Zarlink Semiconductor was a fabless semiconductor company specializing in the design and manufacture of communication and medical semiconductor integrated circuits, modules, and other devices. In 2011, Microsemi acquired Zarlink in a hostile takeover and merged it into its own operations.

Sir Terence Hedley Matthews is a Welsh-Canadian business magnate, serial high-tech entrepreneur, and Wales' first billionaire. He was the richest man in Wales until 2012, when he was surpassed by Sir Michael Moritz.

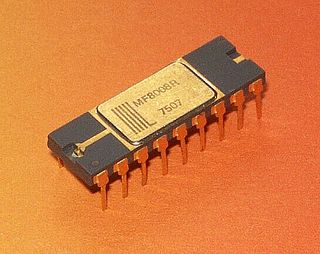

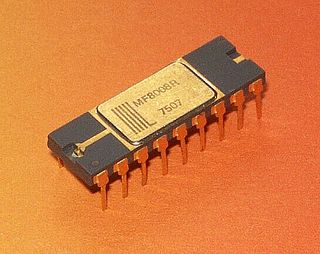

Microsystems International Limited (MIL) was a telecommunications microelectronics company based in Ottawa, Ontario, Canada, founded in 1969. MIL was an early attempt to create a merchant semiconductor house by Nortel Networks.

Cirrus Logic Inc. is an American fabless semiconductor supplier that specializes in analog, mixed-signal, and audio DSP integrated circuits (ICs). Since 1998, the company's headquarters have been in Austin, Texas.

Trident Microsystems Inc. was an American fabless semiconductor company that became in the 1990s a well-known supplier of integrated circuits for video display controllers used in video cards and on motherboards for desktop PCs and laptops. In 2003, it transformed itself into being a supplier of display processors for digital televisions, and primarily LCD TVs starting from 2005, at a time when the global LCD TV market started showing strong growth.

Oak Technology (OAKT) was an American supplier of semiconductor chips for sound cards, graphics cards and optical storage devices such as CD-ROM, CD-RW and DVD. It achieved success with optical storage chips and its stock price increased substantially around the time of the tech bubble in 2000. After falling on hard times, in 2003 it was acquired by Zoran Corporation.

Microchip Technology Incorporated is a publicly listed American semiconductor corporation that manufactures microcontroller, mixed-signal, analog, and Flash-IP integrated circuits.

RF Micro Devices, was an American company that designed and manufactured high-performance radio frequency systems for applications that drive wireless and broadband communications. Headquartered in Greensboro, North Carolina, RFMD traded on the NASDAQ under the symbol RFMD. The Company was founded in Greensboro, North Carolina, in 1991. RF Micro had 3500 employees, 1500 of them in Guilford County, North Carolina.

C-Cube Microsystems, Inc., was an early company in video compression technology as well as the implementation of that technology into semiconductor integrated circuits and systems. C-Cube was the first company to deliver on the market opportunity presented by the conversion of image and video data from analog to digital formats enabling markets such as VideoCD, DVD, DirecTV, digital cable, and non-linear editing systems.

PLX Technology was a manufacturer of integrated circuits focused on PCI Express and Ethernet technologies. On August 12, 2014, Broadcom Inc., acquired the company.

RMI Corporation, formerly Raza Microelectronics, Inc., was a privately held fabless semiconductor company headquartered in Cupertino, California, which specialized in designing system-on-a-chip processors for computer networking and consumer media applications.

Dialog Semiconductor Plc is an Anglo-German semiconductor-based system designer and manufacturer. The company is headquartered in the United Kingdom in Reading, with a global sales, R&D and marketing organization. Dialog creates highly integrated application-specific standard product (ASSP) and application-specific integrated circuit (ASIC) mixed-signal integrated circuits (ICs), optimised for smartphones, computing, Internet of Things devices, LED solid-state lighting (SSL), and smart home applications.

NetLogic Microsystems, Inc. was a fabless semiconductor company that developed high performance products for data center, enterprise, wireless and wireline infrastructure networks. The company was founded in 1995 by Norman Godinho and Varad Srinivasan, became a public company on the NASDAQ exchange under the leadership of CEO Ronald Jankov in July 2004 and was acquired by Broadcom Corporation for $3.7 billion in February 2012.

Integrated Device Technology, Inc. (IDT), was an American semiconductor company headquartered in San Jose, California. The company designed, manufactured, and marketed low-power, high-performance mixed-signal semiconductor products for the advanced communications, computing, and consumer industries. The company marketed its products primarily to original equipment manufacturers (OEMs). Founded in 1980, the company began as a provider of complementary metal-oxide semiconductors (CMOS) for the communications business segment and computing business segments. The company focused on three major areas: communications infrastructure, high-performance computing, and advanced power management. Between 2018 and 2019, IDT was acquired by Renesas Electronics.

Cascade Microtech is a semiconductor test equipment manufacturer based in Beaverton in the Portland metropolitan area of the United States. Founded in 1983, the Oregon-based company employs nearly 400 people. Formerly publicly traded company as CSCD on the NASDAQ, the company is now fully merged with FormFactor, Inc.

ServerWorks Corporation was an American fabless semiconductor company based in Santa Clara, California, that manufactured chipsets for server computers and workstations running IA-32 microprocessors. Founded as Reliance Computer Corporation in 1994, it filed its initial public offering in the beginning of 2000 and was acquired by Broadcom for nearly US$1 billion.

Adam Chowaniec (1950–2015) was a Canadian engineer, entrepreneur, and educator. He is recognised as one of the Founding Fathers of the Personal Computer, by the Computer History Museum at Mountain View, California. In later life, Adam Chowaniec became a champion of Canadian business and entrepreneurship. He died, from cancer, in 2015.

MOSAID is a semiconductor technology company incorporated in Ottawa, Canada. It was founded in 1975 as a DRAM design company, and later branched out into other areas including EDA software, semiconductor reverse engineering, test equipment manufacturing and intellectual property licensing. MOSAID went public in 1994 with a listing on the Toronto Stock Exchange under ticker symbol "MSD". By 2011 the business was based exclusively on patent licensing and the company was acquired by Sterling Partners, a US-based private equity firm. MOSAID was renamed Conversant Intellectual Property Management in 2013. In 2021, the company announced it was changing its name back to MOSAID.

OPTi Inc. was a fabless semiconductor company based in Milpitas, California, that primarily manufactured chipsets for personal computers. The company dissolved in 2001 and transferred its assets to the unaffiliated non-practicing entity OPTi Technologies

Alliance Semiconductor Corporation was an American semiconductor company active from 1985 to 2006 and originally based in San Jose, California. The company specialized in the design and manufacture of dynamic random-access memory (DRAM) and static random-access memory (SRAM). It also designed the silicon for graphics accelerator chips, among other fields. In 2006, the company dissolved, its intellectual property and other assets sold to various companies.