics, and macroeconomic forecasting.

Whitney Kent Newey is the Jane Berkowitz Carlton and Dennis William Carlton Professor of Economics at the Massachusetts Institute of Technology and a well-known econometrician. He is best known for developing, with Kenneth D. West, the Newey–West estimator, which robustly estimates the covariance matrix of a regression model when errors are heteroskedastic and autocorrelated.

Manuel Arellano is a Spanish economist specialising in econometrics and empirical microeconomics. Together with Stephen Bond, he developed the Arellano–Bond estimator, a widely used GMM estimator for panel data. This estimator is based on the earlier article by Arellano's PhD supervisor, John Denis Sargan, and Alok Bhargava. RePEc lists the paper about the Arellano-Bond estimator as the most cited article in economics.

Anil K. Bera is an Indian econometrician. He is Professor of Economics at University of Illinois at Urbana–Champaign's Department of Economics. He is most noted for his work with Carlos Jarque on the Jarque–Bera test.

Kenneth David West is the John D. MacArthur and Ragnar Frisch Professor of Economics in the Department of Economics at the University of Wisconsin. He is currently co-editor of the Journal of Money, Credit and Banking, and has previously served as co-editor of the American Economic Review. He has published widely in the fields of macroeconomics, finance, international economics and econometrics. Among his honors are the John M. Stauffer National Fellowship in Public Policy at the Hoover Institution, Alfred P. Sloan Research Fellowship, Fellow of the Econometric Society, and Abe Fellowship. He has been a research associate at the NBER since 1985.

In statistics, the Glejser test for heteroscedasticity, developed in 1969 by Herbert Glejser, regresses the residuals on the explanatory variable that is thought to be related to the heteroscedastic variance. After it was found not to be asymptotically valid under asymmetric disturbances, similar improvements have been independently suggested by Im, and Machado and Santos Silva.

In statistics and econometrics, optimal instruments are a technique for improving the efficiency of estimators in conditional moment models, a class of semiparametric models that generate conditional expectation functions. To estimate parameters of a conditional moment model, the statistician can derive an expectation function and use the generalized method of moments (GMM). However, there are infinitely many moment conditions that can be generated from a single model; optimal instruments provide the most efficient moment conditions.

Siddhartha Chib is an econometrician and statistician and Professor of Econometrics and Statistics at Washington University in St. Louis. His work is primarily in Bayesian statistics, econometrics, and Markov chain Monte Carlo methods.

Richard T. Baillie is a British–American economist and statistician who is currently the A J Pasant Professor of Economics at the Michigan State University. He is also part time professor at King's College, London, and Senior Scientific Officer for the Rimini Center for Economic Analysis in Italy, and also on the Executive Council of the Society for Nonlinear Dynamics in Econometrics (SNDE).

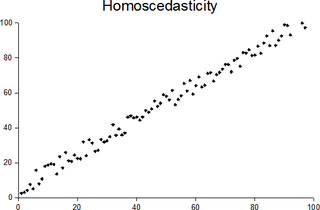

In statistics, a sequence of random variables is homoscedastic if all its random variables have the same finite variance. This is also known as homogeneity of variance. The complementary notion is called heteroscedasticity. The spellings homoskedasticity and heteroskedasticity are also frequently used.

References

- ↑ Bollerslev, Tim. Generalized Autoregressive Conditional Heteroskedasticity with Applications in Finance (Ph.D). University of California, San Diego. Retrieved 14 January 2014– via ProQuest.

- ↑ Engle's Autobiography on the Nobel Prize Website.

- ↑ "Tim Bollerslev's home page".