The economy of Moldova is an emerging upper-middle income economy, with a high Human Development Index. Moldova is a landlocked Eastern European country, bordered by Ukraine on the East and Romania to the West. It is a former Soviet republic and today a candidate member to the European Union.

Seigniorage, also spelled seignorage or seigneurage, is the difference between the value of money and the cost to produce and distribute it. The term can be applied in two ways:

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

In international economics, the balance of payments of a country is the difference between all money flowing into the country in a particular period of time and the outflow of money to the rest of the world. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services.

Nicolae Văcăroiu is a Romanian politician, member of the Social Democratic Party (PSD), who served as Prime Minister between 1992 and 1996. Before the 1989 Revolution, he worked at the Committee for State Planning, together with Theodor Stolojan. He was the President of the Senate of Romania for almost eight years, during two legislatures.

A country's gross external debt is the liabilities that are owed to nonresidents by residents. The debtors can be governments, corporations or citizens. External debt may be denominated in domestic or foreign currency. It includes amounts owed to private commercial banks, foreign governments, or international financial institutions such as the International Monetary Fund (IMF) and the World Bank.

A country's gross government debt is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt.

The Central Bank of the Republic of Turkey (CBRT) is the central bank of Turkey. Its responsibilities include conducting monetary and exchange rate policy, managing international reserves of Turkey, as well as printing and issuing banknotes, and establishing, maintaining and regulating payment systems in the country.

A currency future, also known as an FX future or a foreign exchange future, is a futures contract to exchange one currency for another at a specified date in the future at a price that is fixed on the purchase date; see Foreign exchange derivative. Typically, one of the currencies is the US dollar. The price of a future is then in terms of US dollars per unit of other currency. This can be different from the standard way of quoting in the spot foreign exchange markets. The trade unit of each contract is then a certain amount of other currency, for instance €125,000. Most contracts have physical delivery, so for those held at the end of the last trading day, actual payments are made in each currency. However, most contracts are closed out before that. Investors can close out the contract at any time prior to the contract's delivery date.

Foreign exchange reserves are cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

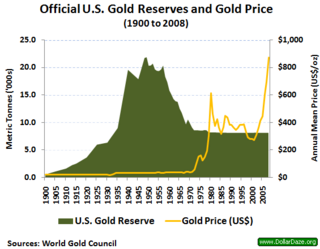

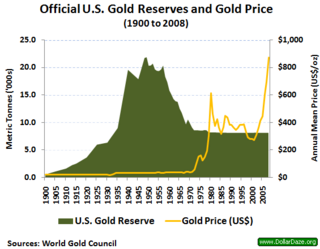

A gold reserve is the gold held by a national central bank, intended mainly as a guarantee to redeem promises to pay depositors, note holders, or trading peers, during the eras of the gold standard, and also as a store of value, or to support the value of the national currency.

The Exchange Stabilization Fund (ESF) is an emergency reserve fund of the United States Treasury Department, normally used for foreign exchange intervention. This arrangement allows the US government to influence currency exchange rates without directly affecting domestic money supply.

The Central Bank of Iran (CBI), also known as Bank Markazi, officially the Central Bank of the Islamic Republic of Iran is the central bank of Iran.

Sebastian Teodor Gheorghe Vlădescu is a Romanian economist and politician. A former member of the National Liberal Party (PNL), he was the Minister of Public Finance of Romania in the first Călin Popescu-Tăriceanu cabinet and starting from 23 December 2009 in the Emil Boc cabinet.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

The Kazakhstan Stock Exchange is a stock exchange located in Almaty, Kazakhstan. The exchange was founded in 1993.

The 1991 Indian economic crisis was an economic crisis in India resulting from a balance of payments deficit due to excess reliance on imports and other external factors. India's economic problems started worsening in 1985 as imports swelled, leaving the country in a twin deficit: the Indian trade balance was in deficit at a time when the government was running on a huge fiscal deficit.

Monetary policy in the United States is associated with interest rates and availability of credit.