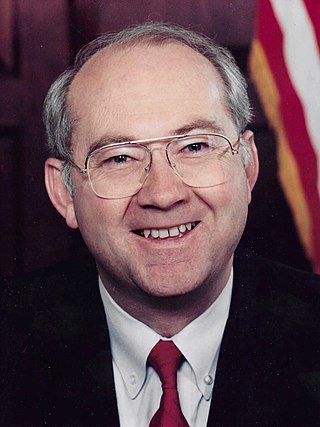

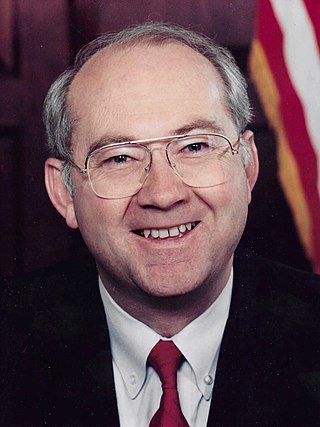

William Philip Gramm is an American economist and politician who represented Texas in both chambers of Congress. Though he began his political career as a Democrat, Gramm switched to the Republican Party in 1983. Gramm was an unsuccessful candidate in the 1996 Republican Party presidential primaries against eventual nominee Bob Dole.

The Congressional Budget and Impoundment Control Act of 1974 is a United States federal law that governs the role of the Congress in the United States budget process.

The United States budget process is the framework used by Congress and the President of the United States to formulate and create the United States federal budget. The process was established by the Budget and Accounting Act of 1921, the Congressional Budget and Impoundment Control Act of 1974, and additional budget legislation.

A balanced budget amendment or debt brake is a constitutional rule requiring that a state cannot spend more than its income. It requires a balance between the projected receipts and expenditures of the government.

PAYGO is the practice in the United States of financing expenditures with funds that are currently available rather than borrowed.

The Budget Enforcement Act of 1990 (BEA) was enacted by the United States Congress as title XIII of the Omnibus Budget Reconciliation Act of 1990, to enforce the deficit reduction accomplished by that law by revising the federal budget control procedures originally enacted by the Gramm–Rudman–Hollings Balanced Budget Act. The BEA created two new budget control processes: a set of caps on annually-appropriated discretionary spending, and a "pay-as-you-go" or "PAYGO" process for entitlements and taxes.

Bowsher v. Synar, 478 U.S. 714 (1986), was a United States Supreme Court case that struck down the Gramm–Rudman–Hollings Act as an unconstitutional usurpation of executive power by Congress because the law empowered Congress to terminate the United States Comptroller General for certain specified reasons, including "inefficiency, 'neglect of duty,' or 'malfeasance.'" The named defendant in the original case was Comptroller General Charles Arthur Bowsher and the constitutional challenge was brought forth by Oklahoma Congressman Mike Synar.

Baseline budgeting is an accounting method the United States Federal Government uses to develop a budget for future years. Baseline budgeting uses current spending levels as the "baseline" for establishing future funding requirements and assumes future budgets will equal the current budget times the inflation rate times the population growth rate. Twice a year—generally in January and August—CBO prepares baseline projections of federal revenues, outlays, and the surplus or deficit. Those projections are designed to show what would happen if current budgetary policies were continued as is—that is, they serve as a benchmark for assessing possible changes in policy. They are not forecasts of actual budget outcomes, since the Congress will undoubtedly enact legislation that will change revenues and outlays. Similarly, they are not intended to represent the appropriate or desirable levels of federal taxes and spending.

The Budget Control Act of 2011 is a federal statute enacted by the 112th United States Congress and signed into law by US President Barack Obama on August 2, 2011. The Act brought conclusion to the 2011 US debt-ceiling crisis.

The 2013 United States federal budget is the budget to fund government operations for the fiscal year 2013, which began on October 1, 2012, and ended on September 30, 2013. The original spending request was issued by President Barack Obama in February 2012.

The United States fiscal cliff refers to the combined effect of several previously-enacted laws that came into effect simultaneously in January 2013, increasing taxes and decreasing spending.

Budget sequestration is a provision of United States law that causes an across-the-board reduction in certain kinds of spending included in the federal budget. Sequestration involves setting a hard cap on the amount of government spending within broadly defined categories; if Congress enacts annual appropriations legislation that exceeds these caps, an across-the-board spending cut is automatically imposed on these categories, affecting all departments and programs by an equal percentage. The amount exceeding the budget limit is held back by the Treasury and not transferred to the agencies specified in the appropriation bills. The word sequestration was derived from a legal term referring to the seizing of property by an agent of the court, to prevent destruction or harm, while any dispute over said property is resolved in court.

As a result of the Budget Control Act of 2011, a set of automatic spending cuts to United States federal government spending in particular of outlays were initially set to begin on January 1, 2013. They were postponed by two months by the American Taxpayer Relief Act of 2012 until March 1 when this law went into effect.

The 2014 United States federal budget is the budget to fund government operations for the fiscal year (FY) 2014, which began on October 1, 2013 and ended on September 30, 2014.

The Continuing Appropriations Resolution, 2014 is a bill that was introduced into the United States House of Representatives on September 10, 2013. The original text of the bill was for a continuing resolution that would make continuing appropriations for the fiscal year 2014 United States federal budget. Though versions of the bill passed each house of Congress, the House and Senate were not able to reconcile the bills and pass a compromise measure.

The Bipartisan Budget Act of 2013 is a federal statute concerning spending and the budget in the United States, that was signed into law by President Barack Obama on December 26, 2013. On December 10, 2013, pursuant to the provisions of the Continuing Appropriations Act, 2014 calling for a joint budget conference to work on possible compromises, Representative Paul Ryan and Senator Patty Murray announced a compromise that they had agreed to after extended discussions between them. The law raises the sequestration caps for fiscal years 2014 and 2015, in return for extending the imposition of the caps into 2022 and 2023, and miscellaneous savings elsewhere in the budget. Overall, the bill is projected to lower the deficit by $23 billion over the long term.

The Baseline Reform Act of 2013 is a bill that would change the way in which discretionary appropriations for individual accounts are projected in CBO’s baseline. Under H.R. 1871, projections of such spending would still be based on the current year’s appropriations, but would not be adjusted for inflation going forward. Other adjustments to projections of future discretionary spending would also be eliminated.

The Budget and Accounting Transparency Act of 2014 is a bill that would modify the budgetary treatment of federal credit programs. The bill would require that the cost of direct loans or loan guarantees be recognized in the federal budget on a fair-value basis using guidelines set forth by the Financial Accounting Standards Board. The bill would also require the federal budget to reflect the net impact of programs administered by Fannie Mae and Freddie Mac. The changes made by the bill would mean that Fannie Mae and Freddie Mac were counted on the budget instead of considered separately and would mean that the debt of those two programs would be included in the national debt. These programs themselves would not be changed, but how they are accounted for in the United States federal budget would be. The goal of the bill is to improve the accuracy of how some programs are accounted for in the federal budget.

The Continuing Appropriations Resolution, 2015 is a continuing resolution and United States public law that funded the federal government of the United States through December 11, 2014 by appropriating $1 trillion.

The United States Federal Budget for fiscal year 2016 began as a budget proposed by President Barack Obama to fund government operations for October 1, 2015 – September 30, 2016. The requested budget was submitted to the 114th Congress on February 2, 2015.