Coal is a combustible black or brownish-black sedimentary rock, formed as rock strata called coal seams. Coal is mostly carbon with variable amounts of other elements, chiefly hydrogen, sulfur, oxygen, and nitrogen. Coal is a type of fossil fuel, formed when dead plant matter decays into peat which is converted into coal by the heat and pressure of deep burial over millions of years. Vast deposits of coal originate in former wetlands called coal forests that covered much of the Earth's tropical land areas during the late Carboniferous (Pennsylvanian) and Permian times.

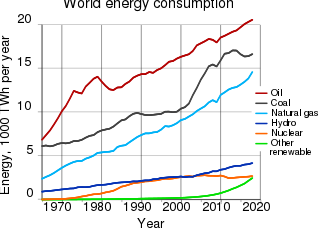

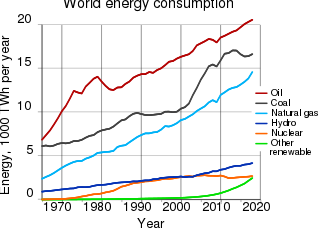

A fossil fuel is a carbon compound- or hydrocarbon-containing material such as coal, oil, and natural gas, formed naturally in the Earth's crust from the remains of prehistoric organisms, a process that occurs within geological formations. Reservoirs of such compound mixtures can be extracted and burned as a fuel for human consumption to provide heat for direct use, to power heat engines that can propel vehicles, or to generate electricity via steam turbine generators. Some fossil fuels are further refined into derivatives such as kerosene, gasoline and diesel.

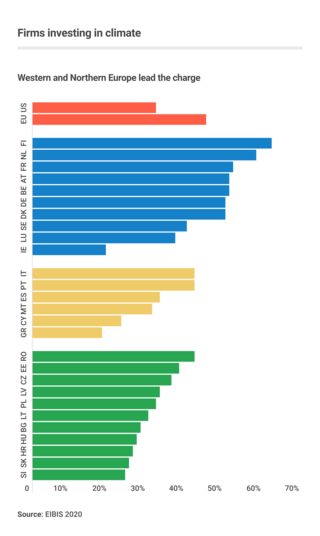

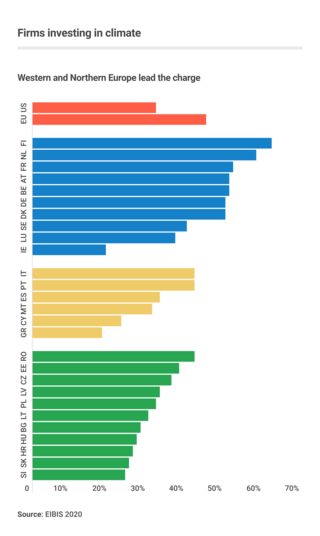

Business action on climate change is a topic which since 2000 includes a range of activities relating to climate change, and to influencing political decisions on climate change-related regulation, such as the Kyoto Protocol. Major multinationals have played and to some extent continue to play a significant role in the politics of climate change, especially in the United States, through lobbying of government and funding of climate change deniers. Business also plays a key role in the mitigation of climate change, through decisions to invest in researching and implementing new energy technologies and energy efficiency measures.

The energy industry is the totality of all of the industries involved in the production and sale of energy, including fuel extraction, manufacturing, refining and distribution. Modern society consumes large amounts of fuel, and the energy industry is a crucial part of the infrastructure and maintenance of society in almost all countries.

Energy in Thailand refers to the production, storage, import and export, and use of energy in the Southeast Asian nation of Thailand. Thailand's energy resources are modest and being depleted. The nation imports most of its oil and significant quantities of natural gas and coal. Its energy consumption has grown at an average rate of 3.3% from 2007 to 2017. Energy from renewables has only recently begun to contribute significant energy.

The energy policy of India is to increase the locally produced energy in India and reduce energy poverty, with more focus on developing alternative sources of energy, particularly nuclear, solar and wind energy. Net energy import dependency was 40.9% in 2021-22. The primary energy consumption in India grew by 13.3% in FY2022-23 and is the third biggest with 6% global share after China and USA. The total primary energy consumption from coal, crude oil, natural gas, nuclear energy, hydroelectricity and renewable power is 809.2 Mtoe in the calendar year 2018. In 2018, India's net imports are nearly 205.3 million tons of crude oil and its products, 26.3 Mtoe of LNG and 141.7 Mtoe coal totaling to 373.3 Mtoe of primary energy which is equal to 46.13% of total primary energy consumption. India is largely dependent on fossil fuel imports to meet its energy demands – by 2030, India's dependence on energy imports is expected to exceed 53% of the country's total energy consumption.

The Investor Network on Climate Risk (INCR) is a nonprofit organization of investors and financial institutions that promotes better understanding of the financial risks and investment opportunities posed by climate change. INCR is coordinated by Ceres, a coalition of investors and environmental groups working to advance sustainable prosperity.

