Related Research Articles

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services.

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 190 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Established on December 27, 1945 at the Bretton Woods Conference, primarily according to the ideas of Harry Dexter White and John Maynard Keynes, it started with 29 member countries and the goal of reconstructing the international monetary system after World War II. It now plays a central role in the management of balance of payments difficulties and international financial crises. Through a quota system, countries contribute funds to a pool from which countries can borrow if they experience balance of payments problems. As of 2016, the fund had SDR 477 billion.

Outsourcing includes both foreign and domestic forms of outside contracting. It is an agreement in which one company hires another company to be responsible for a planned or existing activity which otherwise is or could be carried out internally, i.e. in-house, and sometimes involves transferring employees and assets from one firm to another. The term outsourcing, which came from the phrase outside resourcing, originated no later than 1981 at a time when industrial jobs in the United States were being moved overseas, contributing to the economic and cultural collapse of small, industrial towns.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

Offshoring is the relocation of a business process from one country to another—typically an operational process, such as manufacturing, or supporting processes, such as accounting. Usually this refers to a company business, although state governments may also employ offshoring. More recently, technical and administrative services have been offshored.

Janet Louise Yellen is an American economist serving as the 78th United States secretary of the treasury since January 26, 2021. She previously served as the 15th chair of the Federal Reserve from 2014 to 2018. She is the first woman to hold either post, and has also led the White House Council of Economic Advisers.

Climate change mitigation is action to limit climate change. This action either reduces emissions of greenhouse gases or removes those gases from the atmosphere. The recent rise in global temperature is mostly due to emissions from burning fossil fuels such as coal, oil, and natural gas. There are various ways how mitigation can reduce emissions. One important way is to switch to sustainable energy sources. Other ways are to conserve energy and to increase efficiency. It is possible to remove carbon dioxide from the atmosphere. This can be done by enlarging forests, restoring wetlands and using other natural and technical processes. The name for these processes is carbon sequestration. Governments and companies have pledged to reduce emissions to prevent dangerous climate change. These pledges are in line with international negotiations to limit warming.

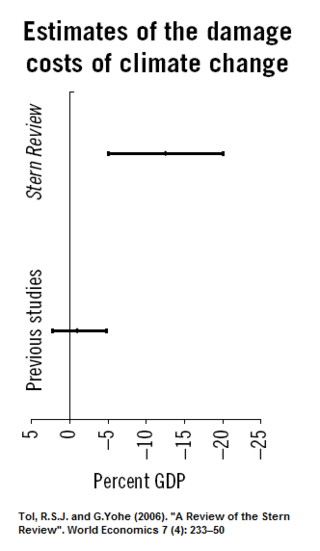

The economic analysis of climate change explains how economic thinking, tools and techniques are applied to calculate the magnitude and distribution of damage caused by climate change. It also informs the policies and approaches for mitigation and adaptation to climate change from global to household scales. This topic is also inclusive of alternative economic approaches, including ecological economics and degrowth. In a cost–benefit analysis, the trade offs between climate change impacts, adaptation, and mitigation are made explicit. Cost–benefit analyses of climate change are produced using integrated assessment models (IAMs), which incorporate aspects of the natural, social, and economic sciences. The total economic impacts from climate change are difficult to estimate, but increase for higher temperature changes.

Supply chain security activities aim to enhance the security of the supply chain or value chain, the transport and logistics systems for the world's cargo and to "facilitate legitimate trade". Their objective is to combine traditional practices of supply-chain management with the security requirements driven by threats such as terrorism, piracy, and theft. A healthy and robust supply chain absent from security threats requires safeguarding against disturbances at all levels such as facilities, information flow, transportation of goods, and so on. A secure supply chain is critical for organizational performance.

Climate change adaptation is the process of adjusting to the effects of climate change. These can be both current or expected impacts. Adaptation aims to moderate or avoid harm for people, and is usually done alongside climate change mitigation. It also aims to exploit opportunities. Humans may also intervene to help adjustment for natural systems. There are many adaptation strategies or options. They can help manage impacts and risks to people and nature. The four types of adaptation actions are infrastructural, institutional, behavioural and nature-based options.

Disaster risk reduction (DRR) is a systematic approach to identifying, assessing and reducing the risks of disaster. It aims to promote sustainable development by increasing the resilience of communities to any disasters they might face. DRR is normally used as policies intended to "define goals and objectives across different timescales and with concrete targets, indicators and time frames." The concept is also called disaster risk management (DRM).

