Valerie Miller | |

|---|---|

| Tax Court of Canada | |

| Assumed office April 2, 2007 | |

Valerie Miller is a judge currently serving on the Tax Court of Canada. [1]

Valerie Miller | |

|---|---|

| Tax Court of Canada | |

| Assumed office April 2, 2007 | |

Valerie Miller is a judge currently serving on the Tax Court of Canada. [1]

Tax noncompliance is a range of activities that are unfavorable to a government's tax system. This may include tax avoidance, which is tax reduction by legal means, and tax evasion which is the illegal non-payment of tax liabilities. The use of the term "noncompliance" is used differently by different authors. Its most general use describes non-compliant behaviors with respect to different institutional rules resulting in what Edgar L. Feige calls unobserved economies. Non-compliance with fiscal rules of taxation gives rise to unreported income and a tax gap that Feige estimates to be in the neighborhood of $500 billion annually for the United States.

The Tax Court of Canada, established in 1983 by the Tax Court of Canada Act, is a federal superior court which deals with matters involving companies or individuals and tax issues with the Government of Canada.

The Canada Revenue Agency is the revenue service of the Canadian federal government, and most provincial and territorial governments. The CRA collects taxes, administers tax law and policy, and delivers benefit programs and tax credits. Legislation administered by the CRA includes the Income Tax Act, parts of the Excise Tax Act, and parts of laws relating to the Canada Pension Plan, employment insurance (EI), tariffs and duties. The agency also oversees the registration of charities in Canada, and enforces much of the country's tax laws.

The Constitution Act, 1867, originally enacted as the British North America Act, 1867, is a major part of the Constitution of Canada. The act created a federal dominion and defines much of the operation of the Government of Canada, including its federal structure, the House of Commons, the Senate, the justice system, and the taxation system. In 1982, with the patriation of the Constitution, the British North America Acts which were originally enacted by the British Parliament, including this Act, were renamed. However, the acts are still known by their original names in records of the United Kingdom. Amendments were also made at this time: section 92A was added, giving provinces greater control over non-renewable natural resources.

The court system of Canada is made up of many courts differing in levels of legal superiority and separated by jurisdiction. In the courts, the judiciary interpret and apply the law of Canada. Some of the courts are federal in nature, while others are provincial or territorial.

The Federal Court of Appeal is a Canadian appellate court that hears cases concerning federal matters.

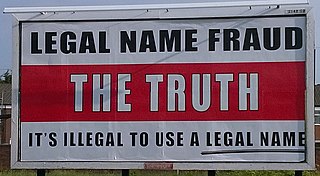

The sovereign citizen movement is a loose group of anti-government activists, litigants, tax protesters, financial scammers, and conspiracy theorists based mainly in the United States. Sovereign citizens have their own pseudolegal belief system based on misinterpretations of common law and claim to not be subject to any government statutes unless they consent to them. The movement appeared in the United States in the early 1970s and has since expanded to other countries; the similar freeman on the land movement emerged during the 2000s in Canada before spreading to other Commonwealth countries. The FBI describes sovereign citizens as "anti-government extremists who believe that even though they physically reside in this country, they are separate or 'sovereign' from the United States".

Cameco Corporation is the world's largest publicly traded uranium company, based in Saskatoon, Saskatchewan, Canada. In 2015, it was the world's second largest uranium producer, accounting for 18% of world production.

A province is an administrative division within a country or state. The term derives from the ancient Roman provincia, which was the major territorial and administrative unit of the Roman Empire's territorial possessions outside Italy. The term province has since been adopted by many countries. In some countries with no actual provinces, "the provinces" is a metaphorical term meaning "outside the capital city".

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries.

Diane Campbell is a Canadian lawyer and jurist serving as a judge of the Tax Court of Canada.

Brent Paris was a judge who served on the Tax Court of Canada. Prior to his appointment in December 2002, he was the Director of the Tax Law Services Section in the British Columbia Regional Office of Justice Canada.

The Honourable Patrick J. Boyle is a Justice of the Tax Court of Canada. He was appointed to the court in 2007 and presides in English and French cases. He served as Acting Associate Chief Justice following the 2021 retirement of Associate Chief Justice Lucie LaMarre until the December 2023 appointment of Associate Chief Justice Anick Pelletier. He is a member of the Court’s Rules Committee and chaired its Judicial Education Committee. In 2014, Justice Boyle was named by Euromoney's ITR International Tax Review as one of the 25 most influential people in the tax world.

Steven K. D'Arcy is a judge currently serving on the Tax Court of Canada. Prior to his appointment, he was a recognized attorney on international tax issues.

The freeman on the land movement, also known as the freemen of the land, the freemen movement, or simply freemen, is a loose group of individuals who adhere to pseudolegal concepts and conspiracy theories implying that they are bound by statute laws only if they consent to those laws. Freemen on the land are mostly present in Commonwealth countries. The movement appeared in Canada in the early 2000s, as an offshoot of the sovereign citizen movement which is more prevalent in the United States.

Canada v GlaxoSmithKline Inc is the first ruling of the Supreme Court of Canada that deals with issues involving transfer pricing and how they are treated under the Income Tax Act of Canada ("ITA").

Don R. Sommerfeldt is a judge currently serving on the Tax Court of Canada.

Pseudolaw consists of pseudolegal statements, beliefs, or practices that are claimed to be based on accepted law or legal doctrine but which deviate significantly from most conventional understandings of law and jurisprudence or which originate from non-existent statutes or legal principles the advocate or adherent incorrectly believes exist.

The strawman theory is a pseudolegal conspiracy theory originating in the redemption/A4V movement and prevalent in antigovernment and tax protester movements such as sovereign citizens and freemen on the land. The theory holds that an individual has two personas, one of flesh and blood and the other a separate legal personality and that one's legal responsibilities belong to the strawman rather than the physical individual.

Carbon pricing in Canada is implemented either as a regulatory fee or tax levied on the carbon content of fuels at the Canadian provincial, territorial or federal level. Provinces and territories of Canada are allowed to create their own system of carbon pricing as long as they comply with the minimum requirements set by the federal government; individual provinces and territories thus may have a higher tax than the federally mandated one but not a lower one. Currently, all provinces and territories are subject to a carbon pricing mechanism, either by an in-province program or by one of two federal programs. As of April 2023 the federal minimum tax is set at CA$65 per tonne of CO2 equivalent, set to increase to CA$170 in 2030.