Related Research Articles

Corporate welfare refers to government financial assistance, subsidies, tax breaks, or other favorable policies provided to private businesses or specific industries, ostensibly to promote economic growth, job creation, or other public benefits. This support can take various forms, including tax credits, tax deductions, tax exemptions, government contracts, preferential regulatory treatment, debt write-offs, public-private partnerships, bailout programs, discount schemes, deferrals, low-interest loans or loan guarantees, direct subsidies or public grants.

The Reserve Bank of India is India's central bank and regulatory body responsible for regulation of the Indian banking system. Owned by the Ministry of Finance of the Government of the Republic of India, it is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development.

Farmers' suicides in India refers to the event of farmers dying by suicide in India since the 1970s, due to their inability to repay loans mostly taken from private landlords and banks. India being an agrarian country with around 70% of its rural population depending directly or indirectly upon agriculture, the sector had a 15% share in the economy of India in 2023, and according to NSSO, around 45.5% of country's labor force was associated with agriculture in 2022. Activists and scholars have offered several conflicting reasons for farmer suicides, such as anti-farmer laws, high debt burdens, poor government policies, corruption in subsidies, crop failure, mental health, personal issues and family problems.

The National Bank for Agriculture and Rural Development (NABARD) is an All India Development Financial Institution (DFI) and an apex Supervisory Body for overall supervision of Regional Rural Banks, State Cooperative Banks and District Central Cooperative Banks in India. It was established under the NABARD Act 1981 passed by the Parliament of India. It is fully owned by Government of India and functions under the Department of Financial Services (DFS) under the Ministry of Finance.

Bhupesh Baghel, popularly known as Kaka, is an Indian politician who served as the 3rd Chief Minister of Chhattisgarh from 2018 to 2023. He was president of Chhattisgarh Pradesh Congress from 2014 to 2019. He represented the Patan constituency in the Chhattisgarh Legislative Assembly since 2013 and from 2003 to 2008. He had been cabinet minister of Transportation in undivided Madhya Pradesh in Digvijaya Singh government from 1999 to 2003. He was first Minister for Revenue, Public Health Engineering and Relief Work of Chhattisgarh.

BASIX is an institution concerning the promotion of livelihood established in 1996 in India. It is headquartered in Hyderabad, Telangana. Around 2010 it's NBFC arm raised funds from private equity investors and declared bankruptcy after couple of years.

Bihar has one of the fastest-growing economies in India. It is largely service-based, with a significant share of agricultural and industrial sectors. The GDP of the state was ₹9,76,514 crores at the current market price (2024–25).

The first introduction of a mutual fund in India occurred in 1963, when the Government of India launched the Unit Trust of India (UTI). Mutual funds are broadly categorised into three segments: equity funds, hybrid funds, and debt funds.

Priority sector lending is lending to those sectors of the economy which may not otherwise receive timely and adequate credit. This role is assigned by the Reserve Bank of India to the banks for providing a specified portion of the bank lending to few specific sectors like agriculture and allied activities, micro- and small enterprises, education, housing for the poor, and other low-income groups and weaker sections. This is essentially meant for an all-round development of the economy as opposed to focusing only on the financial sector.

Bhakta Charan Das is an Indian politician. He was a member of the Indian Parliament and represented the Kalahandi constituency in the 15th Lok Sabha.

The Government of India has initiated several National Missions in order to achieve individual goals that together ensure the wellbeing of its citizens.

The Pradhan Mantri fasal bima yojana (PMFBY) launched on 18 February 2016 by Prime Minister Narendra Modi is an insurance service for farmers for their yields. It was formulated in line with One Nation–One Scheme theme by replacing earlier two schemes Agricultural insurance in India#National Agriculture Insurance Scheme and Modified National Agricultural Insurance Scheme by incorporating their best features and removing their inherent drawbacks (shortcomings). It aims to reduce the premium burden on farmers and ensure early settlement of crop assurance claim for the full insured sum.

Stand-Up India was launched by the Government of India on 5 April 2016 to support entrepreneurship among women and SC & ST communities. Stand Up India Loan Scheme is a government initiative launched by the Government of India in 2016 to promote entrepreneurship and facilitate bank loans to Scheduled Caste (SC) / Scheduled Tribe (ST) and women entrepreneurs in the country. The scheme aims to provide loans between Rs.10 lakhs and Rs.1 crore for setting up a greenfield enterprise in manufacturing, trading or services sector.

The 2017 Tamil Nadu farmers' protest was a protest against the Bharatiya Janata Party-led central government by farmers from Tamil Nadu demanding waiver of their farm loans among other demands due to crop failures. The protests started after the 2016–2017 Drought in Tamil Nadu, which was caused after the worst rainfall to the state after 140 years. This led to many farmers committing suicides and dying of heart attacks.

