Related Research Articles

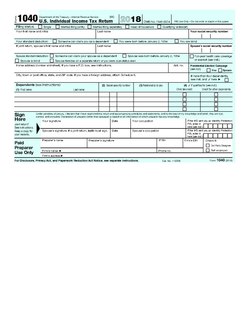

Form 1040 is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government.

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2010, taxes collected by federal, state, and municipal governments amounted to 24.8% of GDP. In the OECD, only Chile and Mexico are taxed less as a share of their GDP.

Economic data or economic statistics are data describing an actual economy, past or present. These are typically found in time-series form, that is, covering more than one time period or in cross-sectional data in one time period. Data may also be collected from surveys of for example individuals and firms or aggregated to sectors and industries of a single economy or for the international economy. A collection of such data in table form comprises a data set.

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff. Payroll taxes generally fall into two categories: deductions from an employee's wages, and taxes paid by the employer based on the employee's wages.

In treasury management, a payroll is the list of employees of some company that are entitled to receive pay as well as other work benefits and the amounts that each should receive. Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including salaries and wages, bonuses, and withheld taxes, or the company's department that deals with compensation. One way that payroll can be handled is in-house, meaning that a company handles all aspects of the payroll process on its own, including timesheets, calculating wages, producing pay checks, sending the ACH, for any direct deposits, and remitting any tax payments necessary. Payroll can also be outsourced to a full-service payroll processing company. When a company chooses to outsource their payroll, timesheets, wage calculations, creating pay checks, direct deposits, and tax payments can be handled all, or in part, by the payroll company.

Three key types of withholding tax are imposed at various levels in the United States:

TurboTax is a software package for preparation of American income tax returns, produced by Intuit. Turbotax is a market leader in its product segment, competing with H&R Block Tax Software and TaxAct. TurboTax was developed by Michael A. Chipman of Chipsoft in 1984 and was sold to Intuit in 1993.

Form 1099 is one of several IRS tax forms used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips. The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds of returns.

Income taxes in the United States are imposed by the federal, most states, and many local governments. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

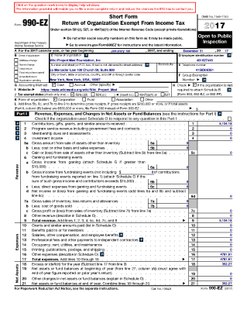

Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States. They are used to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

Internal Revenue Service, Criminal Investigation (IRS-CI) is the United States' federal law enforcement agency responsible for investigating potential criminal violations of the U.S. Internal Revenue Code and related financial crimes, such as money laundering, currency violations, tax-related identity theft fraud, and terrorist financing that adversely affect tax administration. While other federal agencies also have investigative jurisdiction for money laundering and some Bank Secrecy Act violations, IRS-CI is the only federal agency that can investigate potential criminal violations of the Internal Revenue Code, in a manner intended to foster confidence in the tax system and deter violations of tax law. Criminal Investigation is a division of the Internal Revenue Service, which in turn is a bureau within the United States Department of the Treasury.

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% due to the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

Form 990 is a United States Internal Revenue Service form that provides the public with financial information about a nonprofit organization. It is often the only source of such information. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Certain nonprofits have more comprehensive reporting requirements, such as hospitals and other health care organizations.

Customer Account Data Engine (CADE) was a planned update to the Internal Revenue Service (IRS) tax processing system, used for filing United States income tax returns, that was stopped in 2009. Currently, the CADE 2 solution is being developed to deliver a modern tax processing system to the IRS.

This is a table of the total federal tax revenue by state, federal district, and territory collected by the U.S. Internal Revenue Service.

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries.

The Internal Revenue Service (IRS) is the revenue service of the United States federal government. The government agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The IRS is responsible for collecting taxes and administering the Internal Revenue Code, the main body of federal statutory tax law of the United States. The duties of the IRS include providing tax assistance to taxpayers and pursuing and resolving instances of erroneous or fraudulent tax filings. The IRS has also overseen various benefits programs, AND enforces portions of the Affordable Care Act.

