An individual retirement account (IRA) in the United States is a form of "individual retirement plan", provided by many financial institutions, that provides tax advantages for retirement savings. An individual retirement account is a type of "individual retirement arrangement" as described in IRS Publication 590, individual retirement arrangements (IRAs). The term IRA, used to describe both individual retirement accounts and the broader category of individual retirement arrangements, encompasses an individual retirement account; a trust or custodial account set up for the exclusive benefit of taxpayers or their beneficiaries; and an individual retirement annuity, by which the taxpayers purchase an annuity contract or an endowment contract from a life insurance company.

Digital currency is a balance or a record stored in a distributed database on the Internet, in an electronic computer database, within digital files or within a stored-value card. Examples of digital currencies include cryptocurrencies, virtual currencies, central bank digital currencies and e-Cash.

A cryptocurrency exchange or a digital currency exchange (DCE) is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. A cryptocurrency exchange can be a market maker that typically takes the bid-ask spreads as a transaction commission for is service or, as a matching platform, simply charges fees.

A self-directed individual retirement account is an individual retirement account (IRA), provided by some financial institutions in the United States, which allows alternative investments for retirement savings. Some examples of these alternative investments are: real estate, private mortgages, private company stock, oil and gas limited partnerships, precious metals, horses, and intellectual property. The complexity of the rules for self-directed IRA's prompted the SEC to issue a public notice in 2011 against an increased risk of fraud.

Virtual currency, or virtual money, is a type of unregulated digital currency, which is issued and usually controlled by its developers and used and accepted among the members of a specific virtual community. In 2014, the European Banking Authority defined virtual currency as "a digital representation of value that is neither issued by a central bank or a public authority, nor necessarily attached to a fiat currency, but is accepted by natural or legal persons as a means of payment and can be transferred, stored or traded electronically". By contrast, a digital currency that is issued by a central bank is defined as "central bank digital currency".

Bitcoin (₿) is a cryptocurrency invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto and started in 2009 when its source code was released as open-source software.

A cryptocurrency is a digital asset designed to work as a medium of exchange wherein individual coin ownership records are stored in a ledger existing in a form of computerized database using strong cryptography to secure transaction records, to control the creation of additional coins, and to verify the transfer of coin ownership. It typically does not exist in physical form and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to centralized digital currency and central banking systems. When a cryptocurrency is minted or created prior to issuance or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.

Coinbase is a digital currency exchange headquartered in San Francisco, California. They broker exchanges of Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Tezos, and many others, with fiat currencies in approximately 32 countries, and bitcoin transactions and storage in 190 countries worldwide.

Bitcoin is a cryptocurrency, a digital asset designed to work as a medium of exchange that uses cryptography to control its creation and management, rather than relying on central authorities. The presumed pseudonymous Satoshi Nakamoto integrated many existing ideas from the cypherpunk community when creating bitcoin. Over the course of bitcoin's history, it has undergone rapid growth to become a significant currency both on and offline – from the mid 2010s, some businesses began accepting bitcoin in addition to traditional currencies.

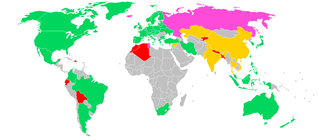

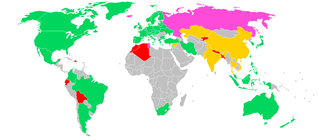

The legal status of bitcoin varies substantially from state to state and is still undefined or changing in many of them. Whereas the majority of countries do not make the usage of bitcoin itself illegal, its status as money varies, with differing regulatory implications.

BitPay is a bitcoin payment service provider headquartered in Atlanta, Georgia, United States. It was founded in May 2011 by Tony Gallippi and Stephen Pair. BitPay provides Bitcoin and Bitcoin Cash payment processing services for merchants.

A gold IRA or precious metals IRA is an Individual Retirement Account in which physical gold or other approved precious metals are held in custody for the benefit of the IRA account owner. It functions the same as a regular IRA, only instead of holding paper assets, it holds physical bullion coins or bars. Precious metals IRAs are usually self-directed IRAs, a type of IRA where the custodian allows more diverse investments to be held in the account.

Circle is a peer-to-peer payments technology company. It was founded by Jeremy Allaire and Sean Neville in October 2013. Circle's mobile payment platform, Circle Pay, allows users to hold, send, and receive traditional fiat currencies. In September 2015, Circle received the first BitLicense issued from the New York State Department of Financial Services. In April 2016, the British government approved the first virtual currency licensure to Circle. Circle is headquartered in Boston, Massachusetts.

CoinDesk is a news site specializing in bitcoin and digital currencies. The site was founded by Shakil Khan and was subsequently acquired by Digital Currency Group.

Roger Keith Ver is an early investor in bitcoin, bitcoin-related startups and an early promoter of bitcoin. He has been known as "Bitcoin Jesus" for his promotion of bitcoin. He now promotes Bitcoin Cash.

United States virtual currency law is financial regulation as applied to transactions in virtual currency in the U.S. The Commodity Futures Trading Commission has regulated and may continue to regulate virtual currencies as commodities. The Securities and Exchange Commission also requires registration of any virtual currency traded in the U.S. if it is classified as a security and of any trading platform that meets its definition of an exchange.

A BitLicense is the common term used for a business license of virtual currency activities, issued by the New York State Department of Financial Services (NYSDFS) under regulations designed for companies. The regulations are limited to activities involving the state of New York or a New York resident. People residing in, located in, having a place of business in, or conducting business in the State of New York count as New York Residents under these regulations. The license was introduced and designed by Benjamin Lawsky, New York's first Superintendent of Financial Services, in July 2014. Chartered entities do not require an explicit BitLicense, but may instead proceed with virtual currency activities via limited purpose trust charters approved by the NYDFS.

Kraken is a US-based cryptocurrency exchange, founded in 2011. The exchange provides cryptocurrency to fiat trading, and provides price information to Bloomberg Terminal.

ShapeShift is a company that offers global trading of a variety of digital assets via web and mobile platforms. It is headquartered in Switzerland, but run out of Denver.

Bitcoin is a digital asset designed by its inventor, Satoshi Nakamoto, to work as a currency.