Related Research Articles

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many of the new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

A direct deposit, in banking, is a deposit of money by a payer directly into a payee's bank account. Direct deposits are most commonly made by businesses in the payment of salaries and wages and for the payment of suppliers' accounts, but the facility can be used for payments for any purpose, such as payment of bills, taxes, and other government charges.

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account or bank account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash.

A money order is a directive to pay a pre-specified amount of money from prepaid funds, making it a more trusted method of payment than a cheque.

Cheque clearing or bank clearance is the process of moving cash from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

Interac is a Canadian interbank network that links financial institutions and other enterprises for the purpose of exchanging electronic financial transactions. Interac serves as the Canadian debit card system and the predominant funds transfer network via its e-Transfer service. There are over 59,000 automated teller machines that can be accessed through the Interac network in Canada, and over 450,000 merchant locations accepting Interac debit payments.

A giro transfer, often shortened to giro, is a payment transfer from one current bank account to another bank account and initiated by the payer, not the payee. The debit card has a similar model. Giros are primarily used in Europe; although electronic payment systems exist in the United States, it is not possible to perform third-party transfers with them. In the European Union, the Single Euro Payments Area (SEPA) allows electronic giro or debit card payments in euros to be executed to any euro bank account in the area.

President's Choice Financial, commonly shortened to PC Financial, is the financial service brand of the Canadian supermarket chain Loblaw Companies.

A traveller's cheque is a medium of exchange that can be used in place of hard currency. They can be denominated in one of a number of major world currencies and are preprinted, fixed-amount cheques designed to allow the person signing it to make an unconditional payment to someone else as a result of having paid the issuer for that privilege.

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date. The term has different meanings depending on its use in the application of different laws and depending on countries and contexts. The word "negotiable" refers to transferable and "instrument" refers to a document giving legal effect by the virtue of the law.

A cheque or check is a document that orders a bank, building society to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

In economics, float is duplicate money present in the banking system during the time between a deposit being made in the recipient's account and the money being deducted from the sender's account. It can be used as investable asset, but makes up the smallest part of the money supply. Float affects the amount of currency available to trade and countries can manipulate the worth of their currency by restricting or expanding the amount of float available to trade.

A direct debit or direct withdrawal is a financial transaction in which one organisation withdraws funds from a payer's bank account. Formally, the organisation that calls for the funds instructs their bank to collect an amount directly from another's bank account designated by the payer and pay those funds into a bank account designated by the payee. Before the payer's banker will allow the transaction to take place, the payer must have advised the bank that they have authorized the payee to directly draw the funds. It is also called pre-authorized debit (PAD) or pre-authorized payment (PAP). After the authorities are set up, the direct debit transactions are usually processed electronically.

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.

Chargeback fraud, also known as friendly fraud, cyber shoplifting, or liar-buyer fraud, occurs when a consumer makes an online shopping purchase with their own credit card, and then requests a chargeback from the issuing bank after receiving the purchased goods or services. Once approved, the chargeback cancels the financial transaction, and the consumer receives a refund of the money they spent. Dependent on the payment method used, the merchant can be accountable when a chargeback occurs.

A payment is the tender of something of value, such as money or its equivalent, by one party to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards.

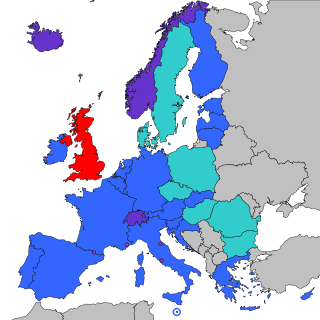

The Single Euro Payments Area (SEPA) is a payment integration initiative of the European Union for simplification of bank transfers denominated in Euros. As of 2020, there were 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the European Free Trade Association, and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City.

Interac e-Transfer is a Canadian funds transfer service between personal and business accounts in participating Canadian banks and other financial institutions, offered through Interac Corporation.

A demand draft (DD) is a negotiable instrument similar to a bill of exchange. A bank issues a demand draft to a client (drawer), directing another bank (drawee) or one of its own branches to pay a certain sum to the specified party (payee).

References

- ↑ CIBC. "CIBC introduces new recurring and future-dated Interac e-Transfer payments". www.newswire.ca. Retrieved 2023-04-27.

- ↑ Bank of Nova Scotia (Scotiabank), Statement by Assistant Manager of National Capital Main Branch (28 April 2023).

- ↑ "UK Payments Administration - Standing Orders"., UK Payments

- ↑ "Standing order vs Direct Debit". SmartDebit. 2012-04-19. Retrieved 2017-07-05.

- ↑ "Standing Order vs Direct Debit". GoCardless . Retrieved 10 April 2014.