Banking in the United States began in the late 1790s along with the country's founding and has developed into highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services namely private banking, asset management, and deposit security.

A bank account is a financial account maintained by a bank for a customer. A bank account can be a deposit account, a credit card account, a current account, or any other type of account offered by a financial institution, and represents the funds that a customer has entrusted to the financial institution and from which the customer can make withdrawals. Alternatively, accounts may be loan accounts in which case the customer owes money to the financial institution.

The Bank Secrecy Act of 1970 (BSA), also known as the Currency and Foreign Transactions Reporting Act, is a U.S. law requiring financial institutions in the United States to assist U.S. government agencies in detecting and preventing money laundering. Specifically, the act requires financial institutions to keep records of cash purchases of negotiable instruments, file reports if the daily aggregate exceeds $10,000, and report suspicious activity that may signify money laundering, tax evasion, or other criminal activities.

Banking in Switzerland began in the early 18th century through Switzerland's merchant trade and has, over the centuries, grown into a complex, regulated, and international industry. Along with the Swiss Alps, Swiss chocolate, watchmaking and mountaineering, banking is seen as emblematic of Switzerland. Switzerland has a long, kindred history of banking secrecy and client confidentiality reaching back to the early 1700s. Started as a way to protect wealthy European banking interests, Swiss banking secrecy was codified in 1934 with the passage of the landmark federal law, the Federal Act on Banks and Savings Banks.

An offshore bank is a bank regulated under international banking license, which usually prohibits the bank from establishing any business activities in the jurisdiction of establishment. Due to less regulation and transparency, accounts with offshore banks were often used to hide undeclared income. Since the 1980s, jurisdictions that provide financial services to nonresidents on a big scale, can be referred to as offshore financial centres. Since OFCs often also levy little or no tax corporate and/or personal income and offer, they are often referred to as tax havens.

Numbered bank accounts are bank accounts where the identity of the holder is replaced with a multi-digit number known only to the client and select private bankers. Although these accounts do add another layer of banking secrecy, they are not completely anonymous as the name of the client is still recorded by the bank and subject to limited, warranted disclosure.

Private banking is banking, investment and other financial services provided by banks to high-net-worth individuals (HNWIs) with high levels of income or sizable assets.

Offshore investment is the keeping of money in a jurisdiction other than one's country of residence. Offshore jurisdictions are a commonly accepted means of reducing the taxes levied in most countries to both large and small-scale investors alike. Poorly regulated offshore domiciles have served historically as havens for tax evasion, money laundering, or to conceal or protect illegally acquired money from law enforcement in the investor's country. However, the modern, well-regulated offshore centres allow legitimate investors to take advantage of higher rates of return or lower rates of tax on that return offered by operating via such domiciles. The advantage to offshore investment is that such operations are both legal and less costly than those offered in the investor's country - or "onshore". Locations favored by investors for low rates of tax are known as offshore financial centers or (sometimes) tax havens.

Raoul Weil is a Swiss banker. Weil is best known as being the former Chairman and Chief Executive Officer of Global Wealth Management & Business Banking at UBS AG. Weil eventually became a member of UBS's Group Executive Board.

Bradley Charles Birkenfeld is an American private banker, convicted felon, and whistleblower. During the mid- to late-2000s, he made a series of disclosures about UBS Group AG clients, in violation of Swiss banking secrecy laws, to the U.S. government alleging possible tax evasion. Known as the 2007 "Birkenfeld Disclosure", the U.S. Department of Justice (DOJ) announced it had reached a deferred prosecution agreement with UBS that resulted in a US$780 million fine and the release of previously privileged information on American tax evaders.

UBS Group AG is a Swiss multinational investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centers as the largest Swiss banking institution in the world. UBS client services are known for their strict bank–client confidentiality and culture of banking secrecy. The bank's large positions in the Americas, EMEA, and Asia Pacific markets make it a global systemically important financial institution.

The International Consortium of Investigative Journalists (ICIJ) is an independent Washington D.C.-based international network. Launched in 1997 by the Center for Public Integrity, ICIJ was spun off in February 2017 into a fully independent organisation which includes more than 200 investigative journalists and 100 media organizations in over 70 countries who work together on "issues such as "cross-border crime, corruption, and the accountability of power." The ICIJ has exposed smuggling and tax evasion by multinational tobacco companies (2000), "by organized crime syndicates; investigated private military cartels, asbestos companies, and climate change lobbyists; and broke new ground by publicizing details of Iraq and Afghanistan war contracts."

Rudolf Elmer is a Swiss private banker, whistleblower, and activist. He worked as a banker at Julius Bär from the 1980s to his dismissal in 2002. At the time of his leaving, he was head of the bank's Caribbean operations for eight years. After initial, unsuccessful attempts to disclose client information in 2005, he was arrested by Zürich authorities and held for 30 days.

Hervé Daniel Marcel Falciani is a French-Italian systems engineer and whistleblower who is credited with "the biggest banking leak in history." In 2008, Falciani began collaborating with numerous European nations by providing allegedly illegal stolen information relating to more than 130,000 suspected tax evaders with Swiss bank accounts – specifically those with accounts in HSBC's Swiss subsidiary HSBC Private Bank.

The Federal Act on Banks and Savings Banks is a Swiss federal law and act-of-parliament that operates as the supreme law governing banking in Switzerland. Although the federal law has only been amended seven times, it has been revised multiple times to limit and expand its banking secrecy provisions since its ratification. The banking secrecy provisions in the Federal Act are additionally enforced through multiple civil codes in the federal Swiss Civil Code and locally through cantonal law. In December 2017, the Swiss parliament launched a standing initiative and expressed an interest in formally embedding banking secrecy within the Swiss Federal Constitution rendering it a federally-protected constitutional right.

The Swiss investment bank and financial services company, UBS Group AG, has been at the center of numerous tax evasion and avoidance investigations undertaken by U.S., French, German, Israeli, and Belgian tax authorities as a consequence of their strict banking secrecy practices.

The Common Reporting Standard (CRS) is an information standard for the Automatic Exchange Of Information (AEOI) regarding bank accounts on a global level, between tax authorities, which the Organisation for Economic Co-operation and Development (OECD) developed in 2014.

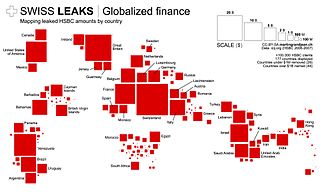

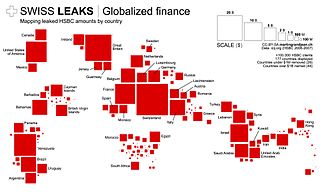

Swiss Leaks is the name of a journalistic investigation, released in February 2015, of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subsidiary, HSBC Private Bank (Suisse). Triggered by leaked information from French computer analyst Hervé Falciani on accounts held by over 100,000 clients and 20,000 offshore companies with HSBC in Geneva, the disclosed information has been called "the biggest leak in Swiss banking history".

In 2010, the United States implemented the Foreign Account Tax Compliance Act; the law required financial firms around the world to report accounts held by US citizens to the Internal Revenue Service. The US on the other hand refused the Common Reporting Standard set up by the Organisation for Economic Co-operation and Development, alongside Vanuatu and Bahrain.

The Republic of Panama is one of the oldest and best-known tax havens in the Caribbean, as well as one of the most established in the region. Panama has had a reputation for tax avoidance since the early 20th century, and Panama has been cited repeatedly in recent years as a jurisdiction which does not cooperate with international tax transparency initiatives.