Carbon pricing is a method for nations to address climate change. The cost is applied to greenhouse gas emissions in order to encourage polluters to reduce the combustion of coal, oil and gas – the main driver of climate change. The method is widely agreed and considered to be efficient. Carbon pricing seeks to address the economic problem that emissions of CO2 and other greenhouse gases (GHG) are a negative externality – a detrimental product that is not charged for by any market.

The economics of climate change mitigation is a contentious part of climate change mitigation – action aimed to limit the dangerous socio-economic and environmental consequences of climate change.

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

Supply chain financing is a form of financial transaction wherein a third party facilitates an exchange by financing the supplier on the customer's behalf. The term also refers to practices used by banks and other financial institutions to manage capital invested into the supply chain and reduce risk for the parties involved.

Economic globalization is one of the three main dimensions of globalization commonly found in academic literature, with the two others being political globalization and cultural globalization, as well as the general term of globalization. Economic globalization refers to the widespread international movement of goods, capital, services, technology and information. It is the increasing economic integration and interdependence of national, regional, and local economies across the world through an intensification of cross-border movement of goods, services, technologies and capital. Economic globalization primarily comprises the globalization of production, finance, markets, technology, organizational regimes, institutions, corporations, and people.

A global value chain (GVC) refers to the full range of activities that economic actors engage in to bring a product to market. The global value chain does not only involve production processes, but preproduction and postproduction processes.

Climate resilience is a concept to describe how well people or ecosystems are prepared to bounce back from certain climate hazard events. The formal definition of the term is the "capacity of social, economic and ecosystems to cope with a hazardous event or trend or disturbance". For example, climate resilience can be the ability to recover from climate-related shocks such as floods and droughts. Methods of coping include suitable responses to maintain relevant functions of societies and ecosystems. To increase climate resilience means one has to reduce the climate vulnerability of people and countries. Efforts to increase climate resilience include a range of social, economic, technological, and political strategies. They have to be implemented at all scales of society, from local community action all the way to global treaties.

Green recovery packages are proposed environmental, regulatory, and fiscal reforms to rebuild prosperity in the wake of an economic crisis, such as the COVID-19 pandemic or the Global Financial Crisis (GFC). They pertain to fiscal measures that intend to recover economic growth while also positively benefitting the environment, including measures for renewable energy, efficient energy use, nature-based solutions, sustainable transport, green innovation and green jobs, amongst others.

Supply chain diplomacy is a form of diplomacy and statecraft that sets out to use diplomatic means, such as negotiation and international collaboration, to manage and improve the flow of goods and services through international supply chains for the collective benefit of nation states. This can include efforts to address issues such as trade barriers, intellectual property rights, and logistics and transportation challenges that impede a nation's access to supply.

References

- 1 2 3 4 Kessler, Sarah (2022-11-18). "What Is 'Friendshoring'?". The New York Times. ISSN 0362-4331 . Retrieved 2023-02-10.

- ↑ Yellen, Janet (April 13, 2022). "Remarks by Secretary of the Treasury Janet L. Yellen on Way Forward for the Global Economy". U.S. Department of the Treasury. Retrieved February 9, 2022.

- ↑ "A New Horizon in U.S. Trade Policy". Center for American Progress. 2023-03-14. Retrieved 2023-07-04.

- 1 2 Rojas, M., et al (2022), Reshoring and “friendshoring” supply chains, accessed 23 January 2023

- 1 2 Austin, Elaine Dezenski and John C. (2021-06-08). "Rebuilding America's economy and foreign policy with 'ally-shoring'". Brookings. Retrieved 2023-02-10.

- ↑ Kollewe, Julia (2022-08-06). "Friendshoring: what is it and can it solve our supply problems?". The Observer. ISSN 0029-7712 . Retrieved 2023-02-10.

- ↑ Rajan, R., Just Say No to "Friend-Shoring", Project Syndicate, published 3 June 2022, accessed 6 January 2023

- 1 2 Benson, Emily; Kapstein, Ethan B. (2023-02-01). "The Limits of "Friend-Shoring"".

{{cite journal}}: Cite journal requires|journal=(help) - 1 2 "US friendshoring supply chain policy 'divisive' - experts". supplychaindigital.com. 2022-11-28. Retrieved 2023-02-11.

- 1 2 3 4 5 Giles, Chris (5 April 2023). "'Friendshoring' is a risk to growth and financial stability, warns IMF". Financial Times. Retrieved 7 April 2023.

- 1 2 Dixon, Hugo (2022-12-05). "Breakingviews - Friendshoring makes sense if done in the right way". Reuters. Retrieved 2023-03-03.