A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to collectively fund government spending, public expenditures, or as a way to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation took place in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

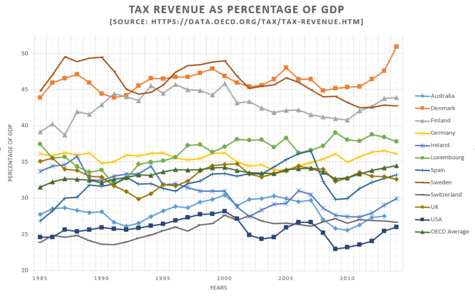

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) in Australia, is a withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as determined on tax returns. PAYE may include withholding the employee portion of insurance contributions or similar social benefit taxes. In most countries, they are determined by employers but subject to government review. PAYE is deducted from each paycheck by the employer and must be remitted promptly to the government. Most countries refer to income tax withholding by other terms, including pay-as-you-go tax.

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education.

Goods and Services Tax (GST) in Australia is a value added tax of 10% on most goods and services sales, with some exemptions and concessions. GST is levied on most transactions in the production process, but is in many cases refunded to all parties in the chain of production other than the final consumer.

An ad valorem tax is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ad valorem tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event. In some countries, a stamp duty is imposed as an ad valorem tax.

Goods and Services Tax (GST) is a value-added tax or consumption tax for goods and services consumed in New Zealand.

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common.

Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations. State governments have not imposed income taxes since World War II. On individuals, income tax is levied at progressive rates, and at one of two rates for corporations. The income of partnerships and trusts is not taxed directly, but is taxed on its distribution to the partners or beneficiaries. Income tax is the most important source of revenue for government within the Australian taxation system. Income tax is collected on behalf of the federal government by the Australian Taxation Office.

Taxes in New Zealand are collected at a national level by the Inland Revenue Department (IRD) on behalf of the Government of New Zealand. National taxes are levied on personal and business income, and on the supply of goods and services. Capital gains tax applies in limited situations, such as the sale of some rental properties within 10 years of purchase. Some "gains" such as profits on the sale of patent rights are deemed to be income – income tax does apply to property transactions in certain circumstances, particularly speculation. There are currently no land taxes, but local property taxes (rates) are managed and collected by local authorities. Some goods and services carry a specific tax, referred to as an excise or a duty, such as alcohol excise or gaming duty. These are collected by a range of government agencies such as the New Zealand Customs Service. There is no social security (payroll) tax.

Taxes in India are levied by the Central Government and the State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality.

Taxation in the British Virgin Islands is relatively simple by comparative standards; photocopies of all of the tax laws of the British Virgin Islands (BVI) would together amount to about 200 pages of paper.

The main fuel tax in Australia is an excise tax, to which Goods and Services Tax ("GST") is added. Both taxes are levied by the federal government. In Australia the GST is applied on top of the fuel excise tax. In some cases, businesses may be entitled to exemptions or rebates for fuel excise tax, including tax credits and certain excise-free fuel sources.

Due to the absence of the tax code in Argentina, the tax regulation takes place in accordance with separate laws, which, in turn, are supplemented by provisions of normative acts adopted by the executive authorities. The powers of the executive authority include levying a tax on profits, property and added value throughout the national territory. In Argentina, the tax policy is implemented by the Federal Administration of Public Revenue, which is subordinate to the Ministry of Economy. The Federal Administration of Public Revenues (AFIP) is an independent service, which includes: the General Tax Administration, the General Customs Office and the General Directorate for Social Security. AFIP establishes the relevant legal norms for the calculation, payment and administration of taxes:

Employers, or a group of related businesses, whose total Australian wages exceed the current NSW monthly threshold are required to pay NSW payroll tax. Broadly speaking, the tax amount is a percentage of taxable wages paid within NSW. This percentage is called the payroll tax rate.

Taxation in Israel include income tax, capital gains tax, value-added tax and land appreciation tax. The primary law on income taxes in Israel is codified in the Income Tax Ordinance. There are also special tax incentives for new immigrants to encourage aliyah.

Taxation in Norway is levied by the central government, the county municipality and the municipality. In 2012 the total tax revenue was 42.2% of the gross domestic product (GDP). Many direct and indirect taxes exist. The most important taxes – in terms of revenue – are VAT, income tax in the petroleum sector, employers' social security contributions and tax on "ordinary income" for persons. Most direct taxes are collected by the Norwegian Tax Administration and most indirect taxes are collected by the Norwegian Customs and Excise Authorities.

Taxes in Germany are levied by the federal government, the states (Länder) as well as the municipalities (Städte/Gemeinden). Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant.

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", where in income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

The Maldives Inland Revenue Authority (MIRA) is a fully autonomous body responsible for tax administration in the Maldives. MIRA collected 78.1% of the total revenue collected by the government of Maldives in 2018. The main responsibilities of MIRA include execution of tax laws, implementation of tax policies and providing technical advice to the government in determining tax policies. The Tax Administration Act stipulates the other responsibilities of MIRA.