Related Research Articles

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States,where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins,while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service;manages U.S. government debt instruments;licenses and supervises banks and thrift institutions;and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury,who is a member of the Cabinet. The treasurer of the United States has limited statutory duties,but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes.

John William Snow is an American economist,attorney,and businessman who is the former CEO of CSX Corporation and served as the 73rd United States secretary of the treasury under U.S. President George W. Bush. He replaced Secretary Paul H. O'Neill on February 3,2003 and was succeeded by Henry Paulson on July 3,2006. Snow submitted a letter of resignation on May 30,2006,effective "after an orderly transition period for my successor." Snow announced on June 29,2006 that he had completed his last day on the job;Robert M. Kimmitt served as acting secretary until Paulson was sworn in. Snow has since worked as chairman of Cerberus Capital Management.

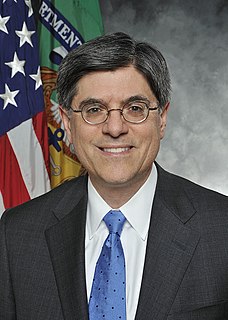

Jacob Joseph Lew is an American attorney and politician who served as the 76th United States Secretary of the Treasury from 2013 to 2017. A member of the Democratic Party,he also served as the 25th White House Chief of Staff from 2012 to 2013 and Director of the Office of Management and Budget in both the Clinton Administration and Obama Administration.

The Under Secretary for Terrorism and Financial Intelligence is a position within the United States Department of the Treasury responsible for directing the Treasury's efforts to cut the lines of financial support for terrorists,fight financial crime,enforce economic sanctions against rogue nations,and combat the financial support of the proliferation of weapons of mass destruction. The Under Secretary is appointed by the President and confirmed by the Senate.

A United States Assistant Secretary of the Treasury is one of several positions in the United States Department of the Treasury,serving under the United States Secretary of the Treasury.

The Urban-Brookings Tax Policy Center,typically shortened to the Tax Policy Center (TPC),is a nonpartisan think tank based in Washington D.C. A joint venture of the Urban Institute and the Brookings Institution,it aims to provide independent analyses of current and longer-term tax issues,and to communicate its analyses to the public and to policymakers. TPC combines national specialists in tax,expenditure,budget policy,and microsimulation modeling to concentrate on five overarching areas of tax policy:fair,simple and efficient taxation,social policy in the tax code,business tax reform,long-term implications of tax and budget choices,and state tax issues.

Alicia Haydock Munnell is an American economist who is the Peter F. Drucker Professor of Management Sciences at Boston College's Carroll School of Management. Educated at Wellesley College,Boston University,and Harvard University,Munnell spent 20 years as an economist at the Federal Reserve Bank of Boston,where she researched wealth,savings,and retirement among American workers. She served in the Bill Clinton administration as Assistant Secretary of the Treasury for Economic Policy and as a member of the Council of Economic Advisers. Since 1997 she has been a professor at Boston College and director of its Center for Retirement Research,where she writes on retirement income policy.

David Robert Malpass is an American economic analyst and former government official serving as President of the World Bank Group since 2019. Malpass previously served as Under Secretary of the Treasury for International Affairs under Donald Trump,Deputy Assistant Treasury Secretary under Ronald Reagan,Deputy Assistant Secretary of State under George H. W. Bush. He served as Chief Economist at Bear Stearns for the six years preceding its collapse.

Michael S. Barr is the Vice Chair of the Federal Reserve for Supervision and a member of the Federal Reserve Board of Governors. Under President Barack Obama Barr served as assistant secretary of the treasury for financial institutions.

C. Eugene "Gene" Steuerle is an American economist,a Richard B. Fisher chair and Institute Fellow at the Urban Institute in Washington,DC,and a columnist under the title The Government We Deserve.

The Assistant Secretary of the Treasury for Financial Institutions is an official in the United States Department of the Treasury who is the head of the Office of Financial Institutions. The office "helps formulate policy on financial institutions and government-sponsored enterprises,cybersecurity and critical infrastructure protection." In June 2017,President Donald Trump nominated Christopher Campbell to the position. He was confirmed by the U.S. Senate on August 3,2017. The post is currently held by Graham Steele,with President Joe Biden nominating him to lead the office on July 19,2021.

