A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to collectively fund government spending, public expenditures, or as a way to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation took place in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

In Canada, taxation is a prerogative shared between the federal government and the various provincial and territorial legislatures.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

An ad valorem tax is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ad valorem tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event. In some countries, a stamp duty is imposed as an ad valorem tax.

Goods and Services Tax (GST) is a value-added tax or consumption tax for goods and services consumed in New Zealand.

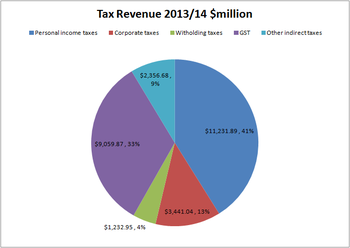

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office. Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

Taxes in India are levied by the Central Government and the State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality.

Inland Revenue or Inland Revenue Department is the public service department of New Zealand charged with advising the government on tax policy, collecting and disbursing payments for social support programmes, and collecting tax.

Under Article 108 of the Basic Law of Hong Kong, the taxation system in Hong Kong is independent of, and different from, the taxation system in mainland China. In addition, under Article 106 of the Hong Kong Basic Law, Hong Kong has independent public finance, and no tax revenue is handed over to the Central Government in China. The taxation system in Hong Kong is generally considered to be one of the simplest, most transparent and straightforward systems in the world. Taxes are collected through the Inland Revenue Department (IRD).

The Student Loan Scheme (SLS), introduced in New Zealand in 1992, provides student loans and allowances for course fees, course-related costs, and living costs to tertiary students who meet StudyLink's funding criteria. StudyLink is the public organisation part of the Ministry for Social Development and is responsible for administering student loans and allowances. Eligibility criteria apply, and courses must be approved.

The Inland Revenue Authority of Singapore (IRAS) is a statutory board under the Ministry of Finance of the Government of Singapore in charge of tax collection.

Taxes provide the most important revenue source for the Government of the People's Republic of China. Tax is a key component of macro-economic policy, and greatly affects China's economic and social development. With the changes made since the 1994 tax reform, China has sought to set up a streamlined tax system geared to a socialist market economy.

The Goods and Services Tax (GST) is an abolished value-added tax in Malaysia. GST is levied on most transactions in the production process, but is refunded with exception of Blocked Input Tax, to all parties in the chain of production other than the final consumer.

Taxation in Norway is levied by the central government, the county municipality and the municipality. In 2012 the total tax revenue was 42.2% of the gross domestic product (GDP). Many direct and indirect taxes exist. The most important taxes – in terms of revenue – are VAT, income tax in the petroleum sector, employers' social security contributions and tax on "ordinary income" for persons. Most direct taxes are collected by the Norwegian Tax Administration and most indirect taxes are collected by the Norwegian Customs and Excise Authorities.

Taxes in Germany are levied by the federal government, the states (Länder) as well as the municipalities (Städte/Gemeinden). Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant.

Taxes provide an important source of revenue for various levels of the Government of the Republic of China. The tax revenue of Taiwan in 2015 amounted NT$2.1 trillion.

The Maldives Inland Revenue Authority (MIRA) is a fully autonomous body responsible for tax administration in the Maldives. The main responsibilities of MIRA include execution of tax laws, implementation of tax policies and providing technical advice to the government in determining tax policies. The Tax Administration Act stipulates the other responsibilities of MIRA.

Tax pooling allows New Zealand taxpayers to pool their provisional tax payments together in an account held by a registered tax pooling intermediary at Inland Revenue (IRD) so that underpayments by some can be offset by overpayments of others. Taxpayers receive/pay an interest rate that is higher/lower than IRD's rates if they overpay/underpay provisional tax. Intermediaries operate under legislation set out in the Income Tax Act 2007 and Tax Administration Act 1994.

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities.

Taxation in Sri Lanka mainly includes excise duties, value added tax, income tax and tariffs. Tax revenue is a primary constituent of the government's fiscal policy. The Government of Sri Lanka imposes taxes mainly of two types in the forms of direct taxes and indirect taxes. As of 2018 CBSL report, taxes are the most important revenue source for the government, contributing 89% of the revenue. The tax revenue to GDP ratio is just about 11.6 percent as of 2018, which is one of the lowest rates among the upper-middle income earning countries. At present, the government of Sri Lanka also face major challenges regarding the continuous budget deficits where government expenditures have exceeded the government tax revenue.