A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodities market for centuries for price risk management.

Contango is a situation in which the futures price of a commodity is higher than the expected spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more [now] for a commodity [to be received] at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market or carrying-cost market.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract traded on the New York Mercantile Exchange (NYMEX). The WTI oil grade is also known as Texas light sweet. Oil produced from any location can be considered WTI if the oil meets the required qualifications. Spot and futures prices of WTI are used as a benchmark in oil pricing. This grade is described as light crude oil because of its low density and sweet because of its low sulfur content.

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE Brent Crude Oil futures contract or the contract itself. The original Brent Crude referred to a trading classification of sweet light crude oil first extracted from the Brent oilfield in the North Sea in 1976. As production from the Brent oilfield declined to zero in 2021, crude oil blends from other oil fields have been added to the trade classification. The current Brent blend consists of crude oil produced from the Forties, Oseberg, Ekofisk, Troll oil fields and oil drilled from Midland, Texas in the Permian Basin.

Light crude oil is liquid petroleum that has a low density and flows freely at room temperature. It has a low viscosity, low specific gravity and high API gravity due to the presence of a high proportion of light hydrocarbon fractions. It generally has a low wax content. Light crude oil receives a higher price than heavy crude oil on commodity markets because it produces a higher percentage of gasoline and diesel fuel when converted into products by an oil refinery.

An energy derivative is a derivative contract based on an underlying energy asset, such as natural gas, crude oil, or electricity. Energy derivatives are exotic derivatives and include exchange-traded contracts such as futures and options, and over-the-counter derivatives such as forwards, swaps and options. Major players in the energy derivative markets include major trading houses, oil companies, utilities, and financial institutions.

The Malaysia Derivatives Exchange (MDEX), also known as Malaysian Distribution Exchange, is a limited share company formed during June 2001 in Malaysia through the merger of the Kuala Lumpur Options and Financial Futures Exchange (KLOFFE) and the Commodity and Monetary Exchange of Malaysia. It is a subsidiary of the Kuala Lumpur Stock Exchange (KLSE).

A benchmark crude or marker crude is a crude oil that serves as a reference price for buyers and sellers of crude oil. There are three primary benchmarks, West Texas Intermediate (WTI), Brent Blend, and Dubai Crude. Other well-known blends include the OPEC Reference Basket used by OPEC, Tapis Crude which is traded in Singapore, Western Canadian Select used in Canada, Bonny Light used in Nigeria, Urals oil used in Russia and Mexico's Isthmus. Energy Intelligence Group publishes a handbook which identified 195 major crude streams or blends in its 2011 edition.

A commodity broker is a firm or an individual who executes orders to buy or sell commodity contracts on behalf of the clients and charges them a commission. A firm or individual who trades for his own account is called a trader. Commodity contracts include futures, options, and similar financial derivatives. Clients who trade commodity contracts are either hedgers using the derivatives markets to manage risk, or speculators who are willing to assume that risk from hedgers in hopes of a profit.

The Dubai Mercantile Exchange (DME) is a commodity exchange based in Dubai currently listing its flagship futures contract, DME Oman Crude Oil Futures Contract (OQD). Launched in 2007, the DME aims to become the crude oil pricing benchmark for the Asian market with its Oman Crude Oil contract, like the Intercontinental Exchange’s (ICE) North Sea Brent is to Europe and the New York Mercantile Exchange’s (NYMEX) West Texas Intermediate is to North America.

Multi Commodity Exchange of India (MCX) is a commodity exchange based in India. It was established in 2003 by the Government of India and is currently based in Mumbai. It is India's largest commodity derivatives exchange. The average daily turnover of commodity futures contracts increased by 26% to ₹32,424 crore during FY2019-20, as against ₹25,648 crore in FY2018-19. The total turnover of commodity futures traded on the Exchange stood at ₹83.98 lakh crore in FY2019-20. MCX offers options trading in gold and futures trading in non-ferrous metals, bullions, oil, natural gas, and agricultural commodities.

The Shanghai Futures Exchange is a futures exchange in Shanghai, China formed from the amalgamation of the national level futures exchanges of China, the Shanghai Metal Exchange, Shanghai Foodstuffs Commodity Exchange, and the Shanghai Commodity Exchange in December 1999. It is a non-profit-seeking incorporated body regulated by the China Securities Regulatory Commission.

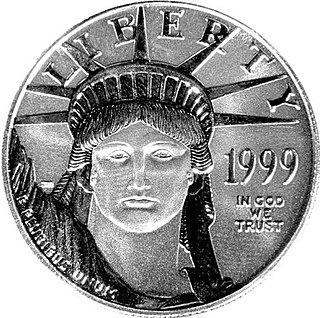

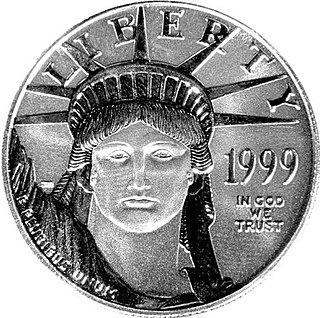

Platinum as an investment is often compared in financial history to gold and silver, which were both known to be used as money in ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold and approximately 60–100 times scarcer than silver, on the basis of annual mine production. Since 2014, platinum prices have fallen lower than gold. Approximately 75% of global platinum is mined in South Africa.

Hong Kong Mercantile Exchange was an electronic commodities exchange established in Hong Kong for the trading of commodity futures, options and other financial derivatives. The exchange was originally pitched as a platform to trade oil futures. In fact, it ended up trading mainly silver and gold futures.

Launched by the Dubai Mercantile Exchange (DME) on 1 June 2007, the DME Oman Crude Oil Futures Contract (OQD) is the Asian crude oil pricing benchmark. The contract is traded on the CME Group’s electronic platform CME Globex, and cleared through CME Clearport.

Indonesia Commodity and Derivatives Exchange (ICDX) provides facilities and infrastructure to its members to conduct prime commodity transactions and enforce laws and regulations to create a fair, transparent, cost effective, and well-organized market as a platform to form accountable and credible prices, and as a hedging tool. With abundant natural resources in Indonesia, ICDX is able to facilitate national interest as a global trading center for prime commodities such as Gold, Crude Oil, Foreign Exchange, Crude Palm Oil (CPO) and Tin. ICDX collaborates with PT Indonesia Clearing House (ICH) and PT ICDX Logistik Berikat (ILB). ICH has a role as the guarantor institution for all transactions including managing risk management, margin, and transaction settlement. Meanwhile, ILB plays a role in physical transactions to eliminate country risk and also integrated logistics management system as end-to-end services.

The 1970s commodities boom refers to the rise of many commodity prices in the 1970s. Excess demand was created with money supply increasing too much and supply shocks that came from Arab–Israeli conflict, initially between Israel and Egypt. The Six-Day War where Israel captured and occupied the Sinai Peninsula for 15 years, the Closure of the Suez Canal (1967–1975) for 8 years of that, lead to supply shocks. 66% of oil consumed by Europe at that time came through the Suez Canal and had to be redirected around the continent of Africa. 15% of all maritime trade passed through the Suez Canal in 1966, the year before it closed.