Christopher Campbell is a former American political aide and senior government official who previously served as Assistant Secretary of the Treasury for Financial Institutions. He was unanimously confirmed as Assistant Secretary by the United States Senate in 2017. Prior to assuming his Department of Treasury role,Campbell was the majority staff director for the United States Senate Committee on Finance and a staffer on the United States Senate Committee on the Judiciary.

Phillip Lee "Phill" Swagel is an American economist who is currently the director of the Congressional Budget Office. As Assistant Secretary of the Treasury for Economic Policy from 2006 to 2009,he played an important role in the Troubled Asset Relief Program that was part of the U.S. government's response to the financial crisis of 2007–08. He was recently a Professor in International Economics at the University of Maryland School of Public Policy,a non-resident scholar at the American Enterprise Institute,senior fellow at the Milken Institute,and co-chair of the Bipartisan Policy Center's Financial Regulatory Reform Initiative.

Karen Dynan is an American economist who is Professor of the Practice of Economics at Harvard University and a Non-resident Senior Fellow at the Peterson Institute for International Economics. She previously served as the Assistant Secretary of the Treasury for Economic Policy and Chief Economist of the United States Department of the Treasury,having been nominated to that position by President Barack Obama in August 2013 and confirmed by the U.S. Senate in June 2014. From 2009 to 2013,Dr. Dynan was the Vice President and Co-director of the Economic Studies program at the Brookings Institution. Prior to joining Brookings,she served on the staff of the Federal Reserve Board for 17 years. Dr. Dynan is an expert on macroeconomic policy,consumer behavior,household finance,and housing policy.

Steven Terner Mnuchin is an American investment banker and film producer who served as the 77th United States secretary of the treasury as part of the Cabinet of Donald Trump from 2017 to 2021. Serving for a full presidential term,Mnuchin was one of the few high-profile members of Trump's cabinet whom the president did not dismiss.

David Kautter is an American lawyer and tax policy advisor who served as Assistant Secretary of the United States Treasury for Tax Policy. Prior to assuming his prior role of Assistant Secretary,he was a partner at accounting firm RSM International. Kautter was previously the managing director of the Kogod Tax Center and executive-in-residence at the Kogod School of Business at American University. He was a partner at Ernst &Young and served as tax legislative counsel for former U.S. Senator John Danforth. According to The Hill,"If confirmed,Kautter would oversee tax matters in the department and would likely play a key role in the administration's tax-reform efforts."

Kimberly Clausing is an American economist. She is the Eric M. Zolt Chair in Tax Law and Policy at UCLA School of Law,and a nonresident senior fellow at the Peterson Institute for International Economics. From 2021 to 2022,she was the deputy assistant secretary for tax analysis at the United States Department of the Treasury. Clausing is known for her work on international trade and tax policy,particularly the taxation of multinational corporations.

Donald Cyril Lubick was an American attorney and tax policy expert. He served every Democratic President—from John F. Kennedy to Barack Obama—and was the Assistant Secretary for Tax Policy at the Department of the Treasury under both President Carter and President Clinton.

Lily Lawrence Batchelder is the Robert C. Kopple Family Professor of Taxation at New York University and Assistant Secretary of the Treasury for tax policy since September 2021. She was the former chief tax counsel to the U.S. Senate Finance Committee under the Obama administration and appointed to head Joe Biden’s IRS transition team.

References

- 1 2 3 Paletta, Damien (August 21, 2014). "Inversions Push Falls to Treasury's Tax Man". Wall Street Journal . Retrieved December 21, 2016.

- 1 2 "Mark Mazur to take over as TPC Director". Tax Policy Center. Brookings Institution . Retrieved December 21, 2016.

- 1 2 3 "Mark J. Mazur". U.S. Department of the Treasury. U.S. Department of the Treasury . Retrieved December 21, 2016.

- ↑ Temple-West, Patrick (August 3, 2012). "Senate confirms top Treasury Department tax official". Reuters . Retrieved December 21, 2016.

- ↑ Davis, John (2017-04-25). "An expert in an era of tax reform". TheHill. Retrieved 2017-05-31.

- ↑ Jagoda, Naomi (December 13, 2016). "Treasury official to lead Tax Policy Center". The Hill . Retrieved December 21, 2016.