A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual, without reference to income or resources. Poll is an archaic term for "head" or "top of the head". The sense of "counting heads" is found in phrases like polling place and opinion poll.

A tax is a mandatory financial charge or levy imposed on a taxpayer by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent.

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935, and the existing version of the Act, as amended, encompasses several social welfare and social insurance programs.

Supply-side economics is a macroeconomic theory postulating that economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics theory, consumers will benefit from greater supply of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity. Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate.

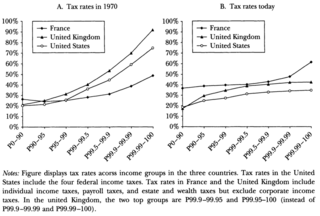

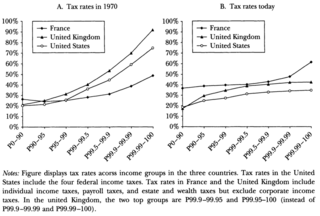

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich.

The Social Security debate in the United States encompasses benefits, funding, and other issues. Social Security is a social insurance program officially called "Old-age, Survivors, and Disability Insurance" (OASDI), in reference to its three components. It is primarily funded through a dedicated payroll tax. During 2015, total benefits of $897 billion were paid out versus $920 billion in income, a $23 billion annual surplus. Excluding interest of $93 billion, the program had a cash deficit of $70 billion. Social Security represents approximately 40% of the income of the elderly, with 53% of married couples and 74% of unmarried persons receiving 50% or more of their income from the program. An estimated 169 million people paid into the program and 60 million received benefits in 2015, roughly 2.82 workers per beneficiary. Reform proposals continue to circulate with some urgency, due to a long-term funding challenge faced by the program as the ratio of workers to beneficiaries falls, driven by the aging of the baby-boom generation, expected continuing low birth rate, and increasing life expectancy. Program payouts began exceeding cash program revenues in 2011; this shortfall is expected to continue indefinitely under current law.

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes and Pigouvian taxes, where the market consumption of a good is inefficient, and a tax brings consumption closer to the efficient level.

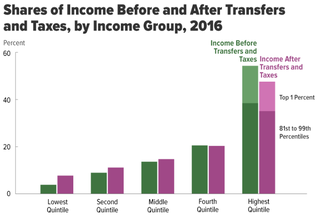

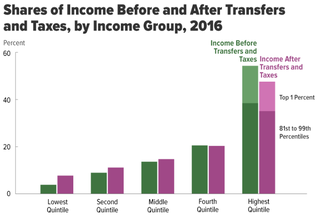

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

The history of taxation in the United States begins with the colonial protest against British taxation policy in the 1760s, leading to the American Revolution. The independent nation collected taxes on imports ("tariffs"), whiskey, and on glass windows. States and localities collected poll taxes on voters and property taxes on land and commercial buildings. In addition, there were the state and federal excise taxes. State and federal inheritance taxes began after 1900, while the states began collecting sales taxes in the 1930s. The United States imposed income taxes briefly during the Civil War and the 1890s. In 1913, the 16th Amendment was ratified, however, the United States Constitution Article 1, Section 9 defines a direct tax. The Sixteenth Amendment to the United States Constitution did not create a new tax.

Income splitting is a tax policy of fictionally attributing earned and passive income of one spouse to the other spouse for the purposes of assessing personal income tax, thus reducing tax rates paid by the spouse who earns more and increasing rates paid by a spouse who earns less.

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

The hidden welfare state is a term coined by Christopher Howard, professor of government at the College of William and Mary, to refer to tax expenditures with social welfare objectives that are often not included in discussions about the U.S. welfare state. Howard's terminology implies that "visible" social welfare programs are designed to help the neediest, but the "hidden" programs often offer benefits to wealthier individuals and companies.

In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money. NIT was proposed by Juliet Rhys-Williams while working on the Beveridge Report in the early 1940s and popularized by Milton Friedman in the 1960s as a system in which the state makes payments to the poor when their income falls below a threshold, while taxing them on income above that threshold. Together with Friedman, supporters of NIT also included James Tobin, Joseph A. Pechman, and Peter M. Mieszkowski, Jim Gray and even then-President Richard Nixon, who suggested implementation of modified NIT in his Family Assistance Plan. After the increase in popularity of NIT, an experiment sponsored by the US government was conducted between 1968 and 1982 on effects of NIT on labour supply, income, and substitution effects.

The healthcare reform debate in the United States has been a political issue focusing upon increasing medical coverage, decreasing costs, insurance reform, and the philosophy of its provision, funding, and government involvement.

Taxation in Puerto Rico consists of taxes paid to the United States federal government and taxes paid to the Government of the Commonwealth of Puerto Rico. Payment of taxes to the federal government, both personal and corporate, is done through the federal Internal Revenue Service (IRS), while payment of taxes to the Commonwealth government is done through the Puerto Rico Department of Treasury.

Tax expenditures are government revenue losses from tax exclusions, exemptions, deductions, credits, deferrals, and preferential tax rates. They are a counterpart to direct expenditures, in that they both are forms of government spending.

To measure the impact that illegal immigrants is hard to accurately display for a plethora of reasons. Not only are we using rough estimations on the number of illegal immigrants in our country but also having to decipher who many resources they are using and if their children are also using the resources that are handed out. Some research shows that illegal immigrants increase the size of the U.S. economy/contribute to economic growth, enhance the welfare of natives, contribute more in tax revenue than they collect, reduce American firms' incentives to offshore jobs and import foreign-produced goods, and benefit consumers by reducing the prices of goods and services. On the other hand, there is data that shows that illegal immigrants are using programs that the government provides.

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, Pub. L. 115–97 (text)(PDF), is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. The legislation is commonly referred to in media as the Trump tax cuts. Major elements of the changes include reducing tax rates for corporations and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and reducing the penalty for violating the individual mandate of the Affordable Care Act (ACA) to $0. The New York Times has described the TCJA as "the most sweeping tax overhaul in decades".

The state and local tax deduction is a United States federal itemized deduction that allows taxpayers to deduct certain taxes paid to state and local governments from their adjusted gross income.