The Agricultural Adjustment Act (AAA) was a United States federal law of the New Deal era designed to boost agricultural prices by reducing surpluses. The government bought livestock for slaughter and paid farmers subsidies not to plant on part of their land. The money for these subsidies was generated through an exclusive tax on companies that processed farm products. The Act created a new agency, the Agricultural Adjustment Administration, also called "AAA" (1933–1942), an agency of the U.S. Department of Agriculture, to oversee the distribution of the subsidies. The Agriculture Marketing Act, which established the Federal Farm Board in 1929, was seen as an important precursor to this act. The AAA, along with other New Deal programs, represented the federal government's first substantial effort to address economic welfare in the United States.

The United States Department of Agriculture (USDA) is an executive department of the United States federal government that aims to meet the needs of commercial farming and livestock food production, promotes agricultural trade and production, works to assure food safety, protects natural resources, fosters rural communities and works to end hunger in the United States and internationally. It is headed by the secretary of agriculture, who reports directly to the president of the United States and is a member of the president's Cabinet. The current secretary is Tom Vilsack, who has served since February 24, 2021.

The Common Agricultural Policy (CAP) is the agricultural policy of the European Commission. It implements a system of agricultural subsidies and other programmes. It was introduced in 1962 and has since then undergone several changes to reduce the EEC budget cost and consider rural development in its aims. It has however, been criticised on the grounds of its cost, its environmental, and humanitarian effects.

Agricultural policy describes a set of laws relating to domestic agriculture and imports of foreign agricultural products. Governments usually implement agricultural policies with the goal of achieving a specific outcome in the domestic agricultural product markets.

An agricultural subsidy is a government incentive paid to agribusinesses, agricultural organizations and farms to supplement their income, manage the supply of agricultural commodities, and influence the cost and supply of such commodities.

Crop insurance is insurance purchased by agricultural producers and subsidized by a country's government to protect against either the loss of their crops due to natural disasters, such as hail, drought, and floods ("crop-yield insurance", or the loss of revenue due to declines in the prices of agricultural commodities.

Charles Walter Stenholm was an American businessman and Democratic Party politician from a rural district of the state of Texas. After establishing himself as owner-operator of a large cotton farm, he entered politics and was elected to Congress in his first run for office. Stenholm was a Democratic Party member of the United States House of Representatives for 13 terms, representing Texas's 17th congressional district from 1979 to 2005.

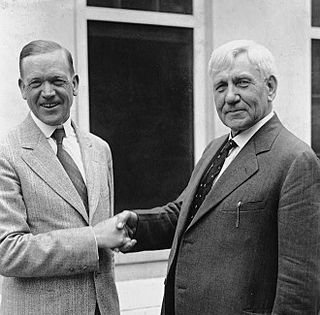

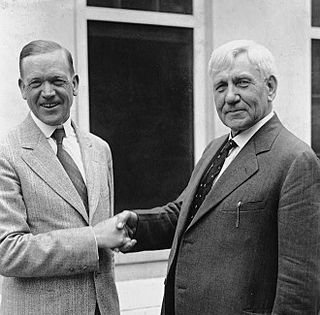

The McNary–Haugen Farm Relief Act, which never became law, was a controversial plan in the 1920s to subsidize American agriculture by raising the domestic prices of five crops. The plan was for the government to buy each crop and then store it or export it at a loss. It was co-authored by Charles L. McNary (R-Oregon) and Gilbert N. Haugen (R-Iowa). Despite attempts in 1924, 1926, 1927, and 1931 to pass the bill, it was vetoed by President Calvin Coolidge, and not approved. It was supported by Secretary of Agriculture Henry Cantwell Wallace and Vice President Charles Dawes.

The Commodity Credit Corporation (CCC) is a wholly owned United States government corporation that was created in 1933 to "stabilize, support, and protect farm income and prices". The CCC is authorized to buy, sell, lend, make payments, and engage in other activities for the purpose of increasing production, stabilizing prices, assuring adequate supplies, and facilitating the efficient marketing of agricultural commodities.

