Saxony-Anhalt is a state of Germany, bordering the states of Brandenburg, Saxony, Thuringia and Lower Saxony. It covers an area of 20,451.7 square kilometres (7,896.4 sq mi) and has a population of 2.17 million inhabitants, making it the 8th-largest state in Germany by area and the 11th-largest by population. Its capital and largest city is Magdeburg.

The Evangelical Church in Germany, also known as the Protestant Church in Germany, is a federation of twenty Lutheran, Reformed, and United Protestant regional Churches in Germany, collectively encompassing the vast majority of the country's Protestants. In 2022, the EKD had a membership of 19,153,000 members, or 22.7% of the German population. It constitutes one of the largest Protestant bodies in the world. Church offices managing the federation are located in Herrenhausen, Hanover, Lower Saxony. Many of its members consider themselves Lutherans.

Transdev Germany is the largest private operator of passenger buses and trains in Germany. It is a subsidiary of Transdev.

The Evangelical Church Berlin-Brandenburg-Silesian Upper Lusatia is a United Protestant church body in the German states of Brandenburg, Berlin and a part of Saxony.

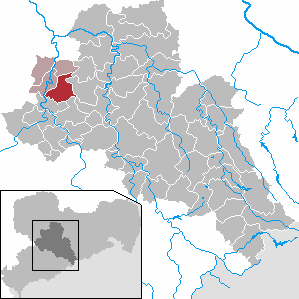

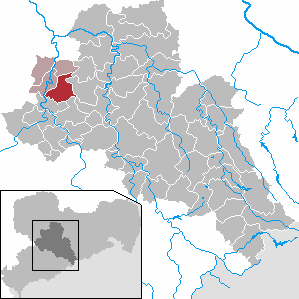

Seelitz is a municipality in the district of Mittelsachsen, in Saxony, Germany. It is part of the administrative partnership Verwaltungsgemeinschaft Rochlitz based in the eponymous town.

Church musician (Kirchenmusiker) is a music profession in Germany.

The Association of German Public Banks is a leading association within the German banking sector, bringing together most of the German public banking sector except the local-level savings banks. Its membership includes 63 banks, including the Landesbanks that are also members of the Deutscher Sparkassen- und Giroverband (DSGV) and form part of the Sparkassen-Finanzgruppe, and promotional and development banks owned by the Federal Republic of Germany or the individual German federal states.

The National Association of German Cooperative Banks is the umbrella association for the German Cooperative Financial Group. Its origins go back to 1864 as Allgemeiner Verband der auf Selbsthilfe beruhenden Deutschen Erwerbs- und Wirtschaftsgenossenschaften. As of 2015 it had 1,021 members, which represents all the cooperative banks in Germany, including local cooperative banks, PSD banks, Sparda banks, Church banks and Cooperative financial institutions, managing around 1.200 trillion euros.

The Bankcard-Servicenetz is a German ATM card interbank network group provided by the Volksbanken und Raiffeisenbanken services group. Technically it is not an interbank network but uses the pre-existing girocard network. Member banks of this cash credit group charge ATM usage fees at a low level and most customers of the co-operative banks enjoy free withdrawal from their accounts. With 19,200 ATMs the Bankcard-Servicenetz group is the second largest ATM group in Germany.

The German Cooperative Financial Group is a major cooperative banking network in Germany that includes local banks named Volksbanken and Raiffeisenbanken, the latter in tribute to 19th-century cooperative movement pioneer Friedrich Wilhelm Raiffeisen. The Cooperative Group represents one of the three "pillars" of Germany's banking sector, the other two being, respectively, the Sparkassen-Finanzgruppe of public banks, and the commercial banking sector represented by the Association of German Banks.

The Evangelical-Lutheran Church of Saxony is one of 20 member Churches of the Protestant Church in Germany (EKD), covering most of the state of Saxony. Its headquarters are in Dresden, and the seat of the bishop is at Meissen Cathedral. Prior to the propagation of state atheism in the German Democratic Republic, it was the largest Evangelical Lutheran church in Germany.

The German Protestant Church Confederation was a formal federation of 28 regional Protestant churches (Landeskirchen) of Lutheran, Reformed or United Protestant administration or confession. It existed during the Weimar Republic from 1922 until replaced by the German Evangelical Church in 1933. It was a predecessor body to the Protestant Church in Germany.

St. Peter is a Romanesque church in Syburg, now a suburb of Dortmund, Germany. It is the active Protestant parish church of Syburg, officially named "Ev. Kirche St. Peter zu Dortmund-Syburg". It serves as a concert venue for the bimonthly Syburger Sonntagsmusiken.

Ludwig Geißel was a German charity administrator who became vice-president of Diakonisches Werk, a charitable organization of the Protestant / Evangelical churches in Germany). He was a co-founder of the Bread for the world programme.

Pax-Bank eG is a German bank that focuses on Christian finance headquartered in Cologne. The bank states that it is a German: Bank für Kirche und Caritas, a cooperative Catholic universal bank. Its members consist of institutions of the Catholic Church and private individuals from the clerical field. The bank was founded as a self-help organization by and for priests in 1917 in Cologne.

The Bank im Bistum Essen eG (BIB) is a German cooperative bank located in Essen and has clients that are not-for-profit, ethical and sustainable organisations and their employees. These include the Catholic Church and its institutions.

Johanne Philippine Nathusius was the founder, in 1861, of the "Elisabethstift", set up as an institution for looking after mentally disabled boys from socially disadvantaged families. As the children grew to adulthood she expanded the remit of the "Elisabethstift" to embrace provision of education, specialist workshops and an auxiliary school for those in her care. Mindful that every individual had his own needs and potential, she took care to ensure that individually suitable employment opportunities were found. She was deeply influenced by her religious beliefs, and convinced that the sick and handicapped who were obliged to live out their lives on the fringes of society, were all loved by God, and she tried to give meaning to the lives of all those for whom she cared through the provision of appropriated education and work chances.

Anne Lequy is a Professor for Specialized Communication – French at the Magdeburg-Stendal University of Applied Sciences and was Rector of this institution from 2014 to 2022.

The German public banking sector represents a significant share of the broader banking sector in Germany. Unlike in most other Western and Central European countries, German public-sector banks have been present since the early phases of formalization of banking entities in the early modern period and have never lost their collective significance. They are typically referred to as one of the three “pillars” of the German banking system, the other two pillars being the cooperative banks and commercial banks.