Related Research Articles

A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

The economy of the Netherlands is a highly developed market economy focused on trade and logistics, manufacturing, services, innovation and technology and sustainable and renewable energy. It is the world's 18th largest economy by nominal GDP and the 28th largest by purchasing power parity (PPP) and is the fifth largest economy in European Union by nominal GDP. It has the world's 11th highest per capita GDP (nominal) and the 13th highest per capita GDP (PPP) as of 2023 making it one of the highest earning nations in the world. Many of the world's largest tech companies are based in its capital Amsterdam or have established their European headquarters in the city, such as IBM, Microsoft, Google, Oracle, Cisco, Uber, Netflix and Tesla. Its second largest city Rotterdam is a major trade, logistics and economic center of the world and is Europe's largest seaport. Netherlands is ranked fifth on global innovation index and fourth on the Global Competitiveness Report. Among OECD nations, Netherlands has a highly efficient and strong social security system; social expenditure stood at roughly 25.3% of GDP.

Guaranteed minimum income (GMI), also called minimum income, is a social-welfare system that guarantees all citizens or families an income sufficient to live on, provided that certain eligibility conditions are met, typically: citizenship and that the person in question does not already receive a minimum level of income to live on.

Basel II is the second of the Basel Accords, which are recommendations on banking laws and regulations issued by the Basel Committee on Banking Supervision. It is now extended and partially superseded by Basel III.

Official development assistance (ODA) is a category used by the Development Assistance Committee (DAC) of the Organisation for Economic Co-operation and Development (OECD) to measure foreign aid. The DAC first adopted the concept in 1969. It is widely used as an indicator of international aid flow. It refers to material resources given by the governments of richer countries to promote the economic development of poorer countries and the welfare of their people. The donor government agency may disburse such resources to the government of the recipient country or through other organizations. Most ODA is in the form of grants, but some is measured as the concessional value in soft (low-interest) loans.

The basic needs approach is one of the major approaches to the measurement of absolute poverty in developing countries globally. It works to define the absolute minimum resources necessary for long-term physical well-being, usually in terms of consumption goods. The poverty line is then defined as the amount of income required to satisfy the needs of the people. The "basic needs" approach was introduced by the International Labour Organization's World Employment Conference in 1976. "Perhaps the high point of the WEP was the World Employment Conference of 1976, which proposed the satisfaction of basic human needs as the overriding objective of national and international development policy. The basic needs approach to development was endorsed by governments and workers' and employers' organizations from all over the world. It influenced the programmes and policies of major multilateral and bilateral development agencies, and was the precursor to the human development approach."

The Italian welfare state is based partly upon the corporatist-conservative model and partly upon the universal welfare model.

The Chile pension system refers to old-age, disability and survivor pensions for workers in Chile. The pension system was changed by José Piñera, during Augusto Pinochet's dictatorship, on November 4, 1980 from a PAYGO-system to a fully funded capitalization system run by private sector pension funds. Many critics and supporters see the reform as an important experiment under real conditions, that may give conclusions about the impact of the full conversion of a PAYGO-system to a capital funded system. The development was therefore internationally observed with great interest. Under Michelle Bachelet's government the Chile Pension system was reformed again.

Median household disposable income in the UK was £29,400 in the financial year ending (FYE) 2019, up 1.4% (£400) compared with growth over recent years; median income grew by an average of 0.7% per year between FYE 2017 and FYE 2019, compared with 2.8% between FYE 2013 and FYE 2017.

Pension Credit is the principal element of the UK welfare system for people of pension age. It is intended to supplement the UK State Pension, or to replace it. It was introduced in the UK in 2003 by Gordon Brown, then Chancellor of the Exchequer. It has been subject to a number of changes over its existence, but has the core aim of lifting retired people of limited means out of poverty.

Social protection, as defined by the United Nations Research Institute for Social Development, is concerned with preventing, managing, and overcoming situations that adversely affect people's well-being. Social protection consists of policies and programs designed to reduce poverty and vulnerability by promoting efficient labour markets, diminishing people's exposure to risks, and enhancing their capacity to manage economic and social risks, such as unemployment, exclusion, sickness, disability, old age., and enhancing their capacity to manage economic and social risks, such as unemployment, exclusion, sickness, disability, and old age. An emerging approach within social protection frameworks is Adaptive Social Protection, which integrates disaster risk management and climate change adaptation to strengthen resilience against shocks.It is one of the targets of the United Nations Sustainable Development Goal 10 aimed at promoting greater equality.

According to the International Labour Organization, social security is a human right that aims at reducing and preventing poverty and vulnerability throughout the life cycle of individuals. Social security includes different kinds of benefits A social pension is a stream of payments from the state to an individual that starts when someone retires and continues to be paid until death. This type of pension represents the non-contributory part of the pension system, the other being the contributory pension, as per the most common form of composition of these systems in most developed countries.

Pensions in Spain consist of a mandatory state pension scheme, and voluntary company and individual pension provision.

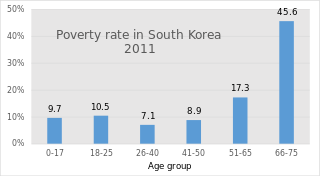

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

Public pensions in Greece are designed to provide incomes to Greek pensioners upon reaching retirement. For decades pensions in Greece were known to be among the most generous in the European Union, allowing many pensioners to retire earlier than pensioners in other European countries. This placed a heavy burden on Greece's public finances which, coupled with an aging workforce, made the Greek state increasingly vulnerable to external economic shocks, culminating in a recession due to the 2008 financial crisis and subsequent European debt crisis. This series of crises has forced the Greek government to implement economic reforms aimed at restructuring the pension system and eliminating inefficiencies within it. Measures in the Greek austerity packages imposed upon Greek citizens by the European Central Bank have achieved some success at reforming the pension system despite having stark ramifications for standards of living in Greece, which have seen a sharp decline since the beginning of the crisis.

Cyprus is a high income country with a well established and extensive welfare system. The Social Insurance Scheme ensures access to healthcare, income support, and pensions, with mandatory contributions for all employees and employers. Income support is means tested on the basis of total family income and assets, which often places the burden of care on the family unit before the state provides assistance. There is also an obligation to seek work. The pension system is fairly comprehensive, yet may still leave some in the private sector unsupported.

The global minimum corporate tax rate, or simply the global minimum tax, is a minimum rate of tax on corporate income internationally agreed upon and accepted by individual jurisdictions in the OECD/G20 Inclusive Framework. Each country would be eligible for a share of revenue generated by the tax. The aim is to reduce tax competition between countries and discourage multinational corporations (MNC) from profit shifting that avoids taxes.

South Korea introduced its Basic Old-Age Pension in 2008 as part of its pension system. According to the Ministry of Health, Welfare and Family Affairs, the Basic Old-Age Pension is "designed to enhance welfare of the elderly by providing a monthly pension payment to the elderly in need." The pension was intended to benefit workers contributing to the National Pension Scheme.

References

- ↑ "Adequacy of Guaranteed Minimum Income benefits". stats.oecd.org. Retrieved 2020-06-06.

- ↑ "Adequacy of Guaranteed Minimum Income benefits". stats.oecd.org. Retrieved 2020-06-06.