Octroi is a local tax collected on various articles brought into a district for consumption.

Bhiwandi-Nizampur City Municipal Corporation is a civic body formed after dissolution of "BNCMC" into a Corporation by an act of Government Of Maharashtra in 2002 to administer the industrial township of Bhiwandi, which is a city in Thane district in the Indian state of Maharashtra. Municipal Corporation mechanism in India was introduced during British Rule with formation of municipal corporation in Madras (Chennai) in 1688, later followed by municipal corporations in Bombay (Mumbai) and Calcutta (Kolkata) by 1762. Bhiwandi-Nizampur Municipal Corporation is headed by Mayor of city and governed by Commissioner. Bhiwandi-Nizampur Municipal Corporation has been formed with functions to improve the infrastructure of town.

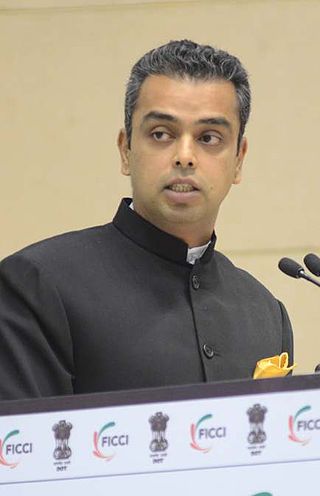

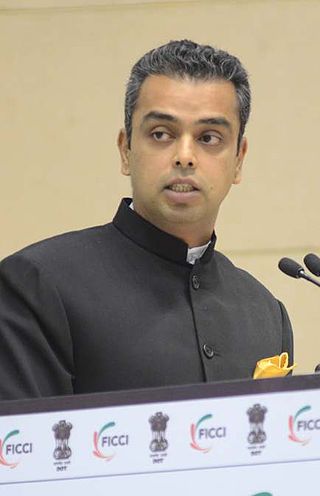

Milind Murli Deora is an Indian politician and former Union Minister of State (MoS) for Communications & Information Technology and Shipping. He was a Member of the 15th Lok Sabha, the lower house of Parliament of India, from the Mumbai South constituency and also President of Mumbai Regional Congress Committee.

Taxes in India are levied by the Central Government and the State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality.

Prithviraj Chavan is an Indian politician who was the 17th Chief Minister of Maharashtra. Chavan is a graduate of the Birla Institute of Technology and Science, Pilani and University of California, Berkeley in mechanical engineering. He spent time working in the field of aircraft instrumentation and designing audio recorders for anti-submarine warfare in the US before returning to India and becoming an entrepreneur in 1974. Referred to in the media as a technocrat with a clean, non-controversial image, a low-profile leader. Chavan served as the Minister of State in the Prime Minister's Office in the Ministry of Parliamentary Affairs and Ministry of Personnel, Public Grievances, and Pensions. Chavan was also General Secretary of the All-India Congress Committee (AICC), in-charge of many states, including Jammu and Kashmir, Karnataka, Haryana, Gujarat, Tripura, and Arunachal Pradesh.

Nagpur Municipal Corporation (NMC) is the municipal body administering Nagpur, in Maharashtra state in Central India.

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

Thane Municipal Corporation (TMC) is the governing body of the city of Thane in the Indian state of Maharashtra. The municipal corporation consisting of democratically elected members, is headed by a mayor and administers the city's infrastructure, public services and transport. Members from the nation's and state's leading political parties such as the Nationalist Congress Party, Indian National Congress, Shiv Sena, Bhartiya Janata Party and the Maharashtra Navnirman Sena hold elected offices in the corporation.

Ashokrao Shankarrao Chavan is an Indian politician from Maharashtra. He is son of ex-Maharashtra Chief Minister Shankarrao Chavan. He was one of the most influential leaders of Indian National Congress in Maharashtra but later resigned and joined Bhartiya Janata Party on 13 Feb 2024. He has served as the Chief Minister of Maharashtra state from 8 December 2008 to 9 November 2010. Also, he has served as Minister for Cultural Affairs, Industries, Mines and Protocol in the Vilasrao Deshmukh government and he is also the former PWD Minister of Maharashtra.

