The Farm Credit Administration is an independent agency of the federal government of the United States. Its function is to regulate the financial institutions that provide credit to farmers.

The Agricultural Adjustment Act (AAA) was a United States federal law of the New Deal era designed to boost agricultural prices by reducing surpluses. The government bought livestock for slaughter and paid farmers subsidies not to plant on part of their land. The money for these subsidies was generated through an exclusive tax on companies which processed farm products. The Act created a new agency, the Agricultural Adjustment Administration, also called "AAA" (1933-1942), an agency of the U.S. Department of Agriculture, to oversee the distribution of the subsidies. The Agriculture Marketing Act, which established the Federal Farm Board in 1929, was seen as an important precursor to this act. The AAA, along with other New Deal programs, represented the federal government's first substantial effort to address economic welfare in the United States.

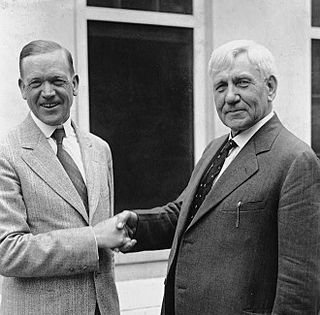

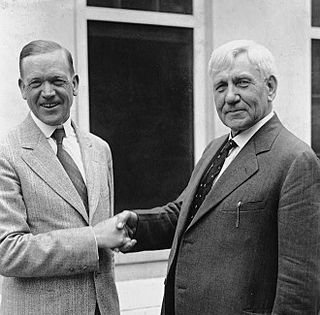

The McNary–Haugen Farm Relief Act, which never became law, was a controversial plan in the 1920s to subsidize American agriculture by raising the domestic prices of five crops. The plan was for the government to buy each crop and then store it or export it at a loss. It was co-authored by Charles L. McNary (R-Oregon) and Gilbert N. Haugen (R-Iowa). Despite attempts in 1924, 1926, 1927, and 1931 to pass the bill, it was vetoed by President Calvin Coolidge, and not approved. It was supported by Secretary of Agriculture Henry Cantwell Wallace and Vice President Charles Dawes.

The Emergency Relief and Construction Act, was the United States's first major-relief legislation, enabled under Herbert Hoover and later adopted and expanded by Franklin D. Roosevelt as part of his New Deal.

The Agricultural Adjustment Act of 1938 was legislation in the United States that was enacted as an alternative and replacement for the farm subsidy policies, in previous New Deal farm legislation, that had been found unconstitutional. The act revived the provisions in the previous Agriculture Adjustment Act, with the exception that the financing of the law's programs would be provided by the Federal Government and not a processor's tax, and was also enforced as a response to the success of the Soil Conservation and Domestic Allotment Act of 1936.

The Agricultural Act of 1954 is a United States federal law that, among other provisions, authorized a Commodity Credit Corporation reserve for foreign and domestic relief.

The Federal Home Loan Bank Act, Pub. L. 72–304, 47 Stat. 725, enacted July 22, 1932, is a United States federal law passed under President Herbert Hoover in order to lower the cost of home ownership. It established the Federal Home Loan Bank Board to charter and supervise federal savings and loan institutions. It also created the Federal Home Loan Banks which lend to building and loan associations, cooperative banks, homestead associations, insurance companies, savings banks, community development financial institutions, and insured depository institutions in order to finance home mortgages.

In different administrative and organizational forms, the Food for Peace program of the United States has provided food assistance around the world for more than 60 years. Approximately 3 billion people in 150 countries have benefited directly from U.S. food assistance. The Bureau for Humanitarian Assistance within the United States Agency for International Development (USAID) is the U.S. Government's largest provider of overseas food assistance. The food assistance programming is funded primarily through the Food for Peace Act. The Bureau for Humanitarian Assistance also receives International Disaster Assistance Funds through the Foreign Assistance Act (FAA) that can be used in emergency settings.