Rajesh Agarwal, State Finance minister of Uttar Pradesh announced the Uttar Pradesh Budget for 2017-18 on 11 July 2017. The size of the budget presented is ₹3 lakh 84 thousand 659 million 71 lakh. It can be read as rupees. This is 10.9% more than the 2016-17 budget. The fiscal deficit of ₹42,967.86 crore, which is 2.97% of the gross state domestic product, is well below the target of 3% set under the Fiscal Responsibility and Budget Management (FRBM) Act.

Rythu Bandhu scheme, also known as Farmer's Investment Support Scheme (FISS), is a welfare program to support farmer’s investment for two crops a year by the Government of Telangana. The government is providing 58.33 lakh (5.8 million) farmers ₹5000 per acre per season to support the farm investment, twice a year, for rabi (winter) and kharif (rainy) seasons. This is a first direct farmer investment support scheme in India, where the cash is paid directly.

Pradhan Mantri Kisan Samman Nidhi is an initiative by the government of India that give farmers up to ₹6,000 (US$70) per year as minimum income support. The initiative was announced by Piyush Goyal during the 2019 Interim Union Budget of India on 1 February 2019. The scheme has cost ₹75,000 crore per annum and came into effect December 2018.

The Pradhan Mantri Matsya Sampada Yojana (PMMSY)(http://pmmsy.dof.gov.in/) is an initiative launched by the Government of India to establish a comprehensive framework and reduce infrastructural gaps in the fisheries sector. The scheme was announced by the Finance Minister, Nirmala Sitharaman during her speech in the parliament of India while presenting the Union budget for 2019–20 on 5 July 2019. The government intends to place India in the first place in Fish production and processing by implementing Neeli Kranti (transl. Blue Revolution). This scheme is in line with governments aim to double the farmers' income by 2022–23.

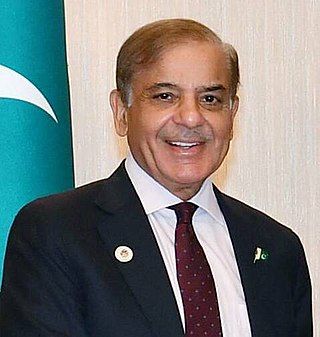

The premiership of Shehbaz Sharif began on 11 April, 2022 after he was nominated as a candidate for Prime Minister of Pakistan by opposition parties following a vote of no confidence in then-Prime Minister Imran Khan during the 2022 Pakistani constitutional crisis. He was sworn in as prime minister by Senate Chairman Sadiq Sanjrani while acting as president on behalf of Arif Alvi. Sharif remained in office until 14 August 2023, when he stepped down for a caretaker government to participate in the 2024 general election. After a heavily contested election, Sharif was re-elected as prime minister on 4 March 2024, defeating the PTI-backed Omar Ayub Khan.

References

- ↑ investopedia.com. "waiver" definition Archived 2011-10-19 at the Wayback Machine

- ↑ "History & Details of Farm Loan Waivers in India". Archived from the original on 2018-12-20. Retrieved 2018-12-20.

- ↑ The Indian Express (29 February 2008). "Rs 60,000 crore loan waiver package for farmers" Archived 2008-07-09 at the Wayback Machine

- ↑ Ministry of Finance (India), National Informatics Centre. "Key Features of Budget 2008-2009" Archived 2011-10-11 at the Wayback Machine

- ↑ Rediff India Abroad (24 May 2008). "FM on whys and hows of farm loan waiver" Archived 2009-05-21 at the Wayback Machine

- ↑ Deccan Chronicle Site. "Farm Loan Waiver now Rs. 72,000 crore" (20 May, 2017)

- ↑ Business Standard (24 May 2008) "The whys and hows of farm loan waiver scheme" Archived 2023-04-15 at the Wayback Machine

- ↑ TheHindu News Site (22 August 2023). "Farm loan waiver monitoring"

- ↑ Kasbekar, Mehak (2 June 2008). "Does loan waiver harm credit culture?" Archived 2009-06-21 at the Wayback Machine Mint

- ↑ Asia Times (11 March 2008). "$15bn loan waiver reaps harvest of anger"

- ↑ Srinivasan, N. (April–June 2008). "Farm Loan Waiver: Right Choice for Supporting Agriculture?" Archived 2010-12-24 at the Wayback Machine . CAB Calling. College of Agricultural Banking

- ↑ Rediff India Abroad (25 February 2008). "Why farm loan waiver is a bad idea" Archived 2009-04-14 at the Wayback Machine

- ↑ "Susan Desai, India's Farm Loan Waiver Crisis, September 11, 2017". Archived from the original on December 4, 2018. Retrieved December 4, 2018.

- ↑ "Punjab farmers hop banks to avoid loan repayment, The Tribune, Nov 15, 2018". Archived from the original on December 4, 2018. Retrieved December 4, 2018.

- ↑ "Paddy procurement drops after loan-waiver promise, Nov 27, 2018". The Times of India. 27 November 2018. Archived from the original on April 15, 2023. Retrieved December 4, 2018.