Related Research Articles

Ovintiv Inc. is an American petroleum company based in Denver. The company was formed in 2020 through a restructuring of its Canadian predecessor, Encana.

China Petroleum and Chemical Corporation, or Sinopec, is a Chinese oil and gas enterprise based in Chaoyang District, Beijing. The SASAC administers China Petroleum and Chemical Corporation for the benefit of State Council of the People's Republic of China. China Petroleum and Chemical Corporation operates a publicly traded subsidiary, called Sinopec, listed in Hong Kong and Shanghai stock exchanges. China Petroleum and Chemical Corporation is the world's largest oil refining conglomerate, state owned enterprise, and second highest revenue company in the world behind Walmart.

Anadarko Petroleum Corporation was a company engaged in hydrocarbon exploration. It was organized in Delaware and headquartered in two skyscrapers in The Woodlands, Texas: the Allison Tower and the Hackett Tower, both named after former CEOs of the company. In 2019, the company was acquired by Occidental Petroleum.

Premier Oil plc was an independent UK oil company with gas and oil interests in the United Kingdom, Asia, Africa and Mexico. It was devoted entirely to the 'upstream' sector of the industry — the exploitation of oil and gas — as opposed to the 'downstream' refining and retail sector. It was listed on the London Stock Exchange until it was acquired by Chrysaor Holdings and then merged into Harbour Energy in March 2021.

APA Corporation is the holding company for Apache Corporation, an American company engaged in hydrocarbon exploration. It is organized in Delaware and headquartered in Houston. The company is ranked 431st on the Fortune 500.

Canadian Oil Sands Limited was a Canadian company that generates income from its oil sands investment in the Syncrude Joint Venture. Syncrude operated an oil sands facility and produced crude oil through the mining of oil sands from ore deposits in the Athabasca region of northern Alberta, Canada.

The Bow is a 158,000-square-metre (1,700,000 sq ft) skyscraper in downtown Calgary, Alberta, Canada. The 236 metre (774 ft) building was the tallest in Calgary between July 8, 2010, when it surpassed the Suncor Energy Centre, and May 11, 2016, when it was exceeded by Brookfield Place. The Bow is currently the second tallest office tower in Calgary and the third tallest in Canada outside Toronto. The Bow is also considered the start of redevelopment in Calgary's Downtown East Village. It was completed in 2012 and was ranked among the top 10 architectural projects in the world of that year according to Azure magazine. It was built for oil and gas company Encana, and was the headquarters of its successors Ovintiv and Cenovus.

Noble Energy, Inc. was a company engaged in hydrocarbon exploration headquartered in Houston, Texas. In October 2020, the company was acquired by Chevron Corporation.

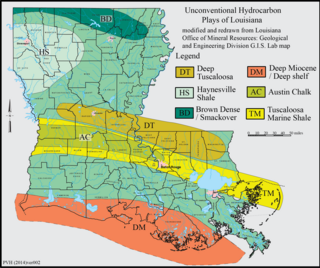

The Haynesville Shale is an informal, popular name for a Jurassic Period rock formation that underlies large parts of southwestern Arkansas, northwest Louisiana, and East Texas. It lies at depths of 10,500 to 13,000 feet below the land’s surface. It is part of a large rock formation which is known by geologists as the Haynesville Formation. The Haynesville Shale underlies an area of about 9,000 square miles and averages about 200 to 300 feet thick. The Haynesville Shale is overlain by sandstone of the Cotton Valley Group and underlain by limestone of the Smackover Formation.

Oando Plc is a Nigerian multinational energy company operating in the upstream, midstream and downstream.

Guma Leandro Aguiar was a Brazilian-born American energy industrialist and millionaire businessman who split his time between the United States and Israel. Aguiar was recognized as a philanthropist who supported a variety of Jewish causes including Nefesh B'Nefesh and the March of the Living. In July 2009, Aguiar invested over $4 million (USD) in support of the Beitar Jerusalem Football Club.

