Related Research Articles

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position.

Synergy is an interaction or cooperation giving rise to a whole that is greater than the simple sum of its parts. The term synergy comes from the Attic Greek word συνεργία synergia from synergos, συνεργός, meaning "working together".

In business, a takeover is the purchase of one company by another. In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company.

A conglomerate is a type of multi-industry company that consists of several different and unrelated business entities that operate in various industries under one corporate group. A conglomerate usually has a parent company that owns and controls many subsidiaries, which are legally independent but financially and strategically dependent on the parent company. Conglomerates are often large and multinational corporations that have a global presence and a diversified portfolio of products and services. Conglomerates can be formed by merger and acquisitions, spin-offs, or joint ventures.

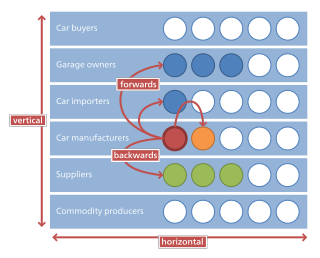

Horizontal integration is the process of a company increasing production of goods or services at the same level of the value chain, in the same industry. A company may do this via internal expansion, acquisition or merger.

In finance, valuation is the process of determining the value of a (potential) investment, asset, or security. Generally, there are three approaches taken, namely discounted cashflow valuation, relative valuation, and contingent claim valuation.

In microeconomics, diseconomies of scale are the cost disadvantages that economic actors accrue due to an increase in organizational size or in output, resulting in production of goods and services at increased per-unit costs. The concept of diseconomies of scale is the opposite of economies of scale. In business, diseconomies of scale are the features that lead to an increase in average costs as a business grows beyond a certain size.

McKinsey & Company is an American multinational strategy and management consulting firm that offers professional services to corporations, governments, and other organizations. Founded in 1926 by James O. McKinsey, McKinsey is the oldest and largest of the "Big Three" management consultancies (MBB). The firm mainly focuses on the finances and operations of their clients.

A golden parachute is an agreement between a company and an employee specifying that the employee will receive certain significant benefits if employment is terminated. These may include severance pay, cash bonuses, stock options, or other benefits. Most definitions specify the employment termination is as a result of a merger or takeover, also known as "change-in-control benefits", but more recently the term has been used to describe perceived excessive CEO severance packages unrelated to change in ownership.

Shareholder value is a business term, sometimes phrased as shareholder value maximization. It became prominent during the 1980s and 1990s along with the management principle value-based management or "managing for value".

An agency cost is an economic concept that refers to the costs associated with the relationship between a "principal", and an "agent". The agent is given powers to make decisions on behalf of the principal. However, the two parties may have different incentives and the agent generally has more information. The principal cannot directly ensure that its agent is always acting in its best interests. This potential divergence in interests is what gives rise to agency costs.

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of the Irish labour force, and created 57% of Irish OECD non-farm value-add. As of 2017, 25 of the top 50 Irish firms were U.S.–controlled businesses, representing 70% of the revenue of the top 50 Irish firms. By 2018, Ireland had received the most U.S. § Corporate tax inversions in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven system.

In business, consolidation or amalgamation is the merger and acquisition of many smaller companies into a few much larger ones. In the context of financial accounting, consolidation refers to the aggregation of financial statements of a group company as consolidated financial statements. The taxation term of consolidation refers to the treatment of a group of companies and other entities as one entity for tax purposes. Under the Halsbury's Laws of England, amalgamation is defined as "a blending together of two or more undertakings into one undertaking, the shareholders of each blending company, becoming, substantially, the shareholders of the blended undertakings. There may be amalgamations, either by transfer of two or more undertakings to a new company or the transfer of one or more companies to an existing company".

Kraft Foods Inc. was a multinational confectionery, food and beverage conglomerate. It marketed many brands in more than 170 countries. Twelve of its brands annually earned more than $1 billion worldwide: Cadbury, Jacobs, Kraft, LU, Maxwell House, Milka, Nabisco, Oreo, Oscar Mayer, Philadelphia, Trident, and Tang. Forty of its brands were at least a century old.

