Related Research Articles

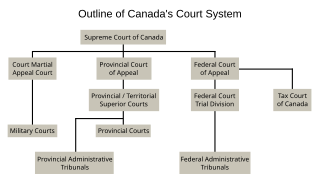

The court system of Canada forms the judicial branch of government, formally known as "The Queen on the Bench", which interprets the law and is made up of many courts differing in levels of legal superiority and separated by jurisdiction. Some of the courts are federal in nature, while others are provincial or territorial.

The United States Tax Court is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides that the Congress has the power to "constitute Tribunals inferior to the supreme Court". The Tax Court specializes in adjudicating disputes over federal income tax, generally prior to the time at which formal tax assessments are made by the Internal Revenue Service. Though taxpayers may choose to litigate tax matters in a variety of legal settings, outside of bankruptcy, the Tax Court is the only forum in which taxpayers may do so without having first paid the disputed tax in full. Parties who contest the imposition of a tax may also bring an action in any United States District Court, or in the United States Court of Federal Claims; however these venues require that the tax be paid first, and that the party then file a lawsuit to recover the contested amount paid. Tax Court judges are appointed for a term of 15 years, subject to presidential removal for "inefficiency, neglect of duty, or malfeasance in office...."

Eugene Rossiter is the Chief Justice of the Tax Court of Canada. He took office on November 23, 2006.

Terrence O'Connor is a judge currently serving on the Tax Court of Canada.

Pierre Archambault is a judge who has served on the Tax Court of Canada since March 24, 1993.

Lucie Lamarre is currently the Associate Chief Justice of the Tax Court of Canada.

Eric Anthony Bowie is a judge currently serving on the Tax Court of Canada.

Diane Campbell is a judge currently serving on the Tax Court of Canada.

Leslie M. Little is a judge currently serving on the Tax Court of Canada.

Brent Paris is a judge currently serving on the Tax Court of Canada. Prior to his appointment, he was the Director of the Tax Law Services Section in the British Columbia Regional Office of Justice Canada.

Paul Bédard is a judge currently serving on the Tax Court of Canada.

Réal Favreau is a judge currently serving on the Tax Court of Canada. He took office on October 27, 2006.

Wyman W. Webb is a Canadian judge currently serving on the Federal Court of Appeal .

Patrick J. Boyle is a judge currently serving on the Tax Court of Canada. He took office on March 30, 2007.

Valerie Miller is a judge currently serving on the Tax Court of Canada.

Robert Hogan is a judge currently serving on the Tax Court of Canada. He took office on March 3, 2008.

Steven K. D'Arcy is a judge currently serving on the Tax Court of Canada. Prior to his appointment, he was a recognized attorney on international tax issues.

Don R. Sommerfeldt is a judge currently serving on the Tax Court of Canada.

References

- ↑ Tax Court of Canada, Current Judges Archived September 29, 2009, at the Wayback Machine .

| This Canadian biographical article relating to law is a stub. You can help Wikipedia by expanding it. |