The Sixteenth Amendment to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 Supreme Court case of Pollock v. Farmers' Loan & Trust Co. The Sixteenth Amendment was ratified by the requisite number of states on February 3, 1913, and effectively overruled the Supreme Court's ruling in Pollock.

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences.

Cumming v. Richmond County Board of Education, 175 U.S. 528 (1899), ("Richmond") was a class action suit decided by the Supreme Court of the United States. It is a landmark case, in that it sanctioned de jure segregation of races in American schools. The decision was overruled by Brown v. Board of Education (1954).

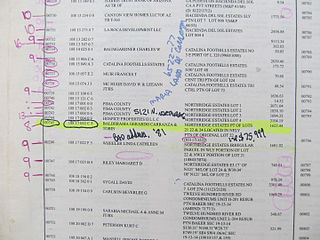

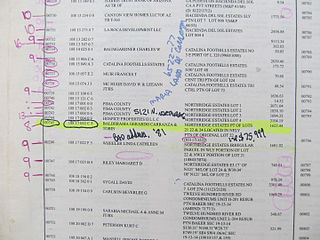

A tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal property, or as a result of failure to pay income taxes or other taxes.

Most individual U.S. states collect a state income tax in addition to federal income tax. The two are separate entities. Some local governments also impose an income tax, often based on state income tax calculations. Forty-two states and many localities in the United States impose an income tax on individuals. Eight states impose no state income tax, and a ninth, New Hampshire, imposes an individual income tax on dividends and interest income but not other forms of income. Forty-seven states and many localities impose a tax on the income of corporations.

International Shoe Co. v. Washington, 326 U.S. 310 (1945), was a landmark decision of the Supreme Court of the United States in which the Court held that a party, particularly a corporation, may be subject to the jurisdiction of a state court if it has "minimum contacts" with that state. The ruling has important consequences for corporations involved in interstate commerce, their payments to state unemployment compensation funds, limits on the power of states imposed by the Due Process Clause of the Fourteenth Amendment, the sufficiency of service of process, and, especially, personal jurisdiction.

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

Tax-free shopping (TFS) is the buying of goods in a foreign country and obtaining a refund of the sales tax which has been collected by the retailer on those goods. The sales tax may be variously described as a sales tax, goods and services tax (GST), value added tax (VAT), or consumption tax.

Internet tax is a tax on Internet-based services. A number of jurisdictions have introduced an Internet tax and others are considering doing so mainly as a result of successful tax avoidance by multinational corporations that operate within the digital economy. Internet taxes prominently target companies including Facebook, Google, Amazon, Airbnb, Uber.

Quill Corp. v. North Dakota, 504 U.S. 298 (1992), was a United States Supreme Court ruling, since overturned, concerning use tax. The decision effectively prevented states from collecting any sales tax from retail purchases made over the Internet or other e-Commerce route unless the seller had a physical presence in the state. The ruling was based on the Dormant Commerce Clause, preventing states from interfering with interstate commerce unless authorized by the United States Congress. The case resulted from an attempt by North Dakota seeking to collect sales tax on licensed computer software offered by the Quill Corporation, an office supply retailer with no North Dakota presence, that allowed users to place orders directly with Quill.

In United States law, a federal enclave is a parcel of federal property within a state that is under the "Special Maritime and Territorial Jurisdiction of the United States". In 1960, the year of the latest comprehensive inquiry, 7% of federal property had enclave status. Of the land with federal enclave status, 57% was under "concurrent" state jurisdiction. The remaining 43%, on which some state laws do not apply, was scattered almost at random throughout the United States. In 1960, there were about 5,000 enclaves, with about one million people living on them. While a comprehensive inquiry has not been performed since 1960, these statistics are likely much lower today, since many federal enclaves were military bases that have been closed and transferred out of federal ownership.

Canton Railroad Company v. Rogan, 340 U.S. 511 (1951), is a case in which the United States Supreme Court held that a state franchise tax upon the services performed by a railroad in handling imported and exported goods did not violate the Import-Export Clause of the United States Constitution.

James v. Dravo Contracting Co., 302 U.S. 134 (1937), is a 5-to-4 ruling by the Supreme Court of the United States that a state's corporate income tax did not violate the Supremacy Clause of the United States Constitution by taxing the Federal government of the United States. It was the first time the Court had upheld a tax on the federal government. The decision is considered a landmark in the field of federal tax immunity, underpins modern legal interpretations of the Supremacy Clause in the U.S. Constitution, and established the "legal incidence test" for tax cases.

In National Bellas Hess v. Department of Revenue of Illinois, 386 U.S. 753 (1967), the Supreme Court ruled that a mail order reseller was not required to collect sales tax unless it had some physical contact with the state.

Section 125 of the Constitution Act, 1867 provides that:

125. No Lands or Property belonging to Canada or any Province shall be liable to Taxation.

Direct Marketing Association v. Brohl, 575 U.S. ___ (2015), was a United States Supreme Court case in which the Court held that a lawsuit by the Direct Marketing Association trade group about a Colorado law regarding reporting the state's tax requirements to customers and to the Colorado Department of Revenue is not barred by the Tax Injunction Act. While the case was reheard and found in favor of Colorado, the concurrence of Justice Anthony Kennedy provided a means for states to bring a challenge the ruling of Quill Corp. v. North Dakota, which has prevented states from collecting taxes from out-of-state vendors.

Comptroller of the Treasury of Maryland v. Wynne, 575 U.S. 542 (2015), is a 2015 U.S. Supreme Court decision which applied the dormant Commerce Clause doctrine to Maryland's personal income tax scheme and found that the failure to provide a full credit for income taxes paid to other states was unconstitutional.

Article I, § 10, clause 2 of the United States Constitution, known as the Import-Export Clause, prevents the states, without the consent of Congress, from imposing tariffs on imports and exports above what is necessary for their inspection laws and secures for the federal government the revenues from all tariffs on imports and exports. Several nineteenth century Supreme Court cases applied this clause to duties and imposts on interstate imports and exports. In 1869, the United States Supreme Court ruled that the Import-Export Clause only applied to imports and exports with foreign nations and did not apply to imports and exports with other states, although this interpretation has been questioned by modern legal scholars.

Brown v. Maryland, 25 U.S. 419 (1827), was a significant United States Supreme Court case which interpreted the Import-Export and Commerce Clauses of the U.S. Constitution to prohibit discriminatory taxation by states against imported items after importation, rather than only at the time of importation. The state of Maryland passed a law requiring importers of foreign goods to obtain a license for selling their products. Brown was charged under this law and appealed. It was the first case in which the U.S. Supreme Court construed the Import-Export Clause. Chief Justice John Marshall delivered the opinion of the court, ruling that Maryland's statute violated the Import-Export and Commerce Clauses and the federal law was supreme. He alleged that the power of a state to tax goods did not apply if they remained in their "original package". A license tax on the importer was essentially the same as a tax on an import itself. Despite arguing the case for Maryland, future chief justice Roger Taney admitted that the case was correctly decided.

South Dakota v. Wayfair, Inc., 585 U.S. ___ (2018), was a United States Supreme Court case in which the court held by a 5–4 majority that states may charge tax on purchases made from out-of-state sellers, even if the seller does not have a physical presence in the taxing state. The decision overturned Quill Corp. v. North Dakota (1992), which had held that the Dormant Commerce Clause barred states from compelling retailers to collect sales or use taxes in connection with mail order or Internet sales made to their residents unless those retailers have a physical presence in the taxing state.