Valuation using discounted cash flows is a method of estimating the current value of a company based on projected future cash flows adjusted for the time value of money. The cash flows are made up of those within the “explicit” forecast period, together with a continuing or terminal value that represents the cash flow stream after the forecast period. In several contexts, DCF valuation is referred to as the "income approach".

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus moving its tax residence to the foreign country. Executives and operational headquarters can stay in the original country. The US definition requires that the original shareholders remain a majority control of the post-inverted company. In US federal legislation a company which has been restructured in this manner is referred to as an "inverted domestic corporation", and the term "corporate expatriate" is also used.

Bain & Company is an American management consulting company headquartered in Boston, Massachusetts. The firm provides advice to public, private, and non-profit organizations. One of the Big Three management consultancies, Bain & Company was founded in 1973 by former Group Vice President of Boston Consulting Group Bill Bain and his colleagues, including Patrick F. Graham. In the late 1970s and early 1980s, the firm grew rapidly. Bill Bain later spun off the alternative investment business into Bain Capital in 1984 and appointed Mitt Romney as its first CEO. Bain experienced several setbacks and financial troubles from 1987 to the early 1990s. Romney and Orit Gadiesh are credited with returning the firm to profitability and growth in their sequential roles as the firm's CEO and chairman respectively.

Aon Hewitt was a provider of human capital and management consulting services headquartered in Lincolnshire, Illinois in the United States. From 500 offices in 120 countries, it provided consulting, outsourcing, and reinsurance brokerage services. The "Aon Hewitt" brand and legal entities have now been absorbed into the "Aon" business, leaving obsolete the names "Hewitt" and "Aon Hewitt."

Steris plc is an Irish-based medical equipment company specializing in sterilization and surgical products for the US healthcare system. Steris is operationally headquartered in Mentor, Ohio, but has been legally registered since 2018 in Dublin, Ireland for tax purposes; it was previously registered in the United Kingdom from 2014 to 2018. Steris is quoted on the NYSE, and is a constituent of the S&P 500 Index.

Repatriation tax avoidance is the legal use of a tax regime within a country in order to repatriate income earned by foreign subsidiaries to a parent corporation while avoiding taxes ordinarily owed to the parent's country on the repatriation of foreign income. Prior to the passage of the Tax Cuts and Jobs Act of 2017, multinational firms based in the United States owed the U.S. government taxes on worldwide income. Companies avoided taxes on the repatriation of income earned abroad through a variety of strategies involving the use of mergers and acquisitions. Three main types of strategies emerged and were given names—the "Killer B", "Deadly D", and "Outbound F"—each of which took advantage of a different area of the Internal Revenue Code to conduct tax-exempt corporate reorganizations.

References

- ↑ McClure, Ben (2004-04-19). "Mergers and Acquisitions: Why They Can Fail". www.investopedia.com.

- ↑ "Kraft and Cadbury: How is it working out?". BBC News. 8 December 2011. Retrieved 31 October 2014.

- ↑ Williams, Dmitri (7 June 2010). "Synergy Bias: Conglomerates and Promotion in the News". Journal of Broadcasting. 46 (3): 456. doi:10.1207/s15506878jobem4603_8. S2CID 154937145.

- ↑ Williamson, Peter J.; Verdin, Paul J. (25 February 1992). "Age, Experience and Corporate Synergy: When Are". British Journal of Management. 3 (4): 233. doi:10.1111/j.1467-8551.1992.tb00047.x.

- ↑ "Why Firms Merge And The Problem They Cause". www.articlesalley.com. Archived from the original on 8 May 2010. Retrieved 31 October 2014.

- ↑ http://www.bain.com/Images/BAIN_BRIEF_Why_some_merging_companies_become_synergy_overachievers.pdf [ bare URL PDF ]

- ↑ Michael, Goold; Andrew, Campbell (September 1998). "Desperately seeking synergy" (PDF). Harvard Business Review: 132–138. Archived from the original (PDF) on 9 November 2014. Retrieved 31 October 2014.