Taxation in Puerto Rico consists of taxes paid to the United States federal government and taxes paid to the Commonwealth government. Payment of taxes to the federal government, both personal and corporate, is done through the IRS, while payment of taxes to the Commonwealth government, whether personal or corporate, is done through the Departamento de Hacienda de Puerto Rico.

In the United States of America, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

Under the federal law of the United States of America, tax evasion or tax fraud, is the purposeful illegal attempt of a taxpayer to evade assessment or payment of a tax imposed by Federal law. Conviction of tax evasion may result in fines and imprisonment. Compared to other countries, Americans are more likely to pay their taxes fairly, honestly, and on time.

References

- 1 2 3 4 5 6 7 8 9 10 "SOI Tax Stats - Purpose and Function of Statistics of Income (SOI) Program". Internal Revenue Service . Retrieved October 15, 2017.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 "Statistics of Income: A Collection of Historical Articles" (PDF). Internal Revenue Service . Retrieved October 15, 2017.

- ↑ "NIPA Handbook: Concepts and Methods of the U.S. National Income and Product Accounts. Chapter 3: Principal Source Data" (PDF). Bureau of Economic Analysis. October 1, 2016. Retrieved October 15, 2017.

- ↑ Anguelov, Chris E.; Iams, Howard M.; Purcell, Patrick J. (2012). "Shifting Income Sources of the Aged". Social Security Bulletin. Social Security Administration. 72 (3): 59–68. PMID 23113429 . Retrieved October 15, 2017.

- ↑ "Most Large Profitable U.S. Corporations Paid Tax But Effective Tax Rates Differed Significantly from the Statutory Rate" (PDF). Government Accountability Office. March 1, 2016. Retrieved October 15, 2017.

- ↑ Butrica, Barbara A.; Iams, Howard M.; Smith, Karen E.; Toder, Eric J. (2009). "The Disappearing Defined Benefit Pension and Its Potential Impact on the Retirement Incomes of Baby Boomers". Social Security Bulletin. Social Security Administration. 69 (3). Retrieved October 15, 2017.

- ↑ "Welcome to Tax Stats" . Retrieved October 15, 2017.

- ↑ Hungerford, Thomas (September 14, 2012). Taxes and the Economy: An Analysis of the Top Tax Rates Since 1945 (PDF) (Report). Congressional Research Service . Retrieved October 15, 2017– via The New York Times .

- ↑ "How many people pay the estate tax?". Tax Policy Center. Retrieved October 15, 2017.

- ↑ LaLumia, Sara (October 1, 2011). "The EITC, Tax Refunds, and Unemployment Spells" (PDF). Retrieved October 15, 2017.

- ↑ Edwards, Chris (May 11, 2005). "Proposal for a "Dual-Rate Income Tax"". Cato Institute . Retrieved October 15, 2017.

- 1 2 Burnham, David (November 20, 1983). "Census Bureau Fighting Plan to Share Personal Data". New York Times . Retrieved October 15, 2017.

- ↑ Browning, Lynnley (June 24, 2008). "One-time tax break saved 843 U.S. corporations $265 billion". New York Times . Retrieved October 15, 2017.

- ↑ Fleischer, Victor (June 5, 2015). "How a Carried Interest Tax Could Raise $180 Billion". New York Times . Retrieved October 15, 2017.

- ↑ Herman, Tom (August 27, 2008). "The Ranks of the Ultrawealthy Grow". Wall Street Journal . Retrieved October 15, 2017.

- ↑ Brady, Peter; Mitchell, Olivia (August 9, 2017). "Do Americans Participate Enough In Retirement Plans?" . Retrieved October 15, 2017.

- ↑ "Statistics of Income: 1916-1937" . Retrieved October 15, 2017.

- ↑ "Obituaries: Vito Natrella". Washington Post . February 8, 2009. Retrieved October 15, 2017.

- ↑ "Farewell Tom Petska". Tax Policy Center . Retrieved October 15, 2017.