BlackRock, Inc. is an American multinational investment company. It is the world's largest asset manager, with $10 trillion in assets under management as of December 31, 2023. Headquartered in New York City, Blackrock has 78 offices in 38 countries, and clients in 100 countries. BlackRock is the manager of the iShares group of exchange-traded funds, and along with The Vanguard Group and State Street, it is considered to be one of the Big Three index fund managers. Its Aladdin software keeps track of investment portfolios for many major financial institutions and its BlackRock Solutions division provides financial risk management services. The head of Aladdin is Sudhir Nair. As of 2023, BlackRock was ranked 229th on the Fortune 500 list of the largest United States corporations by revenue.

Iberdrola is a Spanish multinational electric utility company based in Bilbao, Spain. Iberdrola has a workforce of around 40,000 employees serving around 30 million customers. Subsidiaries include Scottish Power and a significant part of Avangrid, amongst others. As of 2023, the largest shareholder of the company is the Qatar Investment Authority, with BlackRock and Norges Bank also holding significant interests.

Infratil Limited is a New Zealand-based infrastructure investment company. It owns renewable energy, digital infrastructure, airports, and healthcare assets with operations in New Zealand, Australia, Asia, the US and Europe. Infratil was founded by the late Lloyd Morrison, a Wellington-based merchant banker. Morrison's company, H. R. L. Morrison & Co, is responsible for Infratil's management and administration.

Clean technology, in short cleantech or climatetech, is any process, product, or service that reduces negative environmental impacts through significant energy efficiency improvements, the sustainable use of resources, or environmental protection activities. Clean technology includes a broad range of technology related to recycling, renewable energy, information technology, green transportation, electric motors, green chemistry, lighting, grey water, and more. Environmental finance is a method by which new clean technology projects can obtain financing through the generation of carbon credits. A project that is developed with concern for climate change mitigation is also known as a carbon project.

Engie SA is a French multinational utility company, with its headquarters in La Défense, Courbevoie, which operates in the fields of electricity generation and distribution, natural gas, nuclear, renewable energy and petroleum. It is active in both upstream and downstream activities.

The renewable-energy industry is the part of the energy industry focusing on new and appropriate renewable energy technologies. Investors worldwide have paid greater attention to this emerging industry in recent years. In many cases, this has translated into rapid renewable energy commercialization and considerable industry expansion. The wind power, solar power and hydroelectric power industries provide good examples of this.

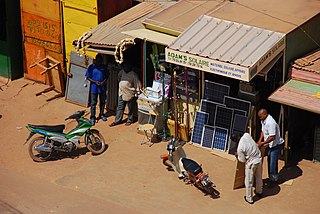

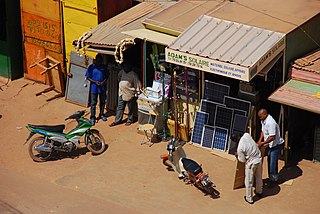

Renewable energy in developing countries is an increasingly used alternative to fossil fuel energy, as these countries scale up their energy supplies and address energy poverty. Renewable energy technology was once seen as unaffordable for developing countries. However, since 2015, investment in non-hydro renewable energy has been higher in developing countries than in developed countries, and comprised 54% of global renewable energy investment in 2019. The International Energy Agency forecasts that renewable energy will provide the majority of energy supply growth through 2030 in Africa and Central and South America, and 42% of supply growth in China.

Actis is a global investment firm focused on the private equity, energy, infrastructure, and real estate asset classes.

Boralex is a power company founded in 1990 in the province of Quebec that develops, builds, and operates renewable energy facilities in Canada, France, the United Kingdom, and the United States. In 2022, Boralex’s total installed capacity is established at 2.5 GW.

EDF Renewables is a wholly owned subsidiary of the French utility EDF Group, specializing in renewable energy production. As an integrated operator, the Group develops and finances the construction of renewable energy facilities, and manages operations and maintenance for its own account and for third parties.

