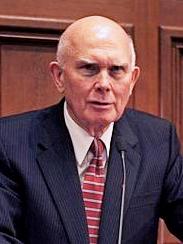

Dallin Harris Oaks is an American religious leader and former jurist and academic who since 2018 has been the first counselor in the First Presidency of the Church of Jesus Christ of Latter-day Saints. He was called as a member of the church's Quorum of the Twelve Apostles in 1984. Currently, he is the second most senior apostle by years of service and is the President of the Quorum of the Twelve Apostles.

MBNA Corporation was a bank holding company and parent company of wholly owned subsidiary MBNA America Bank, N.A., headquartered in Wilmington, Delaware, prior to being acquired by Bank of America in 2006.

Elizabeth Ann Warren is an American politician and former law professor who is the senior United States senator from Massachusetts, serving since 2013. A member of the Democratic Party and regarded as a progressive, Warren has focused on consumer protection, equitable economic opportunity, and the social safety net while in the Senate. Warren was a candidate in the 2020 Democratic Party presidential primaries, ultimately finishing third.

Banking in Switzerland dates to the early 18th century through Switzerland's merchant trade and over the centuries has grown into a complex and regulated international industry. Banking is seen as emblematic of Switzerland and the country has been one of the largest offshore financial centers and tax havens in the world since the mid-20th century, with a long history of banking secrecy and client confidentiality reaching back to the early 1700s. Starting as a way to protect wealthy European banking interests, Swiss banking secrecy was codified in 1934 with the passage of a landmark federal law, the Federal Act on Banks and Savings Banks. These laws were used to protect assets of persons being persecuted by Nazi authorities but have also been used by people and institutions seeking to illegally evade taxes, hide assets, or to commit other financial crime.

Janet Louise Yellen is an American economist, currently serving as the 78th United States secretary of the treasury since January 26, 2021. She previously served as the 15th chair of the Federal Reserve from 2014 to 2018. She is the first woman to hold either post, and has also led the White House Council of Economic Advisers. Yellen is the Eugene E. and Catherine M. Trefethen Professor of Business Administration and Economics at the University of California, Berkeley.

A payday loan is a short-term unsecured loan, often characterized by high interest rates. These loans are typically designed to cover immediate financial needs and are intended to be repaid on the borrower's next payday.

Postal savings systems provide depositors who do not have access to banks a safe and convenient method to save money. Many nations have operated banking systems involving post offices to promote saving money among the poor.

Victoria Anne Kennedy is an American diplomat, attorney, and activist who presently serves as the United States Ambassador to Austria since 2022. She is the widow and the second wife of longtime U.S. senator Ted Kennedy.

Cecil Osborn Samuelson Jr. is an American retired rheumatologist and professor of medicine who served as the 12th president of Brigham Young University (BYU) from 2003 to 2014. Samuelson is an emeritus general authority of the Church of Jesus Christ of Latter-day Saints, a former dean of the school of medicine at the University of Utah, and a former senior vice president of Intermountain Health Care (IHC). While he was president at BYU, Samuelson pushed professors and students to raise their expectations and encouraged mentored learning. During his presidency, student enrollment limits stayed constant, new sports coaches were hired, new buildings were built, and a hiring freeze during the Great Recession reduced faculty.

Black capitalism is a concept that emerged some decades after WW2 and took on popular traction sometime around the time Richard Nixon was elected president of the United States. Nixon had endorsed the idea that the human rights of black Americans was intimately bound up with their rights to own property and accrue the economic power that comes from proprietary wealth. Around this juncture (1969), some 163,000 black firms existed in the United States. The fact that black businessmen and economic thinkers flourished in the first half of the 20th century has been ignored or neglected in standard economic history books until relatively recently.

Bruce Clark Hafen is an American attorney, academic and religious leader. He has been a general authority of the Church of Jesus Christ of Latter-day Saints since 1996.

Lael Brainard is an American economist serving as the 14th director of the National Economic Council since February 21, 2023. She previously served as the 22nd vice chair of the Federal Reserve between May 2022 and February 2023. Prior to her term as vice chair, Brainard served as a member of the Federal Reserve Board of Governors, taking office in 2014. Before her appointment to the Federal Reserve, she served as the under secretary of the treasury for international affairs from 2010 to 2013.

Noel Beldon Reynolds is an American political scientist and an emeritus professor of political science at Brigham Young University (BYU), where he has also served as an associate academic vice president and as director for the Foundation for Ancient Research and Mormon Studies (FARMS). He was a member of the BYU faculty from 1971 to 2011. He has also written widely on the theology of the Church of Jesus Christ of Latter-day Saints, of which he is a member.

Michael S. Barr is an American legal scholar who has been serving as second vice chair of the Federal Reserve for supervision since 2022. From 2009 to 2011, he was assistant secretary of the treasury for financial institutions under President Barack Obama. At the University of Michigan, he has been serving as faculty member since 2001, professor of law since 2006, professor of public policy since 2014.

Sarah Bloom Raskin is an American attorney and financial markets policymaker who served as the 13th United States Deputy Secretary of the Treasury from 2014 to 2017. Raskin previously served as a member of the Federal Reserve Board of Governors from 2010 to 2014. She also was Maryland Commissioner of Financial Regulation. She was a Rubenstein Fellow at Duke University. She is currently the Colin W. Brown Distinguished Professor of the Practice of Law at Duke Law School. She is also a Senior Fellow at the Duke Center on Risk. She also serves as a Partner at Kaya Partners, Ltd., a climate advisory firm.

Anne Finucane is an American banker who was vice chair of Bank of America and chair of Bank of America Europe until retiring from the bank in 2021, after which she became a senior advisor to TPG Rise Climate and chair of Rubicon Carbon. While at Bank of America, she led its socially responsible investing, global public policy, and environmental, social and corporate governance committee.

The Mechanics and Farmers Bank is an American bank owned by M&F Bancorp, Inc based in Durham, North Carolina. It served as one of the most influential African-American businesses in North Carolina in the 20th century.

Saule Tarikhovna Omarova is a Kazakh-American attorney, academic, and public policy advisor. She was the nominee for comptroller of the currency before her nomination was withdrawn at her request on December 7, 2021.

Andrea Gacki is an American attorney. She currently serves as Director of the Financial Crimes Enforcement Network (FinCEN), a bureau within the U.S. Treasury Department tasked with combating financial crimes, in the Biden administration. Previously she directed the Office of Foreign Assets Control (OFAC).

Shennette Monique Garrett-Scott is an American historian. She specializes in African-American women in economic history and wrote the 2019 book Banking on Freedom: Black Women in U.S. Finance Before the New Deal. She has been a professor at the University of Mississippi, Texas A&M University, and Tulane University.