Related Research Articles

In economics, factors of production, resources, or inputs are what is used in the production process to produce output—that is, goods and services. The utilized amounts of the various inputs determine the quantity of output according to the relationship called the production function. There are four basic resources or factors of production: land, labour, capital and entrepreneur. The factors are also frequently labeled "producer goods or services" to distinguish them from the goods or services purchased by consumers, which are frequently labeled "consumer goods".

This aims to be a complete article list of economics topics:

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit. In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" which wants to maximize its total profit, which is the difference between its total revenue and its total cost.

In economics, elasticity measures the responsiveness of one economic variable to a change in another. If the price elasticity of the demand of something is -2, a 10% increase in price causes the quantity demanded to fall by 20%. Elasticity in economics provides an understanding of changes in the behavior of the buyers and sellers with price changes. There are two types of elasticity for demand and supply, one is inelastic demand and supply and other one is elastic demand and supply.

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced.

In microeconomics, a production–possibility frontier (PPF), production possibility curve (PPC), or production possibility boundary (PPB) is a graphical representation showing all the possible options of output for two goods that can be produced using all factors of production, where the given resources are fully and efficiently utilized per unit time. A PPF illustrates several economic concepts, such as allocative efficiency, economies of scale, opportunity cost, productive efficiency, and scarcity of resources.

In economics, a production function gives the technological relation between quantities of physical inputs and quantities of output of goods. The production function is one of the key concepts of mainstream neoclassical theories, used to define marginal product and to distinguish allocative efficiency, a key focus of economics. One important purpose of the production function is to address allocative efficiency in the use of factor inputs in production and the resulting distribution of income to those factors, while abstracting away from the technological problems of achieving technical efficiency, as an engineer or professional manager might understand it.

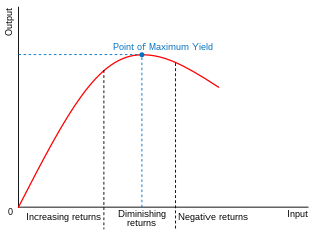

In economics, diminishing returns are the decrease in marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, holding all other factors of production equal. The law of diminishing returns states that in productive processes, increasing a factor of production by one unit, while holding all other production factors constant, will at some point return a lower unit of output per incremental unit of input. The law of diminishing returns does not cause a decrease in overall production capabilities, rather it defines a point on a production curve whereby producing an additional unit of output will result in a loss and is known as negative returns. Under diminishing returns, output remains positive, but productivity and efficiency decrease.

Output in economics is the "quantity of goods or services produced in a given time period, by a firm, industry, or country", whether consumed or used for further production. The concept of national output is essential in the field of macroeconomics. It is national output that makes a country rich, not large amounts of money.

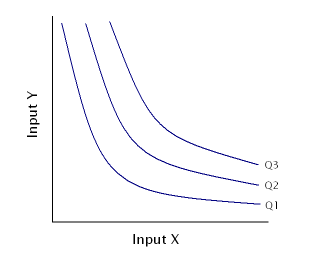

An isoquant, in microeconomics, is a contour line drawn through the set of points at which the same quantity of output is produced while changing the quantities of two or more inputs. The x and y axis on an isoquant represent two relevant inputs, which are usually a factor of production such as labour, capital, land, or organisation. An isoquant may also be known as an “Iso-Product Curve”, or an “Equal Product Curve”.

In economics, a cost curve is a graph of the costs of production as a function of total quantity produced. In a free market economy, productively efficient firms optimize their production process by minimizing cost consistent with each possible level of production, and the result is a cost curve. Profit-maximizing firms use cost curves to decide output quantities. There are various types of cost curves, all related to each other, including total and average cost curves; marginal cost curves, which are equal to the differential of the total cost curves; and variable cost curves. Some are applicable to the short run, others to the long run.

In economics, a conditional factor demand is the cost-minimizing level of an input such as labor or capital, required to produce a given level of output, for given unit input costs of the input factors. A conditional factor demand function expresses the conditional factor demand as a function of the output level and the input costs. The conditional portion of this phrase refers to the fact that this function is conditional on a given level of output, so output is one argument of the function. Typically this concept arises in a long run context in which both labor and capital usage are choosable by the firm, so a single optimization gives rise to conditional factor demands for each of labor and capital.

In economics, total cost (TC) is the minimum dollar cost of producing some quantity of output. This is the total economic cost of production and is made up of variable cost, which varies according to the quantity of a good produced and includes inputs such as labor and raw materials, plus fixed cost, which is independent of the quantity of a good produced and includes inputs that cannot be varied in the short term such as buildings and machinery, including possibly sunk costs.

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or to an individual. Supply can be in produced goods, labour time, raw materials, or any other scarce or valuable object. Supply is often plotted graphically as a supply curve, with the price per unit on the vertical axis and quantity supplied as a function of price on the horizontal axis. This reversal of the usual position of the dependent variable and the independent variable is an unfortunate but standard convention.

Within economics, margin is a concept used to describe the current level of consumption or production of a good or service. Margin also encompasses various concepts within economics, denoted as marginal concepts, which are used to explain the specific change in the quantity of goods and services produced and consumed. These concepts are central to the economic theory of marginalism. This is a theory that states that economic decisions are made in reference to incremental units at the margin, and it further suggests that the decision on whether an individual or entity will obtain additional units of a good or service depending on the marginal utility of the product.

In economics, the marginal product of capital (MPK) is the additional production that a firm experiences when it adds an extra unit of capital. It is a feature of the production function, alongside the labour input.

In economics, a factor market is a market where factors of production are bought and sold. Factor markets allocate factors of production, including land, labour and capital, and distribute income to the owners of productive resources, such as wages, rents, etc.

In economics, the marginal product of labor (MPL) is the change in output that results from employing an added unit of labor. It is a feature of the production function, and depends on the amounts of physical capital and labor already in use.

In any technical subject, words commonly used in everyday life acquire very specific technical meanings, and confusion can arise when someone is uncertain of the intended meaning of a word. This article explains the differences in meaning between some technical terms used in economics and the corresponding terms in everyday usage.

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.

References

- ↑ MANKIW, Gregory N., TAYLOR, Mark P., Economics, 2015,03,P. 2, ISBN 978-1-4080-9379-5

- 1 2 "Human Capital vs. Physical Capital: What's the Difference?".

- ↑ "Physical Capital Definition".

- ↑ MANKIW, Gregory N., TAYLOR, Mark P., Economics, 2015,03, P.136, ISBN 978-1-4080-9379-5

- ↑ "Production Function: Meaning, Definitions and Features". 8 May 2015.