Macroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study aggregated indicators such as GDP, unemployment rates, national income, price indices, and the interrelations among the different sectors of the economy to better understand how the whole economy functions. They also develop models that explain the relationship between such factors as national income, output, consumption, unemployment, inflation, saving, investment, international trade, and international finance.

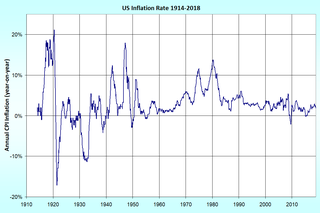

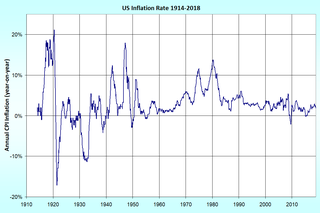

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index, usually the consumer price index, over time. The opposite of inflation is deflation.

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on national output in the short run and on price levels over longer periods. Monetarists assert that the objectives of monetary policy are best met by targeting the growth rate of the money supply rather than by engaging in discretionary monetary policy.

Fischer Sheffey Black was an American economist, best known as one of the authors of the famous Black–Scholes equation.

Monetary economics is the branch of economics that studies the different competing theories of money. It provides a framework for analyzing money and considers its functions, such as medium of exchange, store of value and unit of account. It considers how money, for example fiat currency, can gain acceptance purely because of its convenience as a public good. It examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

Irving Fisher was an American economist, statistician, inventor, and Progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the Post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.

Johan Gustaf Knut Wicksell was a leading Swedish economist of the Stockholm school. His economic contributions would influence both the Keynesian and Austrian schools of economic thought. He was married to the noted feminist Anna Bugge.

David Ernest William Laidler is an economist who has been one of the foremost scholars of monetarism. He published major economics journal articles on the topic in the late 1960s and early 1970s. His book, The Demand for Money, was published in four editions from 1969 through 1993, initially setting forth the stability of the relationship between income and the demand for money and later taking into consideration the effects of legal, technological, and institutional changes on the demand for money. The book has been translated into French, Spanish, Italian, Japanese, and Chinese.

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1, or for money in the broader sense of M2 or M3.

Monetary inflation is a sustained increase in the money supply of a country. Depending on many factors, especially public expectations, the fundamental state and development of the economy, and the transmission mechanism, it is likely to result in price inflation, which is usually just called "inflation", which is a rise in the general level of prices of goods and services.

The following is a list of works by the prominent American economist Milton Friedman.

Phillip David Cagan was an American scholar and author. He was Professor of Economics Emeritus at Columbia University.

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics, especially rational expectations.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

Neil Wallace is an American economist and professor at Pennsylvania State University. Wallace is considered one of the main proponents of new classical macroeconomics.

Leland Bennett Yeager was an American economist and an expert on monetary policy and international trade.

Robert Wayne Clower was an American economist. He is credited with having largely created the field of stock-flow analysis in economics and with seminal works on the microfoundations of monetary theory and macroeconomics.

Lloyd Wynn Mints (1888–1989) was an American economist, notable for his contributions to the quantity theory of money.