Within economics, the concept of utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or satisfaction within the theory of utilitarianism by moral philosophers such as Jeremy Bentham and John Stuart Mill. The term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a consumer's preference ordering over a choice set. Utility has thus become a more abstract concept that is not necessarily solely based on the satisfaction or pleasure received.

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is indifferent. That is, any combinations of two products indicated by the curve will provide the consumer with equal levels of utility, and the consumer has no preference for one combination or bundle of goods over a different combination on the same curve. One can also refer to each point on the indifference curve as rendering the same level of utility (satisfaction) for the consumer. In other words, an indifference curve is the locus of various points showing different combinations of two goods providing equal utility to the consumer. Utility is then a device to represent preferences rather than something from which preferences come. The main use of indifference curves is in the representation of potentially observable demand patterns for individual consumers over commodity bundles.

In economics, elasticity is the measurement of the percentage change of one economic variable in response to a change in another.

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption as measured by their preferences subject to limitations on their expenditures, by maximizing utility subject to a consumer budget constraint.

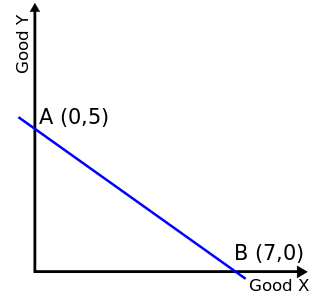

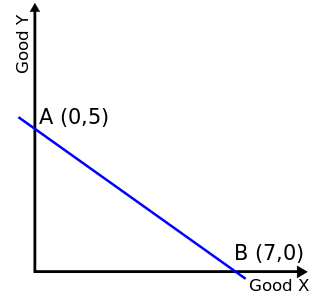

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within his or her given income. Consumer theory uses the concepts of a budget constraint and a preference map to analyze consumer choices. Both concepts have a ready graphical representation in the two-good case.

In microeconomics, two goods are substitutes if the products could be used for the same purpose by the consumers. That is, a consumer perceives both goods as similar or comparable, so that having more of one good causes the consumer to desire less of the other good. Contrary to complementary goods and independent goods, substitute goods may replace each other in use due to changing economic conditions.

In economics and particularly in consumer choice theory, the income-consumption curve is a curve in a graph in which the quantities of two goods are plotted on the two axes; the curve is the locus of points showing the consumption bundles chosen at each of various levels of income.

In microeconomics, the utility maximization problem is the problem consumers face: "how should I spend my money in order to maximize my utility?" It is a type of optimal decision problem. It consists of choosing how much of each available good or service to consume, taking into account a constraint on total spending as well as the prices of the goods.

The Slutsky equation in economics, named after Eugen Slutsky, relates changes in Marshallian (uncompensated) demand to changes in Hicksian (compensated) demand, which is known as such since it compensates to maintain a fixed level of utility. There are two parts of the Slutsky equation, namely the substitution effect, and income effect. In general, the substitution effect is negative. He designed this formula to explore a consumer's response as the price changes. When the price increases, the budget set moves inward, which causes the quantity demanded to decrease. In contrast, when the price decreases, the budget set moves outward, which leads to an increase in the quantity demanded. The equation demonstrates that the change in the demand for a good, caused by a price change, is the result of two effects:

A shadow price is a monetary value assigned to currently unknowable or difficult-to-calculate costs in the absence of correct market prices. It is based on the willingness to pay principle – the most accurate measure of the value of a good or service is what people are willing to give up in order to get it. A shadow price is often calculated based on certain assumptions, and so it is subjective and somewhat inaccurate.

In economics, a consumer's indirect utility function gives the consumer's maximal attainable utility when faced with a vector of goods prices and an amount of income . It reflects both the consumer's preferences and market conditions.

In microeconomics, a consumer's Hicksian demand correspondence is the demand of a consumer over a bundle of goods that minimizes their expenditure while delivering a fixed level of utility. If the correspondence is actually a function, it is referred to as the Hicksian demand function, or compensated demand function. The function is named after John Hicks.

Shephard's lemma is a major result in microeconomics having applications in the theory of the firm and in consumer choice. The lemma states that if indifference curves of the expenditure or cost function are convex, then the cost minimizing point of a given good with price is unique. The idea is that a consumer will buy a unique ideal amount of each item to minimize the price for obtaining a certain level of utility given the price of goods in the market.

Gorman polar form is a functional form for indirect utility functions in economics. Imposing this form on utility allows the researcher to treat a society of utility-maximizers as if it consisted of a single 'representative' individual. Gorman showed that having the function take Gorman polar form is both necessary and sufficient for this condition to hold.

Roy's identity is a major result in microeconomics having applications in consumer choice and the theory of the firm. The lemma relates the ordinary (Marshallian) demand function to the derivatives of the indirect utility function. Specifically, denoting the indirect utility function as the Marshallian demand function for good can be calculated as

Competitive equilibrium is a concept of economic equilibrium introduced by Kenneth Arrow and Gérard Debreu in 1951 appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

In economics and consumer theory, quasilinear utility functions are linear in one argument, generally the numeraire. Quasilinear preferences can be represented by the utility function where is strictly concave. A useful property of the quasilinear utility function is that the Marshallian/Walrasian demand for does not depend on wealth and is thus not subject to a wealth effect; The absence of a wealth effect simplifies analysis and makes quasilinear utility functions a common choice for modelling. Furthermore, when utility is quasilinear, compensating variation (CV), equivalent variation (EV), and consumer surplus are algebraically equivalent. In mechanism design, quasilinear utility ensures that agents can compensate each other with side payments.

In economics, especially in consumer theory, a Leontief utility function is a function of the form:

In consumer theory, a consumer's preferences are called homothetic if they can be represented by a utility function which is homogeneous of degree 1. For example, in an economy with two goods , homothetic preferences can be represented by a utility function that has the following property: for every :

In economics and consumer theory, a linear utility function is a function of the form: