The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Indian rupee is the official currency in the Republic of India. The rupee is subdivided into 100 paise. The issuance of the currency is controlled by the Reserve Bank of India. The Reserve Bank manages currency in India and derives its role in currency management based on the Reserve Bank of India Act, 1934.

The United States Senate Committee on Banking, Housing, and Urban Affairs, also known as the Senate Banking Committee, has jurisdiction over matters related to banks and banking, price controls, deposit insurance, export promotion and controls, federal monetary policy, financial aid to commerce and industry, issuance of redemption of notes, currency and coinage, public and private housing, urban development, mass transit and government contracts.

The Federal Reserve System, commonly known as "the Fed," has faced various criticisms since its establishment in 1913. Critics have questioned its effectiveness in managing inflation, regulating the banking system, and stabilizing the economy. Notable critics include Nobel laureate economist Milton Friedman and his fellow monetarist Anna Schwartz, who argued that the Fed's policies exacerbated the Great Depression. More recently, former Congressman Ron Paul has advocated for the abolition of the Fed and a return to a gold standard.

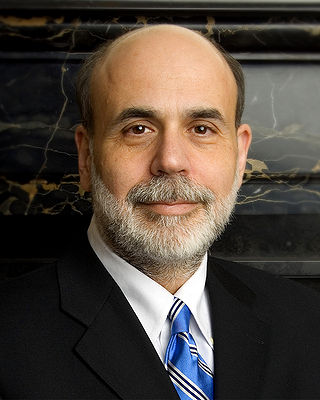

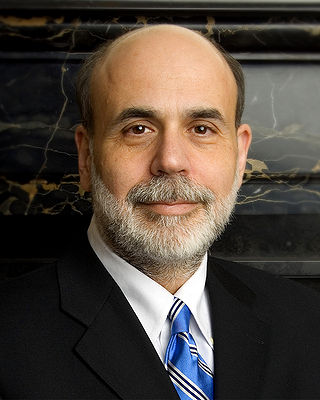

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the 2007–2008 financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the Department of Economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression.

The history of the United States dollar began with moves by the Founding Fathers of the United States of America to establish a national currency based on the Spanish silver dollar, which had been in use in the North American colonies of the Kingdom of Great Britain for over 100 years prior to the United States Declaration of Independence. The new Congress's Coinage Act of 1792 established the United States dollar as the country's standard unit of money, creating the United States Mint tasked with producing and circulating coinage. Initially defined under a bimetallic standard in terms of a fixed quantity of silver or gold, it formally adopted the gold standard in 1900, and finally eliminated all links to gold in 1971.

George Selgin is an American economist. He is Senior Fellow and Director Emeritus of the Cato Institute's Center for Monetary and Financial Alternatives, where he is editor-in-chief of the center's blog, Alt-M, Professor Emeritus of economics at the Terry College of Business at the University of Georgia, and an associate editor of Econ Journal Watch. Selgin formerly taught at George Mason University, the University of Hong Kong, and West Virginia University.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

The U.S. House Financial Services Subcommittee on Domestic and International Monetary Policy, Trade, and Technology was a subcommittee of the House Committee on Financial Services. In the 111th Congress it was split into two subcommittees: Domestic Monetary Policy and Technology, and International Monetary Policy and Trade.

The Greenspan put was a monetary policy response to financial crises that Alan Greenspan, former chair of the Federal Reserve, exercised beginning with the crash of 1987. Successful in addressing various crises, it became controversial as it led to periods of extreme speculation led by Wall Street investment banks overusing the put's repurchase agreements and creating successive asset price bubbles. The banks so overused Greenspan's tools that their compromised solvency in the 2007–2008 financial crisis required Fed chair Ben Bernanke to use direct quantitative easing. The term Yellen put was used to refer to Fed chair Janet Yellen's policy of perpetual monetary looseness.

A Monetary History of the United States, 1867–1960 is a book written in 1963 by future Nobel Prize-winning economist Milton Friedman and Anna Schwartz. It uses historical time series and economic analysis to argue the then-novel proposition that changes in the money supply profoundly influenced the United States economy, especially the behavior of economic fluctuations. The implication they draw is that changes in the money supply had unintended adverse effects, and that sound monetary policy is necessary for economic stability. Orthodox economic historians see it as one of the most influential economics books of the century. The chapter dealing with the causes of the Great Depression was published as a standalone book titled The Great Contraction, 1929–1933.

The United States Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913.

The United States dollar is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

The United States House Financial Services Subcommittee on National Security, Illicit Finance and International Financial Institutions is a subcommittee of the House Committee on Financial Services. It was formerly part of the Subcommittee on Domestic and International Monetary Policy, Trade, and Technology until the 111th Congress, when a separate Subcommittee on Domestic Monetary Policy and Technology was created. In the 113th Congress, the two subcommittees' jurisdictions were again merged, but domestic monetary policy was again removed from its jurisdiction at the start of the 118th Congress.

The Federal Reserve Transparency Act of 2015 was a bill introduced in the U.S. House of Representatives of the 114th United States Congress by Congressman Thomas Massie (KY-4). It included proposals for a reformed audit of the Federal Reserve System. The Senate version was introduced by Senator Rand Paul (R-KY)..

Scott B. Sumner is an American economist. He was previously the Director of the Program on Monetary Policy at the Mercatus Center at George Mason University, a Research Fellow at the Independent Institute, and a professor at Bentley University in Waltham, Massachusetts. His economics blog, The Money Illusion, popularized the idea of nominal GDP targeting, which says that the Federal Reserve and other central banks should target nominal GDP, real GDP growth plus the rate of inflation, to better "induce the correct level of business investment".

Monetary policy in the United States is associated with interest rates and availability of credit.

The trillion-dollar coin is a concept that emerged during the United States debt-ceiling crisis of 2011 as a proposed way to bypass any necessity for the United States Congress to raise the country's borrowing limit, through the minting of very high-value platinum coins. The concept gained more mainstream attention by late 2012 during the debates over the United States fiscal cliff negotiations and renewed debt-ceiling discussions. After reaching the headlines during the week of January 7, 2013, use of the trillion-dollar coin concept was ultimately rejected by the Federal Reserve and the Treasury.