In economics, factors of production, resources, or inputs are what is used in the production process to produce output—that is, finished goods and services. The utilized amounts of the various inputs determine the quantity of output according to the relationship called the production function. There are three basic resources or factors of production: land, labor, and capital. The factors are also frequently labeled "producer goods or services" to distinguish them from the goods or services purchased by consumers, which are frequently labeled "consumer goods".

In economics, physical capital or just capital is a factor of production, consisting of machinery, buildings, computers, and the like. The production function takes the general form Y=f(K, L, N), where Y is the amount of output produced, K is the amount of capital stock used, L is the amount of labor used, and N is the amount of natural resources used. In economic theory, physical capital is one of the three primary factors of production; the others are natural resources, and labor—the stock of competences embodied in the labor force. Physical capital is distinct from human capital, circulating capital, and financial capital. Physical capital is fixed capital, which is any kind of real physical asset that is not used up in the production of a product. Usually the value of land is not included in physical capital as it is not a reproducible product of human activities.

In economics and accounting, fixed capital is any kind of real, physical asset that is used in the production of a product but is not used up in the production. It contrasts with circulating capital such as raw materials, operating expenses and the like. It was first theoretically analyzed in some depth by the economist David Ricardo.

In economics, capital consists of an asset that can enhance one's power to perform economically useful work. For example, in a fundamental sense a stone or an arrow is capital for a caveman who can use it as a hunting instrument, while roads are capital for inhabitants of a city.

In economics, a discouraged worker is a person of legal employment age who is not actively seeking employment or who does not find employment after long-term unemployment. This is usually because an individual has given up looking or has had no success in finding a job, hence the term "discouraged".

A cost-of-living index is a theoretical price index that measures relative cost of living over time or regions. It is an index that measures differences in the price of goods and services, and allows for substitutions with other items as prices vary.

Computer-assisted telephone interviewing (CATI) is a telephone surveying technique in which the interviewer follows a script provided by a software application. It is a structured system of microdata collection by telephone that speeds up the collection and editing of microdata and also permits the interviewer to educate the respondents on the importance of timely and accurate data. The software is able to customize the flow of the questionnaire based on the answers provided, as well as information already known about the participant. It is used in B2B services and corporate sales.

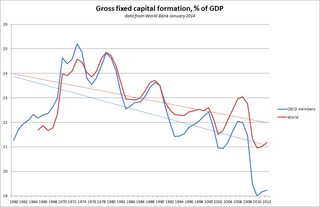

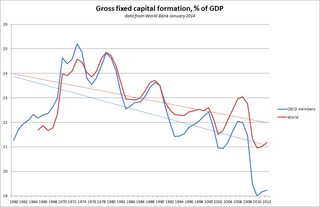

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households less disposals of fixed assets. GFCF is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.

Dale Weldeau Jorgenson is the Samuel W. Morris University Professor at Harvard University, teaching in the Department of Economics and John F. Kennedy School of Government. He served as Chairman of the Department of Economics from 1994 to 1997.

In economics, the absence rate is the ratio of workers with absences to total full-time wage and salary employment. In the United States, absences are defined as instances when persons who usually work 35 or more hours per week worked less than 35 hours during the reference week for one of the following reasons: own illness, injury, or medical problems; childcare problems; other family or personal obligations; civic or military duty; and maternity or paternity leave.

In economics, alternative employment arrangements are categorized in four types of alternative employment arrangements: independent contractors, on-call workers, temporary help agency workers, and workers provided by contract firms.

In economics, a base period or reference period is a point in time used as a reference point for comparison with other periods. It is generally used as a benchmark for measuring financial or economic data. Base periods typically provide a point of reference for economic studies, consumer demand, and unemployment benefit claims.

In economics, benefit incidence refers to the availability of a benefit. In the United States, the benefit incidence is calculated by the National Compensation Survey (NCS).

In economics, the business sector or corporate sector - sometimes popularly called simply "business" - is "the part of the economy made up by companies". It is a subset of the domestic economy, excluding the economic activities of general government, of private households, and of non-profit organizations serving individuals. An alternative analysis of economies, the three-sector theory, subdivides them into:

In the United States, a complete income reporter is a person who provides values for major sources of income, such as wages and salaries, self-employment income, and social security income.

In economics, a consumer unit is defined as either (1) all members of a particular household who are related by blood, marriage, adoption, or other legal arrangements; (2) a person living alone or sharing a household with others or living as a roomer in a private home or lodging house or in permanent living quarters in a hotel or motel, but who is financially independent; or (3) two or more persons living together who pool their income to make joint expenditure decisions. Financial independence is determined by the three major expense categories: housing, food, and other living expenses. To be considered financially independent, a respondent must provide at least two of the three major expense categories.

In statistics relating to national economies, the indexation of contracts also called "index linking" and "contract escalation" is a procedure when a contract includes a periodic adjustment to the prices paid for the contract provisions based on the level of a nominated price index. The purpose of indexation is to readjust contracts to account for inflation. In the United States, the consumer price index (CPI), producer price index (PPI), and, in the U.S., Employment Cost Index (ECI) are the most frequently used indexes.

In statistics, a deflator is a value that allows data to be measured over time in terms of some base period, usually through a price index, in order to distinguish between changes in the money value of a gross national product (GNP) that come from a change in prices, and changes from a change in physical output. It is the measure of the price level for some quantity. A deflator serves as a price index in which the effects of inflation are nulled. It is the difference between real and nominal GDP.

Constant capital (c), is a concept created by Karl Marx and used in Marxian political economy. It refers to one of the forms of capital invested in production, which contrasts with variable capital (v). The distinction between constant and variable refers to an aspect of the economic role of factors of production in creating a new value.

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.