A shill, also called a plant or a stooge, is a person who publicly helps or gives credibility to a person or organization without disclosing that they have a close relationship with said person or organization. Shills can carry out their operations in the areas of media, journalism, marketing, politics, sports, confidence games, cryptocurrency, or other business areas. A shill may also act to discredit opponents or critics of the person or organization in which they have a vested interest.

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory.

Price fixing is an anticompetitive agreement between participants on the same side in a market to buy or sell a product, service, or commodity only at a fixed price, or maintain the market conditions such that the price is maintained at a given level by controlling supply and demand.

eBay Inc. is an American multinational e-commerce company based in San Jose, California, that brokers customer to customer and retail sales through online marketplaces in 190 markets worldwide. Sales occur either via online auctions or "buy it now" instant sales, and the company charges commissions to sellers upon sales. eBay was founded by Pierre Omidyar in September 1995. It has 134 million yearly active buyers worldwide and handled $74 billion in transactions in 2022, 49% of which was in the United States. In 2022, the company had a take rate of 13.25%.

A Dutch auction is one of several similar types of auctions for buying or selling goods. Most commonly, it means an auction in which the auctioneer begins with a high asking price in the case of selling, and lowers it until some participant accepts the price, or it reaches a predetermined reserve price. This type of price auction is most commonly used for goods that are required to be sold quickly such as flowers, fresh produce, or tobacco. A Dutch auction has also been called a clock auction or open-outcry descending-price auction. This type of auction shows the advantage of speed since a sale never requires more than one bid. It is strategically similar to a first-price sealed-bid auction.

An online auction is an auction held over the internet and accessed by internet connected devices. Similar to in-person auctions, online auctions come in a variety of types, with different bidding and selling rules.

Pay-per-click (PPC) is an internet advertising model used to drive traffic to websites, in which an advertiser pays a publisher when the ad is clicked.

A bidding fee auction, also called a penny auction, is a type of all-pay auction in which all participants must pay a non-refundable fee to place each small incremental bid. The auction is extended each time a new bid is placed, typically by 10 to 20 seconds. Once time expires without a new bid being placed, the last bidder wins the auction and pays the amount of that bid. The auctioneer profits from both the fees charged to place bids and the payment for the winning bid; these combined revenues frequently total more than the value of the item being sold. Empirical evidence suggests that revenues from these auctions exceeds theoretical predictions for rational agents. This has been credited to the sunk cost fallacy. Such auctions are typically held over the Internet, rather than in person.

An auction rate security (ARS) typically refers to a debt instrument with a long-term nominal maturity for which the interest rate is regularly reset through a Dutch auction. Since February 2008, most such auctions have failed, and the auction market has been largely frozen. In late 2008, investment banks that had marketed and distributed auction rate securities agreed to repurchase most of them at par.

Bidding is an offer to set a price tag by an individual or business for a product or service or a demand that something be done. Bidding is used to determine the cost or value of something.

Bob Shop, formerly Bidorbuy or bidorbuy.co.za, is a South African e-commerce website based on an internet auction and online marketplace model allowing individuals and businesses to trade with each other. Transactions on bidorbuy are in South African rands.

The term online travel auction is a system of buying and selling travel products and services online by offering them up for auction and then awarding the item to the highest bidder. The need for travel auctions emanated principally due to the high cost of travel. This high cost is also what led to the growth in popularity of low-cost carriers, a concept initially pioneered by Southwest Airlines, and later mimicked by Ryanair.

Swoopo was a bidding fee auction site where purchased credits were used to make bids. Prior to changing its name to Swoopo in 2008, the website was called Telebid. In March 2011, Swoopo's website became inaccessible, and a notice page claimed that Swoopo was experiencing "technical issues." In February 2012, DealDash obtained the domain name for Swoopo.com. The penny auction was invented by Lloyd Liske and William Buckell when the site was first created and known as telebid.com. At that time the site received bids by phone and charged to transfer their bids to the internet site. This is where the format of paying to place a bid started.

A demand-side platform (DSP) is a concept that combines various software solutions for advertisers to automate the process of buying and selling ad impressions in real time.

vWorker was an employment website that enabled companies to outsource projects and independent contractors to find work. Together with Elance, Freelancer.com, Guru.com, and Upwork, it was one of the largest global freelance marketplaces of its kind. It organized and streamlined the management of outsourced employees.

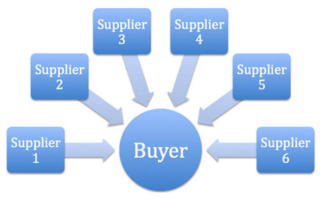

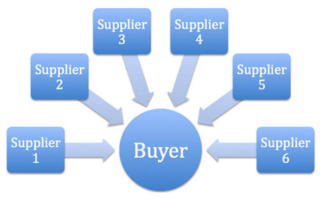

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

Sixjax is an ecommerce company based in New York City, US. It is a pay-per-bid online shopping website, with gaming features offering discounts on products as prizes.

DealDash is a company that operates an online auction and shopping platform. It was founded in 2009, and is headquartered in Minneapolis, Minnesota, United States. The company's platform allows users to bid on and purchase a variety of products, including electronics, home goods, and gift cards.

QuiBids.com is an American online retailer headquartered in Oklahoma City, Oklahoma, United States. It is a retail website that operates as a bidding fee auction, also known as a penny auction. The company has been sued under allegations that it is a form of illegal gambling and that its advertising is misleading. It advertises the price products are auctioned at in QuiBids cash and compares them to US dollars without disclosing the different currencies being used.

Beezid was a Canadian online retailer and penny auction website located in Montreal, Quebec.