The Uniform Commercial Code (UCC), first published in 1952, is one of a number of uniform acts that have been established as law with the goal of harmonizing the laws of sales and other commercial transactions across the United States through UCC adoption by all 50 states, the District of Columbia, and the Territories of the United States.

The Incoterms or International Commercial Terms are a series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) relating to international commercial law. Incoterms define the responsibilities of exporters and importers in the arrangement of shipments and the transfer of liability involved at various stages of the transaction. They are widely used in international commercial transactions or procurement processes and their use is encouraged by trade councils, courts and international lawyers. A series of three-letter trade terms related to common contractual sales practices, the Incoterms rules are intended primarily to clearly communicate the tasks, costs, and risks associated with the global or international transportation and delivery of goods. Incoterms inform sales contracts defining respective obligations, costs, and risks involved in the delivery of goods from the seller to the buyer, but they do not themselves conclude a contract, determine the price payable, currency or credit terms, govern contract law or define where title to goods transfers.

Caveat emptor is Latin for "Let the buyer beware". It has become a proverb in English. Generally, caveat emptor is the contract law principle that controls the sale of real property after the date of closing, but may also apply to sales of other goods. The phrase caveat emptor and its use as a disclaimer of warranties arises from the fact that buyers typically have less information than the seller about the good or service they are purchasing. This quality of the situation is known as 'information asymmetry'. Defects in the good or service may be hidden from the buyer, and only known to the seller.

Specific performance is an equitable remedy in the law of contract, whereby a court issues an order requiring a party to perform a specific act, such as to complete performance of the contract. It is typically available in the sale of land law, but otherwise is not generally available if damages are an appropriate alternative. Specific performance is almost never available for contracts of personal service, although performance may also be ensured through the threat of proceedings for contempt of court.

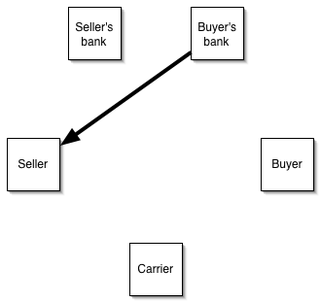

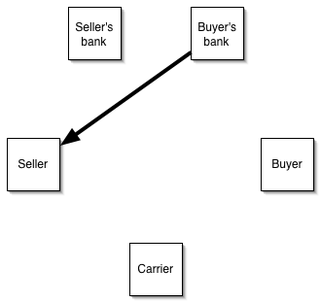

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

In law, a warranty is an expressed or implied promise or assurance of some kind. The term's meaning varies across legal subjects. In property law, it refers to a covenant by the grantor of a deed. In insurance law, it refers to a promise by the purchaser of an insurance about the thing or person to be insured.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business. This type of action is often used in an attempt to dodge creditors who intend to seize such business's inventory; in order to protect the purchaser from claims made by creditors of the seller, the seller must usually complete an affidavit outlining its secured and unsecured creditors, which must usually be filed with a government department, such as a court office. Such procedures are outlined in the bulk sales act of most jurisdictions. If the buyer does not complete the registration process for a bulk sale, creditors of the seller may obtain a declaration that the sale was invalid against the creditors and the creditors may take possession of the goods or obtain judgment for any proceeds the buyer received from a subsequent sale.

In common law jurisdictions, an implied warranty is a contract law term for certain assurances that are presumed to be made in the sale of products or real property, due to the circumstances of the sale. These assurances are characterized as warranties regardless of whether the seller has expressly promised them orally or in writing. They include an implied warranty of fitness for a particular purpose, an implied warranty of merchantability for products, implied warranty of workmanlike quality for services, and an implied warranty of habitability for a home.

Risk of loss is a term used in the law of contracts to determine which party should bear the burden of risk for damage occurring to goods after the sale has been completed, but before delivery has occurred. Such considerations generally come into play after the contract is formed but before buyer receives goods, something bad happens.

