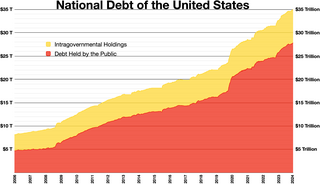

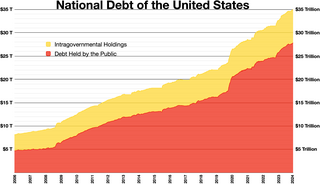

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

A black budget or covert appropriation is a government budget that is allocated for classified or other secret operations of a state. The black budget is an account of expenses and spending related to military research and covert operations. The black budget is mostly classified because of security reasons.

The military budget of the United States is the largest portion of the discretionary federal budget allocated to the Department of Defense (DoD), or more broadly, the portion of the budget that goes to any military-related expenditures. The military budget pays the salaries, training, and health care of uniformed and civilian personnel, maintains arms, equipment and facilities, funds operations, and develops and buys new items. The budget funds six branches of the US military: the Army, Navy, Marine Corps, Coast Guard, Air Force, and Space Force.

PAYGO is the practice of financing expenditures with funds that are currently available rather than borrowed.

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

The 2006 United States Federal Budget began as a proposal by President George W. Bush to fund government operations for October 1, 2005 – September 30, 2006. The requested budget was submitted to the 109th Congress on February 7, 2005.

The United States Department of Defense is an executive branch department of the federal government of the United States charged with coordinating and supervising all agencies and functions of the U.S. government directly related to national security and the United States Armed Forces. As of November 2022, the U.S. Department of Defense is the second largest employer in the world—After India; and potentially China, if including the Central Military Commission. With over 1.4 million active-duty service personnel, including soldiers, marines, sailors, airmen, and guardians. The Department of Defense also maintains over 778,000 National Guard and reservists, and over 747,000 civilians bringing the total to over 2.91 million employees. Headquartered at the Pentagon in Arlington County, Virginia, just outside Washington, D.C., the Department of Defense's stated mission is "to provide the military forces needed to deter war and ensure our nation's security".

The 2008 United States Federal Budget began as a proposal by President George W. Bush to fund government operations for October 1, 2007 – September 30, 2008. The requested budget was submitted to the 110th Congress on February 5, 2007.

The United States federal budget for fiscal year 2009 began as a spending request submitted by President George W. Bush to the 110th Congress. The final resolution written and submitted by the 110th Congress to be forwarded to the President was approved by the House on June 5, 2008.

The United States Federal Budget for Fiscal Year 2010, titled A New Era of Responsibility: Renewing America's Promise, is a spending request by President Barack Obama to fund government operations for October 2009–September 2010. Figures shown in the spending request do not reflect the actual appropriations for Fiscal Year 2010, which must be authorized by Congress.

The United States Federal Budget for Fiscal Year 1997, was a spending request by President Bill Clinton to fund government operations for October 1996-September 1997. Figures shown in the spending request do not reflect the actual appropriations for Fiscal Year 1997, which must be authorized by Congress. The requested budget was submitted to Congress on February 5, 1996.

The 2011 United States federal budget was the United States federal budget to fund government operations for the fiscal year 2011. The budget was the subject of a spending request by President Barack Obama. The actual appropriations for Fiscal Year 2011 had to be authorized by the full Congress before it could take effect, according to the U.S. budget process.

The United States federal budget consists of mandatory expenditures, discretionary spending for defense, Cabinet departments and agencies, and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

The 1996 United States federal budget is the United States federal budget to fund government operations for the fiscal year 1996, which was October 1995 – September 1996. This budget was the first to be submitted after the Republican Revolution in the 1994 midterm elections. Disagreements between Democratic President Bill Clinton and Republicans led by Speaker of the House Newt Gingrich resulted in the United States federal government shutdown of 1995 and 1996.

The United States Federal Budget for Fiscal Year 1998, was a spending request by President Bill Clinton to fund government operations for October 1997 – September 1998. Figures shown in the spending request do not reflect the actual appropriations for Fiscal Year 1998, which must be authorized by Congress.

The 2005 United States Federal Budget began as a proposal by President George W. Bush to fund government operations for October 1, 2004 – September 30, 2005. The requested budget was submitted to the 108th Congress on February 2, 2004.

The 2013 United States federal budget is the budget to fund government operations for the fiscal year 2013, which began on October 1, 2012, and ended on September 30, 2013. The original spending request was issued by President Barack Obama in February 2012.

The 2015 United States federal budget was the federal budget for fiscal year 2015, which runs from October 1, 2014 to September 30, 2015. The budget takes the form of a budget resolution which must be agreed to by both the United States House of Representatives and the United States Senate in order to become final, but never receives the signature or veto of the President of the United States and does not become law. Until both the House and the Senate pass the same concurrent resolution, no final budget exists. Actual U.S. federal government spending will occur through later appropriations legislation that would be signed into law.

The 2017 United States federal budget is the United States federal budget for fiscal year 2017, which lasted from October 1, 2016 to September 30, 2017. President Barack Obama submitted a budget proposal to the 114th Congress on February 9, 2016. The 2017 fiscal year overlaps the end of the Obama administration and the beginning of the Trump administration.

The United States federal budget for fiscal year 2018, which ran from October 1, 2017, to September 30, 2018, was named America First: A Budget Blueprint to Make America Great Again. It was the first budget proposed by newly elected president Donald Trump, submitted to the 115th Congress on March 16, 2017.