History

The Manhattan Company was formed in 1799 with the ostensible purpose of providing clean water to Lower Manhattan. However, the main interest of the company was not in the supply of water, but rather in becoming a part of the banking industry in New York. At that time, the banking industry was monopolized by Alexander Hamilton's Bank of New York and the New York branch of the First Bank of the United States. Following an epidemic of yellow fever in the city, Aaron Burr founded the company and successfully gained banking privileges through a clause in its charter granted to it by the state that allowed it to use surplus capital for banking transactions. The company raised 2 million dollars, used one hundred thousand dollars for building a water supply system, and used the rest to start the bank. [1] The company apparently did a poor job of supplying water, using hollowed out tree trunks for pipes and digging wells in congested areas where there was the danger of raw sewage mixing with the water. [2] After a multitude of cholera epidemics, a water system was finally established with the construction between 1837 and 1842 of the Croton Aqueduct.

Alexander Hamilton was an American statesman and one of the Founding Fathers of the United States. He was an influential interpreter and promoter of the U.S. Constitution, as well as the founder of the nation's financial system, the Federalist Party, the United States Coast Guard, and the New York Post newspaper. As the first Secretary of the Treasury, Hamilton was the main author of the economic policies of George Washington's administration. He took the lead in the Federal government's funding of the states' debts, as well as establishing a national bank, a system of tariffs, and friendly trade relations with Britain. His vision included a strong central government led by a vigorous executive branch, a strong commercial economy, a national bank and support for manufacturing, and a strong military. Thomas Jefferson was his leading opponent, arguing for agrarianism and smaller government.

The President, Directors and Company, of the Bank of the United States, commonly known as the First Bank of the United States, was a national bank, chartered for a term of twenty years, by the United States Congress on February 25, 1791. It followed the Bank of North America, the nation's first de facto central bank.

Yellow fever is a viral disease of typically short duration. In most cases, symptoms include fever, chills, loss of appetite, nausea, muscle pains particularly in the back, and headaches. Symptoms typically improve within five days. In about 15% of people, within a day of improving the fever comes back, abdominal pain occurs, and liver damage begins causing yellow skin. If this occurs, the risk of bleeding and kidney problems is also increased.

On April 17, 1799, the Manhattan Company appointed a committee "to consider the most proper means of employing the capital of the Company" and elected to open an office of discount and deposit. The "Bank" of the Manhattan Company began business on September 1, 1799, in a house at 40 Wall Street. In 1808, the company sold its waterworks, pocketing 1.9 million dollars, to the city and turned completely to banking. Even so, it identified as a water company as late as 1899. The Company maintained a Water Committee which yearly assured, quite truthfully, that no requests for water service had been denied, and moreover conducted its meetings with a pitcher of the water at hand to ensure quality. It is unclear whether anyone at these meetings actually tasted the water. [3]

40 Wall Street, also known as the Trump Building, is a 71-story neo-gothic skyscraper between Nassau Street and William Street in Manhattan, New York City. Erected by The Manhattan Company as its headquarters, the building was originally known as the Bank of Manhattan Trust Building, and also as the Manhattan Company Building, until its founding tenant merged to form the Chase Manhattan Bank. The structure was completed in 1930 after 11 months of construction.

The Bank started paying dividends in July 1800, and in 1853, the Manhattan Company became one of the original 52 members of the New York Clearing House Association. In 1923, it moved its headquarters briefly to the Prudence Building and then in 1929 built what was briefly the tallest building in the world at 40 Wall Street on the site of the Gallatin Bank Building. A 1929 merger made Paul Warburg its chairman. The Bank merged with Chase National Bank in 1955 to become Chase Manhattan. [4] In 1996, Chase Manhattan was acquired by Chemical Bank, who retained the Chase name, to form what was then the largest bank holding company in the United States. In December 2000, the bank acquired J.P. Morgan & Co. to form JPMorgan Chase & Co.

The Prudence Building, or Prudence Bonds Building, was a fourteen-story edifice at the southeast corner of Madison Avenue and 43rd Street, in Manhattan, in the U.S. state of New York. It was the headquarters of the Prudence Bonds Corporation, opening in October 1923. Stores on the street level were leased to affluent shops. The banking floor was a close likeness of the Bankers Trust Company building at the southeast corner of Fifth Avenue and 42nd Street. The Bank of Manhattan was accorded a 21-year lease and moved its headquarters from 40 Wall Street.

The Gallatin Bank Building was constructed in 1887 on a plot at 34 Wall Street (Manhattan). It was enlarged from an original plot bought at 36 Wall Street when the bank was organized in 1829. The purchase price was $12,000. Originally called National Bank, the name was later changed to Gallatin because of its association with the family of Albert Gallatin. The architects were Cady, Berg & See.

Paul Moritz Warburg was an American investment banker born in Germany, and an early advocate of the U.S. Federal Reserve System.

The Texas Commerce Bank was a Texas-based bank acquired by Chemical Banking Corporation of New York in May 1987. The acquisition of Texas Commerce Bank represented the largest interstate banking merger in history at the time with a purchase price of $1.2 billion. The bank had its headquarters in what is now the JPMorgan Chase Building in Downtown Houston, Texas.

Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

J.P. Morgan Chase & Co. is an American multinational investment bank and financial services company headquartered in New York City. JPMorgan Chase is the largest bank in the United States, and is ranked by S&P Global as the sixth largest bank in the world by total assets as of 2018, to the amount of $2.534 trillion. It is the world's most valuable bank by market capitalization.

J.P. Morgan Chase Bank, N.A., doing business as Chase Bank, is a national bank headquartered in Manhattan, New York City, that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase & Co. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and The Manhattan Company in 1955. The bank has been headquartered in Columbus, Ohio since its merger with Bank One Corporation in 2004. The bank acquired the deposits and most assets of The Washington Mutual.