The Federal Farm Board was established by the Agricultural Marketing Act of 1929 from the Federal Farm Loan Board established by the Federal Farm Loan Act of 1916, with a revolving fund of half a billion dollars to stabilize prices and to promote the sale of agricultural products. The board would help farmers stabilize prices by buying and holding surplus grain and cotton in storage. The Farm Board was part of Herbert Hoover's response to the downward spiral of crop prices in the years leading up to the Great Depression.

The Potato Control Law (1929) was based upon an economic policy enacted by U.S. President Herbert Hoover's Federal Emergency Relief Administration at the beginning of the Great Depression. The policy became a formal act in 1935, and its legislative sponsors were from the state of North Carolina. Hoover's presidential successor, Franklin D. Roosevelt, signed the Act into law on August 24, 1935.

The Warehouse Act of 1916 permitted Federal Reserve member banks to give loans to farmers on the security of their staple crops which were kept in Federal storage units as collateral.

The Federal Works Agency (FWA) was an independent agency of the federal government of the United States which administered a number of public construction, building maintenance, and public works relief functions and laws from 1939 to 1949. Along with the Federal Security Agency and Federal Loan Agency, it was one of three catch-all agencies of the federal government pursuant to reorganization plans authorized by the Reorganization Act of 1939, the first major, planned reorganization of the executive branch of the government of the United States since 1787.

The Agricultural Act of 1956 created the Soil Bank Program, addressed the disposal of Commodity Credit Corporation (CCC) inventories of surplus stocks, contained commodity support program provisions, and contained forestry provisions. The Soil Bank Act authorized short- and long-term removal of land from production with annual rental payments to participants. The Acreage Reserve Program, for wheat, corn, rice, cotton, peanuts, and several types of tobacco, allowed producers to retire land on an annual basis in crop years 1956 through 1959 in return for payments. The Conservation Reserve Program allowed producers to retire cropland under contracts of 3, 5, or 10 years in return for annual payments. The Soil Bank Act was repealed by Section 601 of the Food and Agriculture Act of 1965. The Conservation Reserve portion of the Soil Bank was a model for the subsequent Conservation Reserve Program (CRP), enacted in 1985.

In United States federal agriculture legislation, the Agricultural Act of 1970 initiated a significant change in commodity support policy.

The Consolidated Farm and Rural Development Act of 1961 authorized a major expansion of USDA lending activities, which at the time were administered by Farmers Home Administration (FmHA), but now through the Farm Service Agency. The legislation was originally enacted as the Consolidated Farmers Home Administration Act of 1961.

The Federal Crop Insurance Reform and Department of Agriculture Reorganization Act of 1994, Pub. L. 103–354, 108 Stat. 3178, was introduced on April 14, 1994 by Eligio de la Garza (D-TX) and was signed into law on October 13, 1994 by President William J. Clinton. It consisted of two titles:

The Food and Agriculture Act of 1965, the first multiyear farm legislation, provided for four year commodity programs for wheat, feed grains, and upland cotton. It was extended for one more year through 1970. It authorized a Class I milk base plan for the 75 federal milk marketing orders, as well as a long term diversion of cropland under a Cropland Adjustment Program. It also continued payment and diversion programs for feed grains and cotton, and marketing certificate and diversion programs for wheat.

The United States Food and Agriculture Act of 1977 was an omnibus farm bill. The S. 275 legislation was passed by the 95th U.S. Congressional session and signed into law by the 39th President of the United States Jimmy Carter on September 29, 1977.

The Farm Labor Contractor Registration Act (FLCRA) — P.L. 88-582 — regulated the activities of farm labor contractors, that is, agents who recruit and are otherwise engaged in the transport, housing, and employment of migratory agricultural workers. Under FLCRA, farm labor contractors were required to secure certification through the United States Department of Labor.

The Capper–Ketcham Act, sponsored by Sen. Arthur Capper (R) of Kansas and Rep. John C. Ketcham (R) of Michigan, built on Senator Capper's background running "Capper Clubs" to teach boys and girls about agriculture. The legislation officially recognized and provided matching funds to States to create "4-H" clubs for demonstration work to enable counties to hire youth and home agents. It also granted federal money to agricultural extension network and the work of agricultural colleges. The "Future Farmers of America" (FFA) was founded through the Act.