A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to collectively fund government spending, public expenditures, or as a way to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

A flat tax is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount. There are various tax systems that are labeled "flat tax" even though they are significantly different. The defining characteristic is the existence of only one tax rate other than zero, as opposed to multiple non-zero rates that vary depending on the amount subject to taxation.

Supply-side economics is a macroeconomic theory that postulates economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics, consumers will benefit from greater supplies of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity. Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

Arthur Betz Laffer is an American economist and author who first gained prominence during the Reagan administration as a member of Reagan's Economic Policy Advisory Board (1981–1989). Laffer is best known for the Laffer curve, an illustration of the theory that there exists some tax rate between 0% and 100% that will result in maximum tax revenue for government. In certain circumstances, this would allow governments to cut taxes, and simultaneously increase revenue and economic growth.

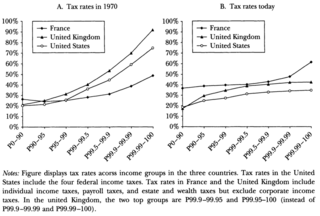

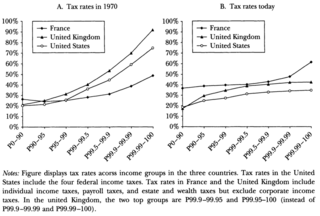

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich.

Tax reform is the process of changing the way taxes are collected or managed by the government and is usually undertaken to improve tax administration or to provide economic or social benefits. Tax reform can include reducing the level of taxation of all people by the government, making the tax system more progressive or less progressive, or simplifying the tax system and making the system more understandable or more accountable.

A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes.

FairTax is a single rate tax proposal in which has been proposed as a bill in Congress regularly since 2005 in the United States that includes complete dismantling of the Internal Revenue Service. The proposal would eliminate all federal income taxes, payroll taxes, gift taxes, and estate taxes, replacing them with a single consumption tax on retail sales.

The Tax Foundation is an American think tank based in Washington, D.C. It was founded in 1937 by a group of businessmen in order to "monitor the tax and spending policies of government agencies". The Tax Foundation collects data and publishes research studies on U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity".

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resources and/or foreign aid. An inefficient collection of taxes is greater in countries characterized by poverty, a large agricultural sector and large amounts of foreign aid.

Dynamic scoring is a forecasting technique for government revenues, expenditures, and budget deficits that incorporates predictions about the behavior of people and organizations based on changes in fiscal policy, usually tax rates. Dynamic scoring depends on models of the behavior of economic agents which predict how they would react once the tax rate or other policy change goes into effect. This means the uncertainty induced in predictions is greater to the degree that the proposed policy is unlike current policy. Unfortunately, any such model depends heavily on judgment, and there is no evidence that it is more effective or accurate.

Citizens for Tax Justice (CTJ) is a Washington, D.C.-based think tank and advocacy group founded in 1979 focusing on tax policies and their impact. CTJ's work focuses primarily on federal tax policy, but also analyzes state and local tax policies.

The Fair Tax Act is a bill in the United States Congress for changing tax laws to replace the Internal Revenue Service (IRS) and all federal income taxes, payroll taxes, corporate taxes, capital gains taxes, gift taxes, and estate taxes with a national retail sales tax, to be levied once at the point of purchase on all new goods and services. The proposal also calls for a monthly payment to households of citizens and legal resident aliens as an advance rebate of tax on purchases up to the poverty level.

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes and Pigouvian taxes, where the market consumption of a good is inefficient, and a tax brings consumption closer to the efficient level.

The Urban-Brookings Tax Policy Center, typically shortened to the Tax Policy Center (TPC), is a nonpartisan think tank based in Washington D.C., United States. A joint venture of the Urban Institute and the Brookings Institution, it aims to provide independent analyses of current and longer-term tax issues, and to communicate its analyses to the public and to policymakers. TPC combines national specialists in tax, expenditure, budget policy, and microsimulation modeling to concentrate on five overarching areas of tax policy: fair, simple and efficient taxation, social policy in the tax code, business tax reform, long-term implications of tax and budget choices, and state tax issues.

The Fair Tax Act is a bill in the United States Congress for changing tax laws to replace the Internal Revenue Service (IRS) and all federal income taxes, payroll taxes, corporate taxes, capital gains taxes, gift taxes, and estate taxes with a national retail sales tax, to be levied once at the point of purchase on all new goods and services. The proposal also calls for a monthly payment to households of citizens and legal resident aliens as an advance rebate of tax on purchases up to the poverty level.

Economic theory evaluates how taxes are able to provide the government with required amount of the financial resources and what are the impacts of this tax system on overall economic efficiency. If tax efficiency needs to be assessed, tax cost must be taken into account, including administrative costs and excessive tax burden also known as the dead weight loss of taxation (DWL). Direct administrative costs include state administration costs for the organisation of the tax system, for the evidence of taxpayers, tax collection and control. Indirect administrative costs can include time spent filling out tax returns or money spent on paying tax advisors.

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, meaning that there is a tax rate between 0% and 100% that maximizes government tax revenue.

The economic impact of undocumented immigrants in the United States is challenging to measure, and politically contentious. Research shows that undocumented immigrants increase the size of the U.S. economy/contribute to economic growth, enhance the welfare of natives, contribute more in tax revenue than they collect, reduce American firms' incentives to offshore jobs and import foreign-produced goods, and benefit consumers by reducing the prices of goods and services. Economists estimate that legalization of the undocumented immigrant population would increase the immigrants' earnings and consumption considerably, and increase U.S. gross domestic product.

Michael Ettlinger is a public policy expert, administrator, educator and political advisor in the United States. He is a senior fellow at the Institute on Taxation and Economic Policy, a senior fellow at the Carsey School of Public Policy at the University of New Hampshire, and an independent author. Ettlinger is a fellow with the National Academy of Public Administration, a member of the Federal Reserve Bank of Boston New England Public Policy Center Advisory Board, and a board member of the Just Jobs Network. He is also a fellow at the Warren Rudman Center for Justice, Leadership and Public Service and an Affiliate Professor of Law at the Franklin Pierce School of Law.