Lost volume seller is a legal term in the law of contracts. Such a seller is a special case in contract law. Ordinarily, a seller whose buyer breaches a contract and refuses to purchase the goods can recover from the breaching buyer only the difference between the contract price and the price for which the seller ultimately sells the goods to another buyer.

Repossession, colloquially repo, is a "self-help" type of action in which the party having right of ownership of a property takes the property in question back from the party having right of possession without invoking court proceedings. The property may then be sold by either the financial institution or third party sellers.

Lemon laws are laws that provide a remedy for purchasers of cars and other consumer goods in order to compensate for products that repeatedly fail to meet standards of quality and performance. Although many types of products can be defective, the term "lemon" is mostly used to describe defective motor vehicles, such as cars, trucks, and motorcycles.

A requirements contract is a contract in which one party agrees to supply as much of a good or service as is required by the other party, and in exchange the other party expressly or implicitly promises that it will obtain its goods or services exclusively from the first party. For example, a grocery store might enter into a contract with the farmer who grows oranges under which the farmer would supply the grocery store with as many oranges as the store could sell. The farmer could sue for breach of contract if the store were thereafter to purchase oranges for this purpose from any other party. The converse of this situation is an output contract, in which one buyer agrees to purchase however much of a good or service the seller is able to produce.

The United Nations Convention on Contracts for the International Sale of Goods (CISG), sometimes known as the Vienna Convention, is a multilateral treaty that establishes a uniform framework for international commerce. As of December 2023, it has been ratified by 97 countries, representing two-thirds of world trade.

Canadian contract law is composed of two parallel systems: a common law framework outside Québec and a civil law framework within Québec. Outside Québec, Canadian contract law is derived from English contract law, though it has developed distinctly since Canadian Confederation in 1867. While Québecois contract law was originally derived from that which existed in France at the time of Québec's annexation into the British Empire, it was overhauled and codified first in the Civil Code of Lower Canada and later in the current Civil Code of Quebec, which codifies most elements of contract law as part of its provisions on the broader law of obligations. Individual common law provinces have codified certain contractual rules in a Sale of Goods Act, resembling equivalent statutes elsewhere in the Commonwealth. As most aspects of contract law in Canada are the subject of provincial jurisdiction under the Canadian Constitution, contract law may differ even between the country's common law provinces and territories. Conversely; as the law regarding bills of exchange and promissory notes, trade and commerce, maritime law, and banking among other related areas is governed by federal law under Section 91 of the Constitution Act, 1867; aspects of contract law pertaining to these topics are harmonised between Québec and the common law provinces.

The Sale of Goods Act 1979 is an Act of the Parliament of the United Kingdom which regulated English contract law and UK commercial law in respect of goods that are sold and bought. The Act consolidated the original Sale of Goods Act 1893 and subsequent legislation, which in turn had codified and consolidated the law. Since 1979, there have been numerous minor statutory amendments and additions to the 1979 act. It was replaced for some aspects of consumer contracts from 1 October 2015 by the Consumer Rights Act 2015 but remains the primary legislation underpinning business-to-business transactions involving selling or buying goods.

A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more parties. A contract typically involves consent to transfer of goods, services, money, or promise to transfer any of those at a future date. The activities and intentions of the parties entering into a contract may be referred to as contracting. In the event of a breach of contract, the injured party may seek judicial remedies such as damages or equitable remedies such as specific performance or rescission. A binding agreement between actors in international law is known as a treaty.

Contract law regulates the obligations established by agreement, whether express or implied, between private parties in the United States. The law of contracts varies from state to state; there is nationwide federal contract law in certain areas, such as contracts entered into pursuant to Federal Reclamation Law.

The South African law of sale is an area of the legal system in that country that describes rules applicable to a contract of sale, generally described as a contract whereby one person agrees to deliver to another the free possession of a thing in return for a price in money.

OW Bunker, founded in 1980, was a marine fuel (bunker) company based at Nørresundby in northern Denmark. It was the world's largest bunker supplier until its collapse on 7 November 2014. It went from initial public offering (IPO) to bankruptcy in less than a year. The dramatic collapse of the company led to expedited litigation in the English courts.