Although there are numerous oil companies operating in Canada, as of 2009, the majority of production, refining and marketing was done by fewer than 20 of them. According to the 2013 edition of Forbes Global 2000, canoils.com and any other list that emphasizes market capitalization and revenue when sizing up companies, as of March 31, 2014 these are the largest Canada-based oil and gas companies.

Thomas Scott Kaplan is an American businessman, philanthropist and art collector. He is the world's largest private collector of Rembrandt's works.

Cenovus Energy Inc. is a Canadian integrated oil and natural gas company headquartered in Calgary, Alberta. Its offices are located at Brookfield Place, having completed a move from the neighbouring Bow in 2019.

Newfield Exploration Company was a petroleum, natural gas and natural gas liquids exploration and production company organized in Delaware and headquartered in Houston, Texas. In February 2019, the company was acquired by Encana.

Sara and Myra were two Israeli offshore drilling licenses located west of Netanya, Israel. The licenses expired on July 13, 2015. Exploratory drilling in the license area in 2012 was unsuccessful, but seismic studies indicated the possibility of oil and gas at deeper strata that were not explored.

Linn Energy, Inc. was a hydrocarbon exploration company based in Houston. In 2018, the company split into Roan Resources and Riviera Resources.

EnCap Investments is an American private equity firm, specializing in the energy industry, particularly oil & gas. The firm was established in 1988 and is based in Houston, Texas.

Cimarex Energy Co. was a company engaged in hydrocarbon exploration, particularly shale oil and gas drilling. It was organized in Delaware and headquartered in Denver, Colorado, with operations primarily in Texas, Oklahoma, and New Mexico.

Encana Corporation was a Canadian independent petroleum company that existed from 2002 to 2020. The company, stylised as EnCana until 2010, was created by David P. O'Brien of PanCanadian Petroleum and Gwyn Morgan of the Alberta Energy Company through the merger of their companies. At the time of its creation Encana was the world's largest independent petroleum company by measure of its value, production, and reserves. Morgan ran the company from its inception through the end of 2005. During its early years, Encana established its reputation as Canada's flagship energy company and an icon of Western Canadian business. In September 2005 it became Canada's largest corporation by market capitalisation for a brief time.

References

- 1 2 "The Tragedy Of Guma Aguiar And A $2 Billion Texas Gas Fortune". Forbes . June 28, 2012.

- ↑ Alpert, Bill (February 15, 2010). "There's (Possibly) Gold in Them Thar Hills". Barron's .

- 1 2 "EnCana acquiring Leor Energy's Deep Bossier assets". Oil & Gas Journal . November 5, 2007.

- ↑ "Leor Energy Closes Significant Equity Transaction; Transaction to Accelerate the Development of the Amoruso Field" (Press release). Business Wire. May 9, 2006.

- ↑ "Leor Energy Announces Partial Sale; Leor Energy Announces Important New Production Results" (Press release). Business Wire. July 28, 2006.

- ↑ "Merrill Lynch invests $150M in Leor Energy". American City Business Journals . January 25, 2007.

- ↑ "East Texas gas play a winner for Leor Energy". American City Business Journals . April 5, 2007.

- ↑ "Leor Energy invests in Navasota Energy". Oil & Gas Journal . June 5, 2007.

- ↑ "EnCana to acquire partner Leor Energy's interests in highly prolific Deep Bossier gas fields of East Texas for US$2.55 billion" (Press release). PR Newswire. November 5, 2007.

- ↑ Shwiff, Kathy (November 5, 2007). "EnCana to Buy Natural-Gas Interests From Leor Energy for $2.55 Billion" . The Wall Street Journal .

- ↑ PARTRIDGE, JOHN (November 5, 2007). "EnCana drops $2.5-billion for control of Texas gas field" . The Globe and Mail .

- ↑ "Canada: Encana Buys Gas Partner" . Bloomberg News . The New York Times. November 6, 2007.

- 1 2 DeLuca, Matthew (July 13, 2017). "New Clues in the Mysterious Disappearance of Multimillionaire Guma Aguiar". The Daily Beast .

- ↑ "Comancheria Energy Resources, LLC acquires Leor Resources, LLC" (Press release). PR Newswire. September 29, 2015.