Corporate welfare is a phrase used to describe a government's bestowal of money grants, tax breaks, or other special favorable treatment for corporations.

An economist is a professional and practitioner in the social science discipline of economics.

Supply-side economics is a macroeconomic theory that postulates economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics, consumers will benefit from greater supplies of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity. Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

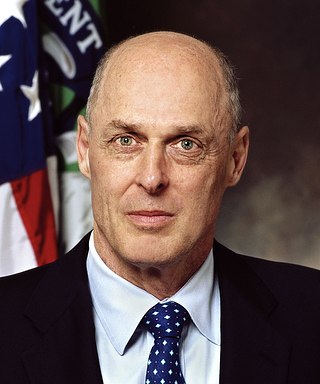

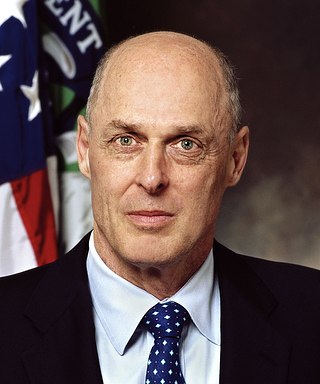

Henry "Hank" Merritt Paulson Jr. is an American banker and financier who served as the 74th United States Secretary of the Treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson was the Chairman and Chief Executive Officer (CEO) of major investment bank Goldman Sachs.

Stephen Moore is an American conservative writer and television commentator on economic issues. He co-founded and served as president of the Club for Growth from 1999 to 2004. Moore is a former member of the Wall Street Journal editorial board. He worked at The Heritage Foundation from 1983 to 1987 and again since 2014. Moore advised Herman Cain's 2012 presidential campaign and Donald Trump's 2016 presidential campaign.

The master list of Nixon political opponents was a secret list compiled by President Richard Nixon's Presidential Counselor Charles Colson. It was an expansion of the original Nixon's Enemies List of 20 key people considered opponents of President Richard Nixon. In total, the expanded list contained 220 people or organizations.

George Jesus Borjas is a Cuban-American economist and the Robert W. Scrivner Professor of Economics and Social Policy at the Harvard Kennedy School. He has been described as "America’s leading immigration economist" and "the leading sceptic of immigration among economists". Borjas has published a number of studies that conclude that low-skilled immigration adversely affects low-skilled natives, a proposition that is debated among economists.

A tax haven is a term, sometimes used negatively and for political reasons, to describe a place with very low tax rates for non-domiciled investors, even if the official rates may be higher.

The Friedman doctrine, also called shareholder theory, is a normative theory of business ethics advanced by economist Milton Friedman which holds that the social responsibility of business is to increase its profits. This shareholder primacy approach views shareholders as the economic engine of the organization and the only group to which the firm is socially responsible. As such, the goal of the firm is to increase its profits and maximize returns to shareholders. Friedman argues that the shareholders can then decide for themselves what social initiatives to take part in, rather than have an executive whom the shareholders appointed explicitly for business purposes decide such matters for them.

Joel Brian Slemrod is an American economist and academic, currently serving as a professor of economics at the University of Michigan and the Paul W. McCracken Collegiate Professor of Business Economics and Public Policy at the Stephen M. Ross School of Business at the University of Michigan.

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax avoidance tool in history and by 2010 was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement.

Padma Desai was an Indian-American development economist who was the Gladys and Roland Harriman Professor Emerita of comparative economic systems and director of the Center for Transition Economies at Columbia University. Known for her scholarship on Soviet and Indian industrial policy, she was awarded the Padma Bhushan in 2009.

Finn Michael Westby Caspersen Sr. was an American financier and philanthropist. A graduate of the Peddie School, Brown University and Harvard Law School, he was chairman and chief executive of Beneficial Corporation, one of the largest consumer finance companies in the United States. After an $8.6 billion acquisition of Beneficial by Household International in 1998, Caspersen ran Knickerbocker Management, a private financial firm overseeing the assets of trusts and foundations.

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is detained. The Organisation for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Because businesses that operate across borders can utilize BEPS to obtain a competitive edge over domestic businesses, it affects the righteousness and integrity of tax systems. Furthermore, it lessens deliberate compliance, when taxpayers notice multinationals legally avoiding corporate income taxes. Because developing nations rely more heavily on corporate income tax, they are disproportionately affected by BEPS.

Bermuda black hole refers to base erosion and profit shifting (BEPS) tax avoidance schemes in which untaxed global profits end up in Bermuda, which is considered a tax haven. The term was most associated with US technology multinationals such as Apple and Google who used Bermuda as the "terminus" for their Double Irish arrangement tax structure.

Gabriel Zucman is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy.

Conduit OFC and sink OFC is an empirical quantitative method of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens.

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic "tax haven lists", including the § Leaders in tax haven research, and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven.

James R. Hines Jr. is an American economist and a founder of academic research into corporate-focused tax havens, and the effect of U.S. corporate tax policy on the behaviors of U.S. multinationals. His papers were some of the first to analyse profit shifting, and to establish quantitative features of tax havens. Hines showed that being a tax haven could be a prosperous strategy for a jurisdiction, and controversially, that tax havens can promote economic growth. Hines showed that use of tax havens by U.S. multinationals had maximized long-term U.S. exchequer tax receipts, at the expense of other jurisdictions. Hines is the most cited author on the research of tax havens, and his work on tax havens was relied upon by the CEA when drafting the Tax Cuts and Jobs Act of 2017.

Dhammika Dharmapala is an economist who is the Paul H. and Theo Leffman Professor of Law at the University of Chicago Law School. He is known for his research into corporate tax avoidance, corporate use of tax havens, and the corporate use of base erosion and profit shifting ("BEPS") techniques.