Kolhapur Municipality was established on 12th October 1954. Establishment of municipality initiated planning of modern Kolhapur city of Maharashtra state. Due to Maharashtra government anaunces the 15% growth in the municipal corporations seats there was a 92 seats from 81 seats in Kolhapur municipal corporation. Municipal Corporation mechanism in India was introduced during British Rule with formation of municipal corporation in Madras (Chennai) in 1688, later followed by municipal corporations in Bombay (Mumbai) and Calcutta (Kolkata) by 1762. Kolhapur Municipal Corporation is headed by Mayor of city and governed by Commissioner. Kolhapur Municipal Corporation has been formed with functions to improve the infrastructure of town.

Officially known as The Constitution Act, 2016, this amendment introduced a national Goods and Services Tax (GST) in India from 1 July 2017. It was introduced as the One Hundred and Twenty Second Amendment Bill of the Constitution of India,

The Adarsh Housing Society is a 31-story building constructed on prime real estate in Colaba, Bombay, for the welfare of war widows and personnel of India's Ministry of Defence. Over a period of several years, politicians, bureaucrats and military officers allegedly conspired to bend several rules concerning land ownership, zoning, floor space index and membership getting themselves flats allotted in this cooperative society at below-market rates.

The Ahmednagar Municipal Corporation, is the governing body of the city of Ahmednagar in the Indian state of Maharashtra. The municipal corporation consists of democratically elected members, is headed by a mayor and administers the city's infrastructure, public services and police. Members from the state's various leading political parties hold elected offices in the corporation. Ahmednagar Municipal Corporation is located in Ahmednagar and was formed in the year 2003. The current Mayor of Ahmednagar is Rohini Shendge. She is a member of the Shivsena political party.

VAT was introduced very beginning in year on year value added tax (VAT) into the Indian taxation system from 1 April 2005. The existing general sales tax laws were replaced with the Value Added Tax Act (2005) and associated VAT rules.

Vinod Sridhar Tawde is an Indian politician from Maharashtra and a senior leader of the Bharatiya Janata Party (BJP). He was the General Secretary for Maharashtra unit of the party, President for Mumbai, All India National Executive Council Member and a key member of co-ordination Committee of the BJP for the 12th and 13th Lok Sabha Election

Bhubaneswar Municipal Corporation or BMC is the local urban governing body of the city of Bhubaneswar in the Indian state of Odisha. The municipal corporation consists of democratically elected members, is headed by a mayor and administers the city's infrastructure and public services. This civic administrative body administers an area of 161 km2 (62 sq mi).

Vasai-Virar City Municipal Corporation (VVCMC) is the civic body that governs areas and villages in Vasai-Virar taluka in Maharashtra, India comprising the most populated part of Palghar district. According to the 2011 census, it is the fifth largest city in Maharashtra with a population of more than 1.3 million. The city is located 50 km north of Mumbai, on the north bank of Vasai Creek, part of the estuary of the Ulhas River. It was formed on 3 July 2010 by combining four municipal councils and 53 gram panchayats.

The Goods and Services Tax (GST) is a successor to VAT used in India on the supply of goods and services. Both VAT and GST have the same taxation slabs. It is a comprehensive, multistage, destination-based tax: comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Multi-staged as it is, the GST is imposed at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination-based tax, it is collected from point of consumption and not point of origin like previous taxes.

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities.

The Sangli-Miraj-Kupwad Municipal Corporation (SMKC) is the governing body of the Sangli Metropolitan Region in the Indian state of Maharashtra. It is located in Sangli. The municipal corporation consists of democratically-elected members, is headed by a mayor and administers the city's infrastructure and public services. It was founded on 9 February 1998. SMKC serves an area approximately 118.18 km2 and provides civil services and facilities for more than 6.5 lakh (650,000) people.