In the United States, the farm bill is comprehensive omnibus bill that is the primary agricultural and food policy instrument of the federal government. Congress typically passes a new farm bill every five to six years.

The Food, Conservation, and Energy Act of 2008 was a $288 billion, five-year agricultural policy bill that was passed into law by the United States Congress on June 18, 2008. The bill was a continuation of the 2002 Farm Bill. It continues the United States' long history of agricultural subsidies as well as pursuing areas such as energy, conservation, nutrition, and rural development. Some specific initiatives in the bill include increases in Food Stamp benefits, increased support for the production of cellulosic ethanol, and money for the research of pests, diseases and other agricultural problems.

Food versus fuel is the dilemma regarding the risk of diverting farmland or crops for biofuels production to the detriment of the food supply. The biofuel and food price debate involves wide-ranging views and is a long-standing, controversial one in the literature. There is disagreement about the significance of the issue, what is causing it, and what can or should be done to remedy the situation. This complexity and uncertainty are due to the large number of impacts and feedback loops that can positively or negatively affect the price system. Moreover, the relative strengths of these positive and negative impacts vary in the short and long terms, and involve delayed effects. The academic side of the debate is also blurred by the use of different economic models and competing forms of statistical analysis.

The agricultural policy of the United States is composed primarily of the periodically renewed federal U.S. farm bills. The Farm Bills have a rich history which initially sought to provide income and price support to US farmers and prevent them from adverse global as well as local supply and demand shocks. This implied an elaborate subsidy program which supports domestic production by either direct payments or through price support measures. The former incentivizes farmers to grow certain crops which are eligible for such payments through environmentally conscientious practices of farming. The latter protects farmers from vagaries of price fluctuations by ensuring a minimum price and fulfilling their shortfalls in revenue upon a fall in price. Lately, there are other measures through which the government encourages crop insurance and pays part of the premium for such insurance against various unanticipated outcomes in agriculture.

The Food, Agriculture, Conservation, and Trade (FACT) Act of 1990 — P.L. 101-624 was a 5-year omnibus farm bill that passed Congress and was signed into law.

The Food Security Act of 1985, a five-year omnibus farm bill, allowed lower commodity price, income supports, and established a dairy herd buyout program. This 1985 farm bill made changes in a variety of other USDA programs. Several enduring conservation programs were created, including sodbuster, swampbuster, and the Conservation Reserve Program.

Farm programs can be part of a concentrated effort to boost a country’s agricultural productivity in general or in specific sectors where they may have a comparative advantage. There are many different types of farm programs, with a variety of objectives and created with different economic mechanisms in mind. Some are meant to benefit farmers directly, while others seek to benefit consumers. They target food prices and quantity of food available on the market, as well as production and consumption of certain goods. Some are meant to benefit farmers directly, while others seek to benefit consumers. They target food prices and quantity of food available on the market, as well as production and consumption of certain goods.

The production of corn plays a major role in the economy of the United States. The US is the largest corn producer in the world, with 96,000,000 acres (39,000,000 ha) of land reserved for corn production. Corn growth is dominated by west/north central Iowa and east central Illinois. Approximately 13% of its annual yield is exported.

The Agricultural Act of 2014 is an act of Congress that authorizes nutrition and agriculture programs in the United States for the years of 2014–2018. The bill authorizes $956 billion in spending over the next ten years.

The Hemp Farming Act of 2018 was a proposed law to remove hemp from Schedule I controlled substances and making it an ordinary agricultural commodity. Its provisions were incorporated in the 2018 United States farm bill that became law on December 20, 2018.

The 2018 farm bill or Agriculture Improvement Act of 2018 is an enacted United States farm bill that reauthorized $867 billion for many expenditures approved in the prior farm bill. The bill was passed by the Senate and House on December 11 and 12, 2018, respectively. On December 20, 2018, it was signed into law by President Donald Trump.