28 Liberty Street, formerly known as One Chase Manhattan Plaza, is a banking skyscraper located in the downtown Manhattan Financial District of New York City, between Pine, Liberty, Nassau, and William Streets. Construction on the building was completed in 1961. It has 60 floors, with 5 basement floors, and is 248 meters (813 ft) tall, making it the 26th tallest building in New York City, the 43rd tallest in the United States, and the 200th tallest building in the world.

William B. Harrison Jr.,, in Rocky Mount, North Carolina, is the former CEO and chairman of JPMorgan Chase. He attended high school at Virginia Episcopal School, where he was a basketball star. He attended the University of North Carolina at Chapel Hill, where he was admitted to the Zeta Psi fraternity. Having risen through the ranks of Chemical Bank before succeeding Walter V. Shipley during the Chemical Bank merger with the Chase Manhattan Corporation in 1995, which kept the Chase name. As Chairman and CEO of Chase, he and Douglas A. Warner III, then CEO of J.P. Morgan & Co., were the principal architects of the US$30.9 billion acquisition by Chase of J.P. Morgan & Co. in 2000, to form JPMorgan Chase & Co. Harrison has been a director of the Firm or a predecessor institution since 1991. Harrison is also a director of Merck & Co., Inc.

Marine Midland Bank was a bank formerly headquartered in Buffalo, New York, with several hundred branches throughout the state of New York. In 1998 branches extended to Pennsylvania. It was acquired by HSBC in 1980, and changed its name to HSBC Bank USA in 1999. As a result of several transactions since the turn of the millennium, much of what was once Marine Midland is now part of KeyBank.

J.P. Morgan & Co. is a commercial and investment banking institution founded by J. P. Morgan in 1871. The company was a predecessor of three of the largest banking institutions in the world, JPMorgan Chase & Morgan Stanley, and was involved in the formation of Drexel Burnham Lambert. The company is sometimes referred to as the "House of Morgan" or simply "Morgan".

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.

The Corn Exchange Bank was founded in 1853 in New York, but had branches in other states, including Pennsylvania, Wisconsin, and Nebraska. It was a retail bank that acquired many community banks.

John Thompson (1802–1891) was a United States banker, financial publisher, and dealer in bank notes. The son of a Revolutionary War soldier, he was born near Pittsfield, Mass.

A correspondent account is an account established by a banking institution to receive deposits from, make payments on behalf of, or handle other financial transactions for another financial institution. Correspondent accounts are established through bilateral agreements between the two banks.

The JPMorgan Chase Building, formerly the Gulf Building, is a 37-story 130 m (430 ft) Art Deco skyscraper in downtown Houston, Texas. Completed in 1929, it remained the tallest building in Houston until 1963, when the Exxon Building surpassed it in height. The building is the Houston headquarters of JPMorgan Chase Bank, and was formerly the headquarters of Texas Commerce Bank.

First Chicago Bank was a Chicago-based retail and commercial bank tracing its roots back to 1863. Over the years, the bank operated under several names including The First National Bank of Chicago and First Chicago NBD. In 1998, First Chicago NBD merged with Banc One Corporation to form Bank One Corporation, today a part of Chase.

277 Park Avenue is an office building in the Midtown Manhattan neighborhood of New York City. It stands on the east side of Park Avenue between East 47th and 48th Streets; it is 687 feet (209 m) tall, with 50 floors.

CCMP Capital is an American private equity investment firm that focuses on leveraged buyout and growth capital transactions. Formerly known as JP Morgan Partners, the investment professionals of JP Morgan Partners separated from JPMorgan Chase on July 31, 2006. CCMP has invested approximately $12 billion in leveraged buyout and growth capital transactions since inception. In 2007, CCMP was ranked #17 among World's largest private equity funds.

Hambrecht & Quist (H&Q) was an investment bank based in San Francisco, California noted for its focus on the technology and Internet sectors. H&Q was founded by William Hambrecht and George Quist in California, in 1968.

One Equity Partners is the private merchant banking arm of JPMorgan Chase, focused on leveraged buyout and growth capital investments in middle-market companies. Formed at Bank One in 2001, the group has offices in New York City, Chicago, Sao Paulo, Vienna, Hong Kong and Frankfurt. It manages approximately $10 billion of investments and capital commitments by JPMorgan Chase. In 2014, it was announced that J.P Morgan was to sell of half of its stake in One Equity Partners.

James Bainbridge Lee, Jr. was an American investment banker, notable for his role in the development of the leveraged finance markets in the U.S. in the 1980s. He is widely credited as the architect of the modern-day syndicated loan market. At the time of his death, Lee was vice chairman of JPMorgan Chase & Co. and a member of the bank’s executive committee. He was also Co-Chairman of JPMorgan's investment bank.

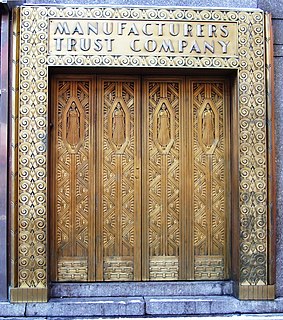

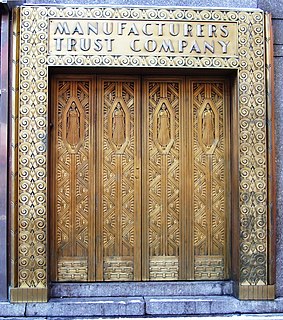

The Manufacturers Trust Company Building, now known as 510 Fifth Avenue, is a historic building located at the southwest corner of West 43rd Street and Fifth Avenue in the New York City borough of Manhattan.