Riverstone Holdings is a multinational private equity firm based in New York City focused on leveraged buyout, growth capital, and credit investments in the energy industry and electrical power industry sectors. The firm focuses on oil and gas exploration, midstream pipelines, electricity generation, energy and power services, energy and power technology, and renewable energy infrastructure and technology. Riverstone has raised approximately $41 billion since the firm's inception in 2000.

Eco-investing or green investing is a form of socially responsible investing where investments are made in companies that support or provide environmentally friendly products and practices. These companies encourage new technologies that support the transition from carbon dependence to more sustainable alternatives. Green finance is "any structured financial activity that has been created to ensure a better environmental outcome."

Fondi Italiani per le Infrastrutture SGR S.p.A. or, in short form, F2i SGR S.p.A., is Italy's largest independent infrastructure fund manager, with assets under management of approximately €7 billion. It currently manages five funds and one infrastructure Debt Fund.

Most of Kenya's electricity is generated by renewable energy sources. Access to reliable, affordable, and sustainable energy is one of the 17 main goals of the United Nations’ Sustainable Development Goals. Development of the energy sector is also critical to help Kenya achieve the goals in Kenya Vision 2030 to become a newly industrializing, middle-income country. With an installed power capacity of 2,819 MW, Kenya currently generates 826 MW hydroelectric power, 828 geothermal power, 749 MW thermal power, 331 MW wind power, and the rest from solar and biomass sources. Kenya is the largest geothermal energy producer in Africa and also has the largest wind farm on the continent. In March 2011, Kenya opened Africa's first carbon exchange to promote investments in renewable energy projects. Kenya has also been selected as a pilot country under the Scaling-Up Renewable Energy Programmes in Low Income Countries Programme to increase deployment of renewable energy solutions in low-income countries. Despite significant strides in renewable energy development, about a quarter of the Kenyan population still lacks access to electricity, necessitating policy changes to diversify the energy generation mix and promote public-private partnerships for financing renewable energy projects.

ACWA Power is a developer, investor, co-owner and operator of a portfolio of power generation and desalinated water production plants with a presence in 12 countries across the Middle East, Africa, Central and South-East Asia. ACWA Power's portfolio of projects in operation and development has an investment value of USD 82.8 billion, and a capacity of 53.7 GW of power and 7.6 million m3/day of desalinated water.

National Investment and Infrastructure Fund Limited (NIIFL) is an Government owned company which maintains infrastructure investments funds for international and Indian investors anchored by the Government of India. The objective behind creating this organisation was to catalyse capital into the country and support its growth needs across sectors of importance.

Octopus Energy Group is a British renewable energy group specialising in sustainable energy. It was founded in 2015 with the backing of British fund management company Octopus Group, a British asset management company. Headquartered in London, the company has operations in the United Kingdom, France, Germany, Italy, Spain, Australia, Japan, New Zealand and the United States. Following the acquisition of Shell Energy on 1 December 2023, Octopus Energy is the UK's second largest domestic energy provider.

Adani Green Energy Limited (AGEL) is an Indian renewable energy company, headquartered in Ahmedabad, India. It is owned by Indian conglomerate Adani Group. The company operates Kamuthi Solar Power Project, one of the largest solar photovoltaic plants in the world.

ACEN Corporation, formerly AC Energy, is the energy firm under the Ayala Group. The company has over 4,000 MW of attributable capacity in the Philippines, Vietnam, Indonesia, India, and Australia, with a renewable share of 98% which is among the highest in the region.

Investment Corporation of Dubai is the principal investment arm of the Government of Dubai focused on strengthening Dubai’s economy through long-term value and wealth creation and investing in global opportunities. Established in 2006, ICD manages the Government of Dubai Portfolio of commercial companies and investments. In 2022, ICD reported assets worth $320 billion and revenue of $73 billion. The Dubai-based corporation provides strategic oversight, develops and implements investment strategies and corporate governance policies, and operates in multiple sectors, including oil and gas, transportation, banking, and financial services.