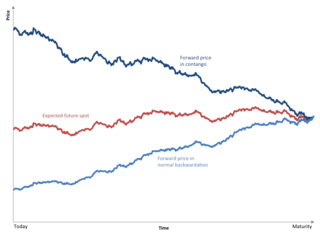

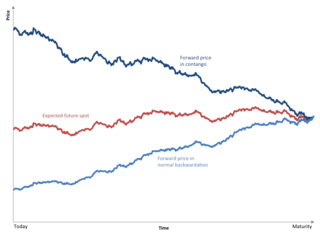

Contango is a situation where the futures price of a commodity is higher than the expected spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more [now] for a commodity [to be received] at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market, or carrying-cost market.

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. It is considered a systemically important financial institution by the Financial Stability Board.

Blair Hull is an American businessman, investor, and Democratic politician.

Paul Tudor Jones II is an American billionaire hedge fund manager, conservationist and philanthropist. In 1980, he founded his hedge fund, Tudor Investment Corporation, an asset management firm headquartered in Stamford, Connecticut. Eight years later he founded the Robin Hood Foundation, which focuses on poverty reduction. As of April 2022, his net worth was estimated at US$7.3 billion.

Jack Schwager is a trader and author. His books include Market Wizards (1989), The New Market Wizards (1992), Stock Market Wizards (2001) and Unknown Market Wizards: The best traders you've never heard of (2020). He is a well-known author, fund manager and an industry expert in futures and hedge funds. He's published a number of books, such as Market Wizards.

Monroe Trout, Jr. is a retired financial speculator and hedge fund manager profiled in the book New Market Wizards by Jack D. Schwager. Monroe Trout, Jr.'s expertise is in quantitative analysis, with pattern recognition backed by statistical analysis. He subscribes to Ayn Rand's Objectivism. He has traded stocks, stock index futures, commodity futures, and options on all these, both for his own account and as an advisor for others.

Lawrence D. Hite is a hedge fund manager who, along with Ed Seykota, is one of the forefathers of system trading. He is the author of the book, The Rule: How I Beat the Odds in the Markets and in Life—and How You Can Too, which was named a Wall Street Journal, LA Times, and Porchlight Books bestseller.

Linda Bradford Raschke (/'ræʃki/) is an American financier, operating mostly as a commodities and futures trader.

A commodity broker is a firm or an individual who executes orders to buy or sell commodity contracts on behalf of the clients and charges them a commission. A firm or individual who trades for his own account is called a trader. Commodity contracts include futures, options, and similar financial derivatives. Clients who trade commodity contracts are either hedgers using the derivatives markets to manage risk, or speculators who are willing to assume that risk from hedgers in hopes of a profit.

Amaranth Advisors LLC was an American multi-strategy hedge fund founded by Nicholas M. Maounis and headquartered in Greenwich, Connecticut. At its peak, the firm had up to $9.2 billion in assets under management before collapsing in September 2006, after losing in excess of $6 billion on natural gas futures. Amaranth Advisors collapse is one of the biggest hedge fund collapses in history and at the time (2006) largest known trading losses.

Farallon Capital Management, L.L.C. is an American multi-strategy hedge fund headquartered in San Francisco, California. Founded by Tom Steyer in 1986, the firm employs approximately 230 professionals in eight countries around the world.

Paulson & Co. Inc. is a family office based in New York City, previously it was a hedge fund established by John Paulson in 1994. It specializing in "global merger, event arbitrage and credit strategies", the firm had a relatively low profile on Wall Street until its hugely successful bet against the subprime mortgage market in 2007. At one time the company had offices in London and Dublin.

Winton Group, Ltd is a British investment management firm founded by David Harding. In the United States, Winton is registered with the Securities and Exchange Commission as an investment advisor and with the Commodity Futures Trading Commission as a CTA, and is authorised by the Financial Conduct Authority in the UK. The company trades on more than 100 global futures markets in a wide variety of asset classes and on global equity markets. The firm was launched with $1.6 million in 1997, reached a peak of $28.5 billion in assets under advisement, before dropping to $7.3 billion by late 2020. Winton Group has six offices around the world: London, New York, Hong Kong, Shanghai, Sydney, and Abu Dhabi.

Michael Edward Novogratz is an American investor, formerly of the investment firm Fortress Investment Group. He is currently CEO of Galaxy Investment Partners which focuses on investments in cryptocurrency.

Peter F. Borish is chairman and CEO of Computer Trading Corporation (CTC), an investment and advisory firm. Borish sits on the board of CIBC Bank USA. He is also a partner in Adam Hoffman's natural gas options trading team at Torsion Technologies, LLC. and a Partner of Quantrarian Asset Management

Pierre Andurand is a French businessman and hedge fund manager. His funds have approximately $2bn in assets under management and have produced cumulative returns of between 900-1300% for investors since 2008. He is also the majority shareholder of the international kickboxing league Glory.

Cantab Capital Partners is a hedge fund based in Cambridge, England, co-founded by Dr. Ewan Kirk and Erich Schlaikjer. Cantab operates quantitative funds using computer models to drive investment decisions. As of Feb 2015 Cantab had $4.5 billion in assets under management, after launching with $30 million in 2006. The firm takes its name from Cantabrigia, the medieval Latin name for Cambridge. It is regulated in the UK by the Financial Conduct Authority. Cantab Capital Partners was acquired by GAM in 2016 and is since part of GAM Systematic.

Dwight W. Anderson is an American investor and the founder of Ospraie Management, LLC, a basic industries and commodities-focused asset management firm with a venture arm focused on investments in the agriculture sector.

Goldman Sachs, an investment bank, has been the subject of controversies. The company has been criticized for lack of ethical standards, working with dictatorial regimes, close relationships with the U.S. federal government via a "revolving door" of former employees, and driving up prices of commodities through futures speculation. It has also been criticized by its employees for 100-hour work weeks, high levels of employee dissatisfaction among first-year analysts, abusive treatment by superiors, a lack of mental health resources, and extremely high levels of stress in the workplace leading to physical discomfort.