A coal-fired power station or coal power plant is a thermal power station which burns coal to generate electricity. Worldwide there are over 2,400 coal-fired power stations, totaling over 2,130 gigawatts capacity. They generate about a third of the world's electricity, but cause many illnesses and the most early deaths, mainly from air pollution. World installed capacity doubled from 2000 to 2023 and increased 2% in 2023.

Fossil fuel phase-out is the gradual reduction of the use and production of fossil fuels to zero, to reduce deaths and illness from air pollution, limit climate change, and strengthen energy independence. It is part of the ongoing renewable energy transition, but is being hindered by fossil fuel subsidies.

Energy subsidies are measures that keep prices for customers below market levels, or for suppliers above market levels, or reduce costs for customers and suppliers. Energy subsidies may be direct cash transfers to suppliers, customers, or related bodies, as well as indirect support mechanisms, such as tax exemptions and rebates, price controls, trade restrictions, and limits on market access.

350.org is an international environmental organization addressing the climate crisis. Its stated goal is to end the use of fossil fuels and transition to renewable energy by building a global, grassroots movement.

The environmental impact of the energy industry is significant, as energy and natural resource consumption are closely related. Producing, transporting, or consuming energy all have an environmental impact. Energy has been harnessed by human beings for millennia. Initially it was with the use of fire for light, heat, cooking and for safety, and its use can be traced back at least 1.9 million years. In recent years there has been a trend towards the increased commercialization of various renewable energy sources. Scientific consensus on some of the main human activities that contribute to global warming are considered to be increasing concentrations of greenhouse gases, causing a warming effect, global changes to land surface, such as deforestation, for a warming effect, increasing concentrations of aerosols, mainly for a cooling effect.

Post Carbon Institute (PCI) is a think tank which provides information and analysis on climate change, energy scarcity, and other issues related to sustainability and long term community resilience. Its Fellows specialize in various fields related to the organization's mission, such as fossil fuels, renewable energy, food, water, and population. Post Carbon is incorporated as a 501(c)(3) non-profit organization and is based in Corvallis, Oregon, United States.

In 2019, the total energy production in Indonesia is 450.79 million tonnes of oil equivalent, with a total primary energy supply of 231.14 million tonnes of oil equivalent and electricity final consumption of 263.32 terawatt-hours. From 2000 to 2021, Indonesia's total energy supply increased by nearly 60%.

Energy consumption per person in Turkey is similar to the world average, and over 85 per cent is from fossil fuels. From 1990 to 2017 annual primary energy supply tripled, but then remained constant to 2019. In 2019, Turkey's primary energy supply included around 30 per cent oil, 30 per cent coal, and 25 per cent gas. These fossil fuels contribute to Turkey's air pollution and its above average greenhouse gas emissions. Turkey mines its own lignite but imports three-quarters of its energy, including half the coal and almost all the oil and gas it requires, and its energy policy prioritises reducing imports.

Stranded assets are "assets that have suffered from unanticipated or premature write-downs, devaluations or conversion to liabilities". Stranded assets can be caused by a variety of factors and are a phenomenon inherent in the 'creative destruction' of economic growth, transformation and innovation; as such they pose risks to individuals and firms and may have systemic implications. Climate change is expected to cause a significant increase in stranded assets for carbon-intensive industries and investors, with a potential ripple effect throughout the world economy.

An energy transition is a major structural change to energy supply and consumption in an energy system. Currently, a transition to sustainable energy is underway to limit climate change. Most of the sustainable energy is renewable energy. Therefore, another term for energy transition is renewable energy transition. The current transition aims to reduce greenhouse gas emissions from energy quickly and sustainably, mostly by phasing-down fossil fuels and changing as many processes as possible to operate on low carbon electricity. A previous energy transition perhaps took place during the Industrial Revolution from 1760 onwards, from wood and other biomass to coal, followed by oil and later natural gas.

The carbon bubble is a hypothesized bubble in the valuation of companies dependent on fossil-fuel-based energy production, resulting from future decreases in value of fossil fuel reserves as they become unusable in order to meet carbon budgets and recognition of negative externalities of carbon fuels which are not yet taken into account in a company's stock market valuation.

Fossil fuel subsidies are energy subsidies on fossil fuels. They may be tax breaks on consumption, such as a lower sales tax on natural gas for residential heating; or subsidies on production, such as tax breaks on exploration for oil. Or they may be free or cheap negative externalities; such as air pollution or climate change due to burning gasoline, diesel and jet fuel. Some fossil fuel subsidies are via electricity generation, such as subsidies for coal-fired power stations.

Fossil fuel divestment or fossil fuel divestment and investment in climate solutions is an attempt to reduce climate change by exerting social, political, and economic pressure for the institutional divestment of assets including stocks, bonds, and other financial instruments connected to companies involved in extracting fossil fuels.