Related Research Articles

John Pierpont Morgan was an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age. As the head of the banking firm that ultimately became known as J.P. Morgan and Co., he was the driving force behind the wave of industrial consolidation in the United States spanning the late 19th and early 20th centuries.

A merchant bank is historically a bank dealing in commercial loans and investment. In modern British usage it is the same as an investment bank. Merchant banks were the first modern banks and evolved from medieval merchants who traded in commodities, particularly cloth merchants. Historically, merchant banks' purpose was to facilitate and/or finance production and trade of commodities, hence the name "merchant". Few banks today restrict their activities to such a narrow scope.

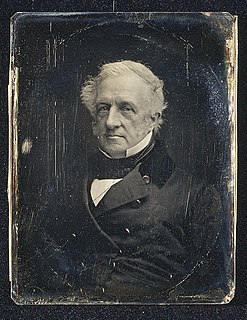

George Peabody was an American financier and philanthropist. He is widely regarded as the father of modern philanthropy.

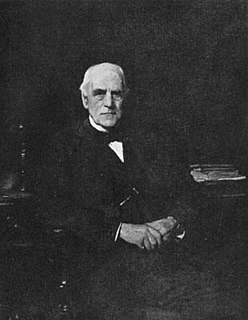

Junius Spencer Morgan I was an American banker and financier, as well as the father of John Pierpont "J.P." Morgan and patriarch to the Morgan banking house.

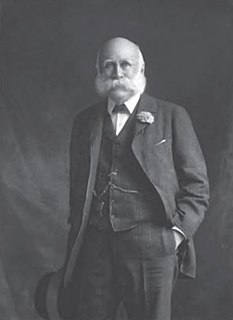

Anthony Joseph Drexel Sr. was an American banker who played a major role in the rise of modern global finance after the American Civil War. As the dominant partner of Drexel & Co. of Philadelphia, he founded Drexel, Morgan & Co in New York in 1871 with J. P. Morgan as his junior partner. He also founded Drexel University in 1891. He was also the first president of the Fairmount Park Art Association, the nation's first private organization dedicated to integrating public art and urban planning.

Morgan, Grenfell & Co. was a leading London-based investment bank regarded as one of the oldest and once most influential British merchant banks.

J.P. Morgan & Co. was a commercial and investment banking institution founded by J. P. Morgan in 1871. The company was a predecessor of three of the largest banking institutions in the world—JPMorgan Chase, Morgan Stanley, and Deutsche Bank —and was involved in the formation of Drexel Burnham Lambert. The company is sometimes referred to as the "House of Morgan" or simply "Morgan".

John Pierpont "Jack" Morgan Jr. was an American banker, finance executive, and philanthropist. He inherited the family fortune and took over the business interests including J.P. Morgan & Co. after his father J. P. Morgan died in 1913.

Stephen Gordon Catto, 2nd Baron Catto, was a British banker and businessman.

Morgan, Harjes & Co. was a Paris-based investment bank founded in 1868 by John H. Harjes, Eugene Winthrop and Anthony J. Drexel as Drexel, Harjes & Co. In 1871, with the formation of Drexel, Morgan & Co., together with J. Pierpont Morgan, the company became the French affiliate of an international banking firm with offices in London, Philadelphia, New York City and Paris that would subsequently become J.P. Morgan & Co.

Junius Spencer Morgan II was a banker, art collector and nephew of John Pierpont Morgan, Sr.

Philadelphia financier Jay Cooke established the first modern American investment bank during the Civil War era. However, private banks had been providing investment banking functions since the beginning of the 19th century and many of these evolved into investment banks in the post-bellum era. However, the evolution of firms into investment banks did not follow a single trajectory. For example, some currency brokers such as Prime, Ward & King and John E. Thayer and Brother moved from foreign exchange operations to become private banks, taking on some investment bank functions. Other investment banks evolved from mercantile firms such as Thomas Biddle and Co. and Alexander Brothers.

Keith Reginald Harris is a London-based investment banker and financier with a 30-year career as a senior corporate finance and takeover advisor, having held senior executive positions at leading institutions Morgan Grenfell, Drexel Burnham Lambert, Apax Partners, and HSBC Investment Bank. He is a private equity investor with interests in varied private equity holdings in financials, media, and sport.

JPMorgan Chase is an American multinational banking corporation with a large presence in the United Kingdom. The corporation’s European subsidiaries J.P. Morgan Europe Limited, J.P. Morgan International Bank Limited and J.P. Morgan Securities plc are headquartered in London.

Duncan, Sherman & Company was a New York City banking firm, founded in 1852, that went bankrupt in 1875.

The Morgan family is an American family and banking dynasty, which became prominent in the U.S. and throughout the world in the late 19th century and early 20th century. Members of the family amassed an immense fortune over the generations, primarily through the noted work of John Pierpont Morgan (1837-1913).

William Butler Duncan was a Scottish-American banker and railroad executive.

The National Bank of Commerce in New York was a national bank headquartered in New York City that merged into the Guaranty Trust Company of New York.

John Clarke Lee was an American lawyer, merchant, banker and politician who co-founded the prominent stock brokerage firm of Lee, Higginson & Co.

Samuel Endicott Peabody was an American merchant and banker who was a partner in the London banking firm of J.S. Morgan & Co.

References

- ↑ Carosso, Vincent P. (1987). The Morgans: Private International Bankers, 1854-1913 . Retrieved October 9, 2019.

- ↑ Burk, p. xiii

- ↑ "Three generations of bankers". www.jpmorgan.com. J.P. Morgan & Co. Retrieved October 9, 2019.

- ↑ "COL. S. E. PEABODY DEAD. Well Known Boston Banker Dies at His Residence in Salem, Mass". The New York Sun . October 31, 1909. p. 16. Retrieved May 13, 2022.

- ↑ "SAMUEL ENDICOTT PEABODY". Boston Evening Transcript . November 1, 1909. p. 10. Retrieved May 13, 2022.

- ↑ Burk (1989), p. xiv

- ↑ George Peabody and Co. : J.S. Morgan and Co. : Morgan Grenfell and Co. : Morgan Grenfell and Co Ltd. 1838-1958. Oxford University Press. 1958. OCLC 83721702.

- ↑ Burk, p. 51

- ↑ Burk, Kathleen (1989). Morgan Grenfell 1838-1988: The Biography of a Merchant Bank. Clarendon Press. ISBN 978-0-19-828306-5.